Market Trends

What is the current state of venture capital liquidity in Silicon Valley?

Silicon Valley is experiencing a serious liquidity crisis. While the 1990s averaged 130 IPOs per year for emerging growth companies, recent statistics show only three venture-backed IPOs in the first half of this year. Over 5,000 venture-backed companies funded since 2004 have had no exits (either through IPOs or acquisitions). This represents a broken liquidity cycle that typically operated on a four to six-year timeframe. The situation reflects the impact of the deep recession, which has affected both financial markets and the real economy, creating a liquidity drought in the venture capital sector.

Watch clip answer (02:29m)Do you think the S&P 500 is a sell at its current record high, particularly with the upcoming election?

No, Leon Cooperman doesn't believe the S&P 500 is a sell at its current level. He notes that conditions typically preceding market downturns (recession, accelerating inflation, hostile Fed, geopolitical events) are not present. The market appears stable with consumer confidence high, strong retail sales and employment, and decent corporate profits. Cooperman does express concern about two factors: the alarming rate of debt buildup in the country and the political shift to the left. He's also worried about market structure changes, including the elimination of the uptick rule and reduced stabilizing forces. Despite these concerns, he believes the market is 'okay' for the near future.

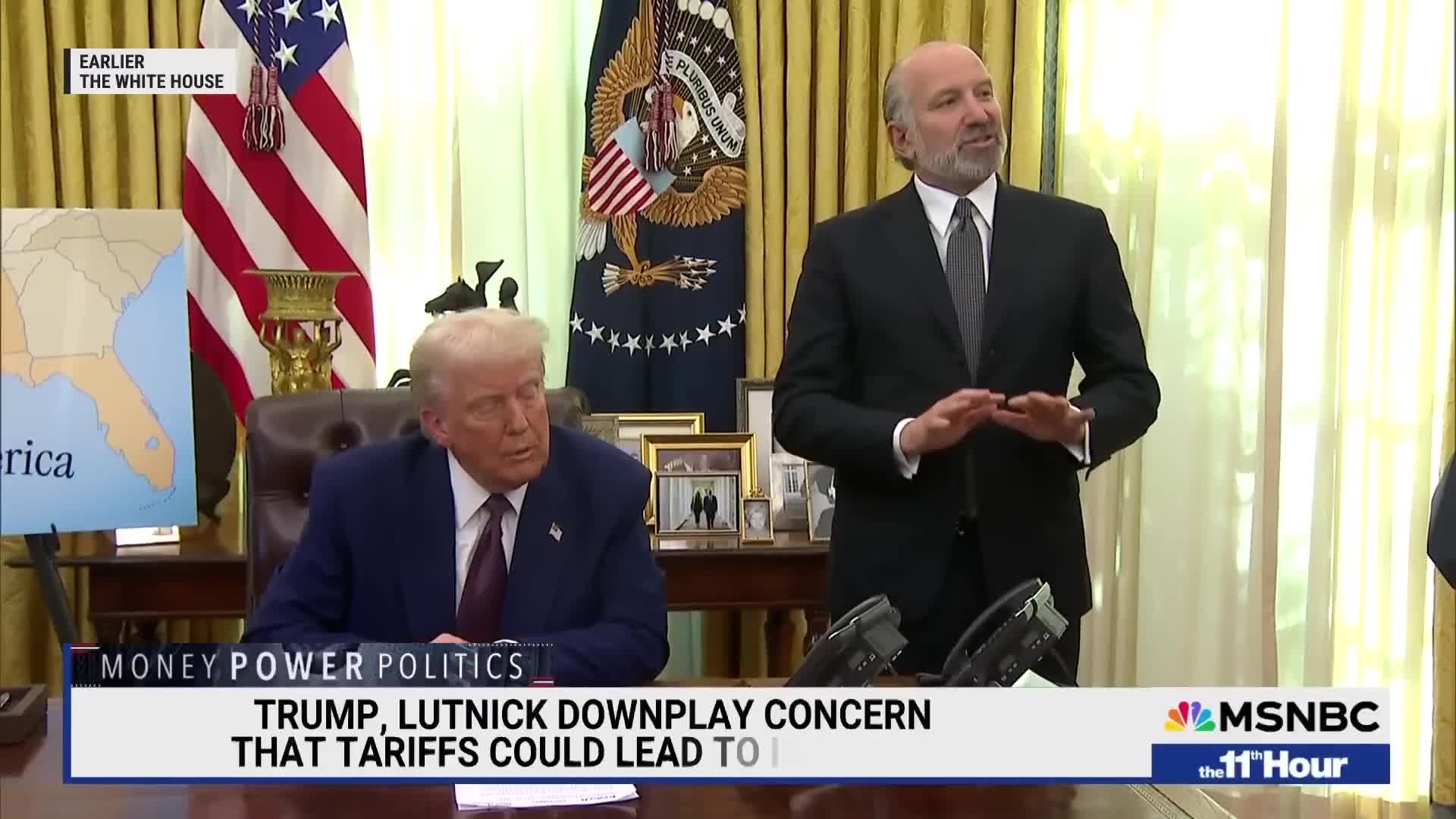

Watch clip answer (02:51m)How did the markets react to Trump's delay in tariff implementation?

The markets reacted very positively to the announcement that the tariff study wouldn't be completed until April 1, with tariffs potentially not being implemented until sometime after that date. This delay in the implementation of potential new tariffs was received as a relief by market participants. As Bill Cohan explains, this postponement gives businesses and investors more time to prepare and adjust strategies, reducing immediate economic uncertainty. The market's positive response indicates that concerns about tariffs' inflationary impact and potential disruption to global trade had been weighing on investor sentiment.

Watch clip answer (00:15m)How did defense stocks perform compared to tech stocks in the recent market?

While heavyweight tech stocks experienced declines, defense stocks continued to gain ground in the broader market, showing notable resilience. This divergent performance occurred alongside positive movement in mid and small cap indexes, with the BSE Mid cap index adding 1.2% and the small cap index surging by a more substantial 2.4%. This pattern indicates a rotation of investor interest from technology into defense sectors, potentially reflecting changing market sentiments and sector-specific dynamics.

Watch clip answer (00:13m)How did Asian markets perform on Wednesday?

Asian markets closed with mixed results on Wednesday as investors responded to recent earnings releases and economic indicators. Japan's Nikkei 225 showed gains, buoyed by strong corporate earnings, while Chinese markets struggled amid continued economic uncertainty. In India, the benchmark indices ended slightly lower after a volatile trading session. The Nifty index declined as heavyweight tech stocks faced downward pressure, though defense stocks continued to show strength in the broader market. This mixed performance reflects varying regional economic conditions and sector-specific trends across Asian markets.

Watch clip answer (00:27m)What factors are currently pressuring the Indian rupee and what is its expected trading range?

The Indian rupee is currently under pressure due to multiple factors including rising crude oil prices, weak market sentiment, and foreign investor outflows, according to financial experts. These elements have collectively weighed on the currency's performance. The USD/INR pair is expected to trade within a specific range between 86.75 and 87.25. Market analysts anticipate possible interventions by the Reserve Bank of India (RBI) at weaker levels, particularly when markets open, to potentially stabilize the currency against excessive depreciation.

Watch clip answer (00:22m)