Market Trends

What caused Philips shares to drop significantly, and what are investors currently focused on in the market?

Philips, the Dutch healthcare tech firm, experienced a sharp decline of nearly 12% in its shares following disappointing sales performance and a weak outlook for 2025. This significant drop occurred during a mixed trading day for European stocks, which came after the Stoxx 600 index had hit a record close on Tuesday. Meanwhile, investors are shifting their attention to upcoming U.S. economic indicators, specifically awaiting the Federal Reserve's FOMC meeting minutes and housing data. These economic reports are anticipated to provide critical insights that could influence direction on global market trends in the near term.

Watch clip answer (00:22m)What has happened to China's consumer confidence index and what does it indicate?

China's consumer confidence index has experienced a dramatic decline, dropping from 121.5 in January 2022 to 86.4 in December 2024. This sharp decrease of nearly 35 points over a three-year period signals significantly weakened consumer sentiment throughout the Chinese economy. This plummeting confidence level reflects broader economic concerns in China, particularly related to the struggling real estate sector. The decline indicates consumers are increasingly pessimistic about their financial prospects, which could lead to reduced spending and further economic challenges ahead.

Watch clip answer (00:12m)Are there any signs of recovery in China's real estate market despite the prolonged downturn?

Despite the prolonged real estate downturn in China, some analysts see early indications of a potential turnaround. New home prices experienced an uptick in January, while the stock market has shown short-lived rebounds, particularly in the tech sector following AI innovation launches. However, significant uncertainty persists in the market. Government policymakers continue implementing stimulus measures, but their effectiveness for long-term real estate stability remains unclear. As China navigates this economic challenge, attention is focused on the government's upcoming strategies to stabilize the property sector and restore investor confidence.

Watch clip answer (00:35m)What is the extent of Zeekr's global expansion?

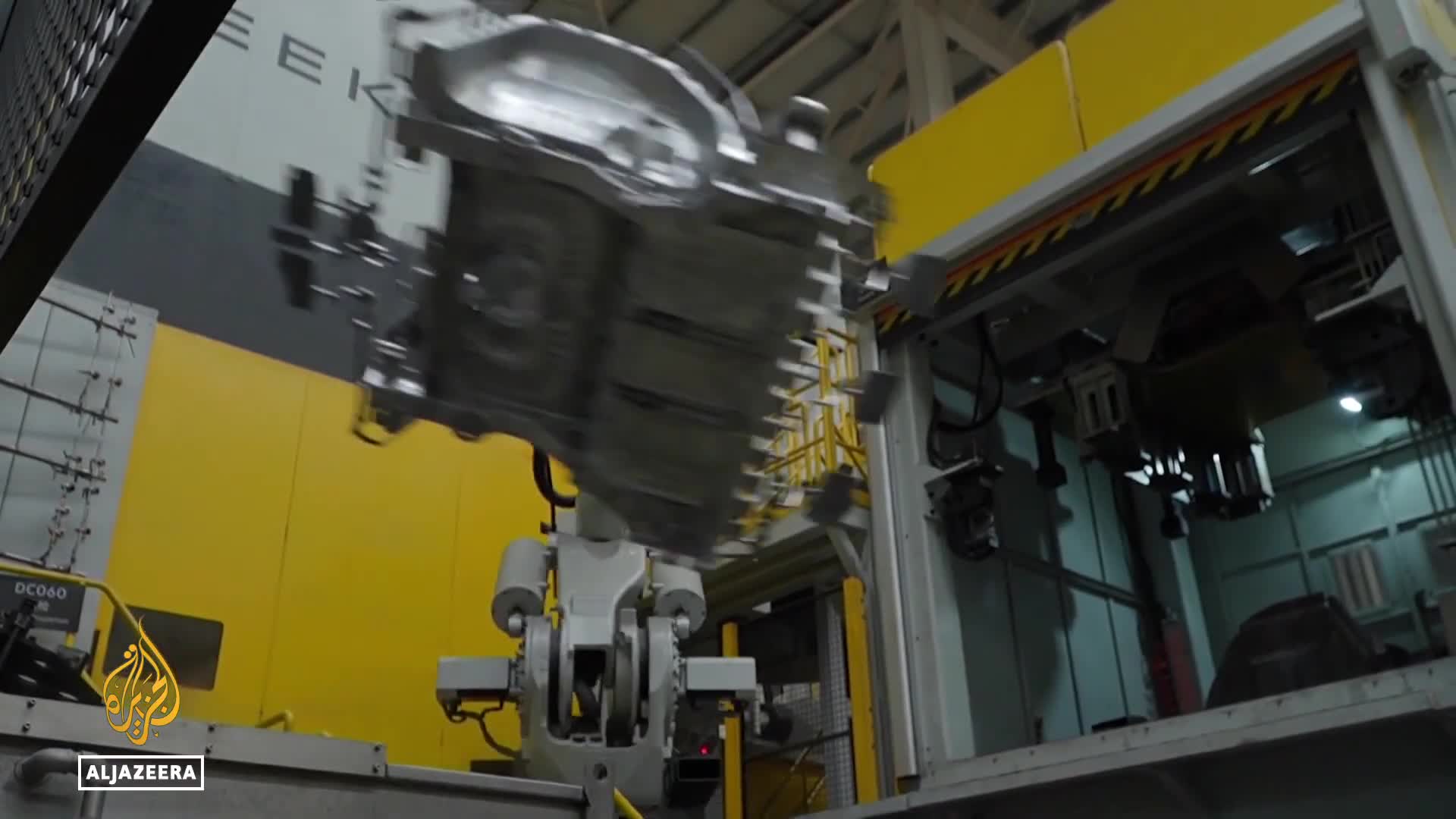

In the last two years, Zeekr has rapidly expanded its presence to over 40 countries worldwide, establishing itself as a growing force in the global electric vehicle market. The company recognizes that each market presents its own unique path and challenges for development. As part of its international strategy, Zeekr aims to double its international sales from the current 10% of total sales, with promising opportunities in regions like Australia and the Middle East. This expansion is supported by the company's advanced manufacturing capabilities, including automated, solar-powered production facilities in Ningbo, China.

Watch clip answer (00:12m)What is Zeekr's global expansion strategy for this year?

Zeekr's strategy for this year is to focus on enhancing customer experience in markets they have already entered, recognizing that building strong customer relationships requires significant resources and patience. The company is specifically targeting promising markets like Australia, Singapore, Malaysia, and the Middle East as part of their international expansion efforts. Currently, only 10% of Zeekr's sales come from international customers, indicating substantial growth potential as they strengthen their global presence in these strategic regions.

Watch clip answer (00:24m)How significant is the growth of electric vehicles in China's automotive market?

The electric vehicle sector has experienced rapid growth in China, establishing the country as a global leader in EV adoption. By 2025, electric vehicles are projected to dominate China's automotive market, accounting for nearly 60% of total car sales. This remarkable growth trajectory demonstrates China's successful transition toward sustainable transportation. The rapid expansion reflects strong consumer acceptance, government support through incentives, and advancements by domestic manufacturers like Zeekr in developing competitive electric vehicles.

Watch clip answer (00:11m)