How do changes in interest rates affect company valuations?

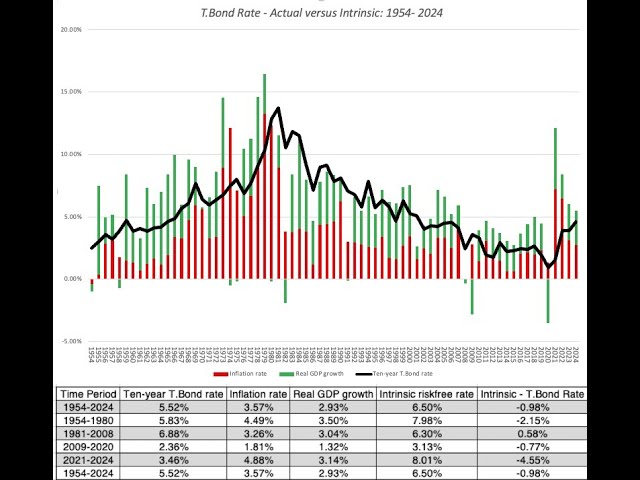

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

People also ask

TRANSCRIPT

Load full transcript

0

From

Impact of Interest Rates on Company Valuation and Inflation Insights

Aswath Damodaran·5 months ago