Market Trends

What is competitive intelligence and why is it important for businesses?

Competitive intelligence is the practice of gathering, analyzing, and utilizing information about competitors, customers, and market factors to make strategic business decisions. It involves systematically collecting data from various sources and applying analytical frameworks like SWOT and Porter's Five Forces to identify patterns and insights. CI is critical for businesses as it helps anticipate market changes, identify opportunities for innovation, and mitigate risks. Statistics show that 90% of businesses believe CI is essential to their success, and companies actively engaged in CI activities are 2.5 times more likely to become industry leaders.

Watch clip answer (06:08m)What is competitive intelligence and why is it important for businesses?

Competitive intelligence is the practice of gathering, analyzing, and utilizing information about competitors, customers, and market factors to make strategic business decisions. It involves understanding the external environment, assessing threats and opportunities, and leveraging insights to inform strategy and operations. This discipline is critical for businesses striving to maintain a competitive edge in their industries. Companies that actively engage in competitive intelligence activities are 2.5 times more likely to be industry leaders, as CI helps organizations anticipate market changes, identify opportunities for innovation, mitigate risks, and make informed decisions to capitalize on opportunities.

Watch clip answer (05:58m)Why are industry trends important for a business plan?

Industry trends are crucial components of a comprehensive business plan as they provide valuable insights into market conditions that impact a company's success. By thoroughly examining industry trends, entrepreneurs gain clarity on the feasibility of business ideas while identifying opportunities and potential risks in their sector. Analyzing trends through frameworks like Porter's Five Forces, SWOT analysis, and PESTEL helps business leaders integrate findings into various plan sections, informing marketing strategies and financial projections. This analysis demonstrates a deep understanding of the business environment, increases plan credibility, and enables informed decision-making for long-term growth in constantly evolving markets.

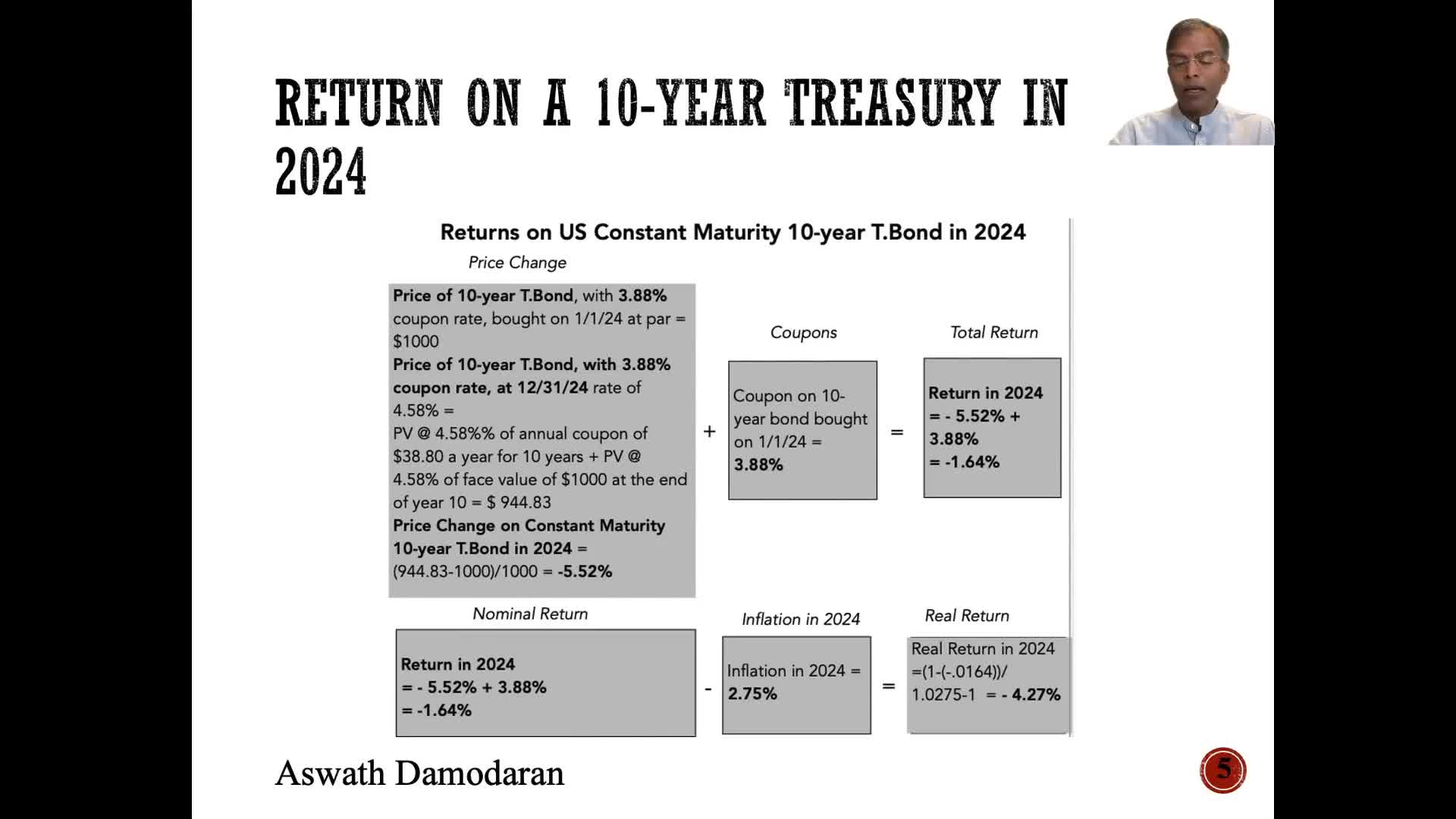

Watch clip answer (02:54m)What is the intrinsic risk-free rate and how does it explain interest rate movements?

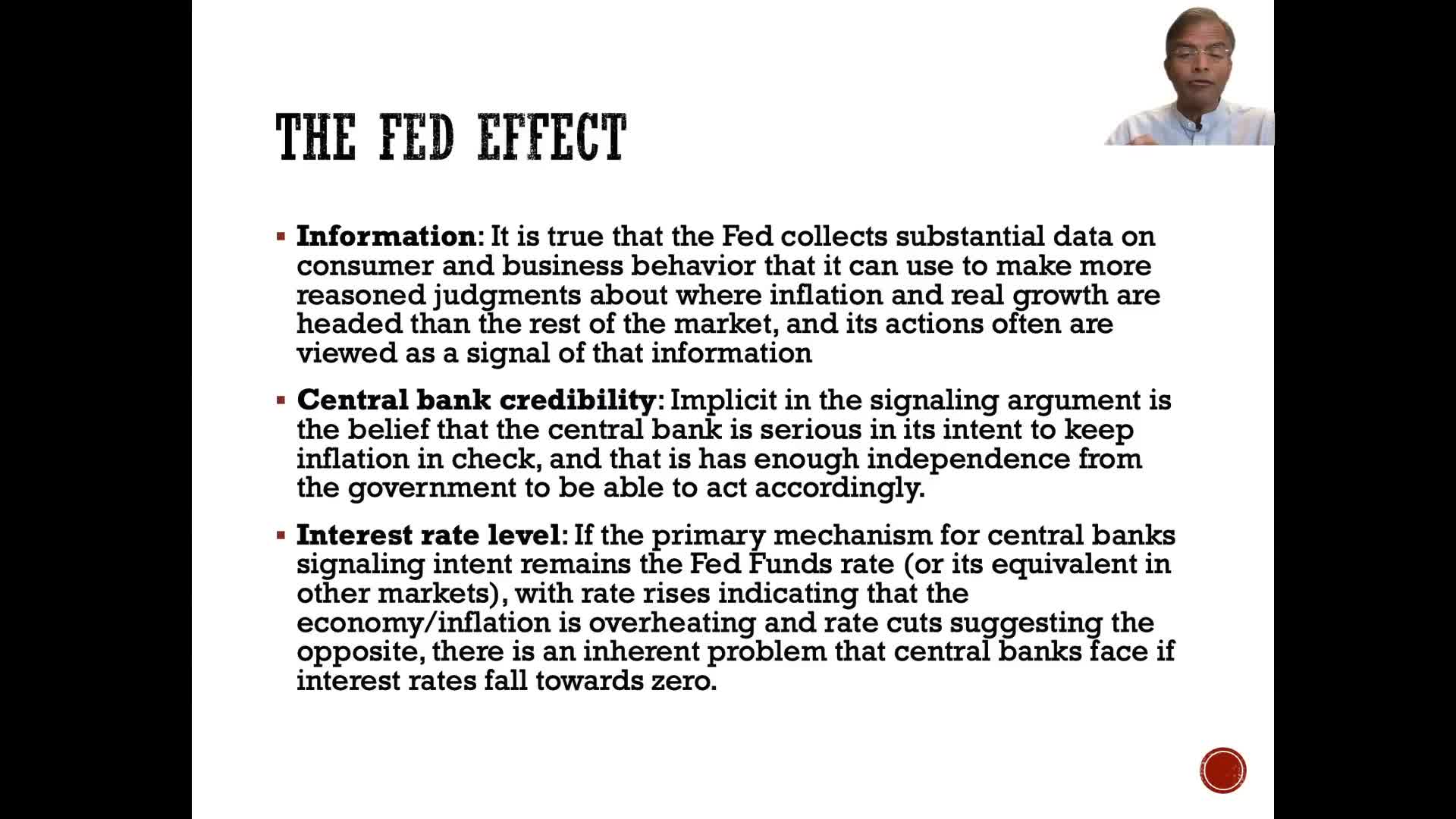

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

Watch clip answer (00:24m)How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)What are the two key phases of personal finance according to Scott Galloway, and how should people approach them?

According to Scott Galloway, personal finance consists of two key phases: investing and harvesting. The investing phase occurs during younger years when individuals should save money to deploy capital that grows while they sleep, providing future security. During this phase, market downturns are actually beneficial as they create opportunities to purchase assets at lower prices. The harvesting phase comes later in life when one begins spending more than earning, living off accumulated investments. Galloway criticizes current economic policies that artificially support markets through government intervention, which prevents younger generations from experiencing the natural investment opportunities that market cycles would normally provide.

Watch clip answer (00:58m)