What is the intrinsic risk-free rate and how does it explain interest rate movements?

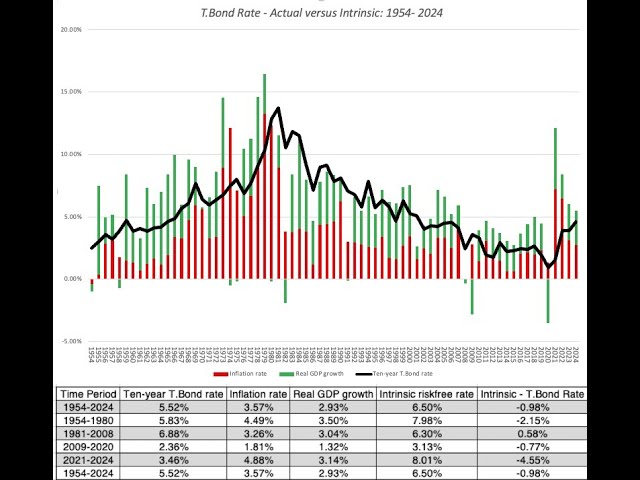

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

People also ask

TRANSCRIPT

Load full transcript

0

From

Understanding Intrinsic Risk Free Rates and Their Impact on Interest Rates

Aswath Damodaran·5 months ago