Inflation Policy

What is the intrinsic risk-free rate and how does it explain interest rate movements?

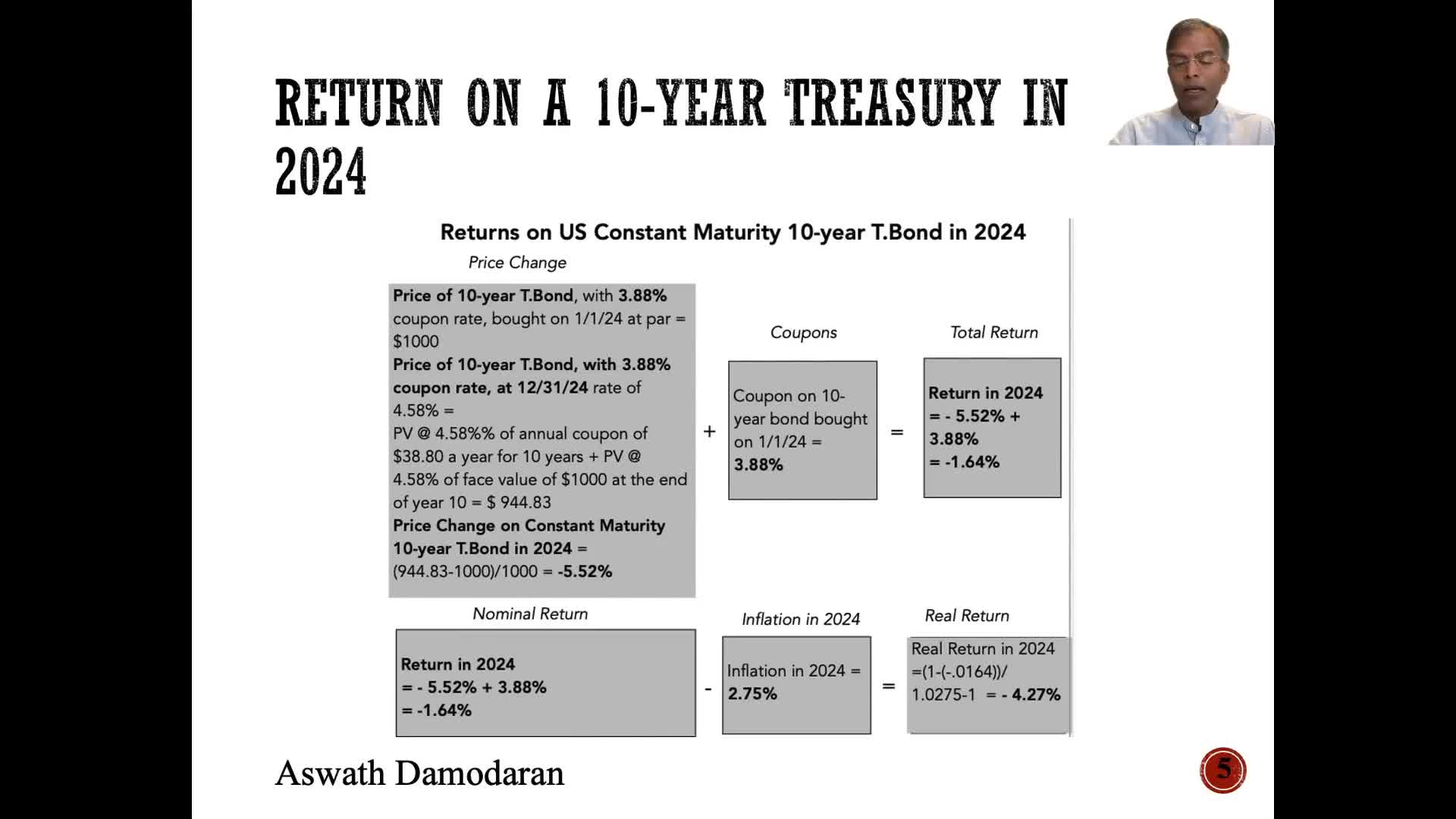

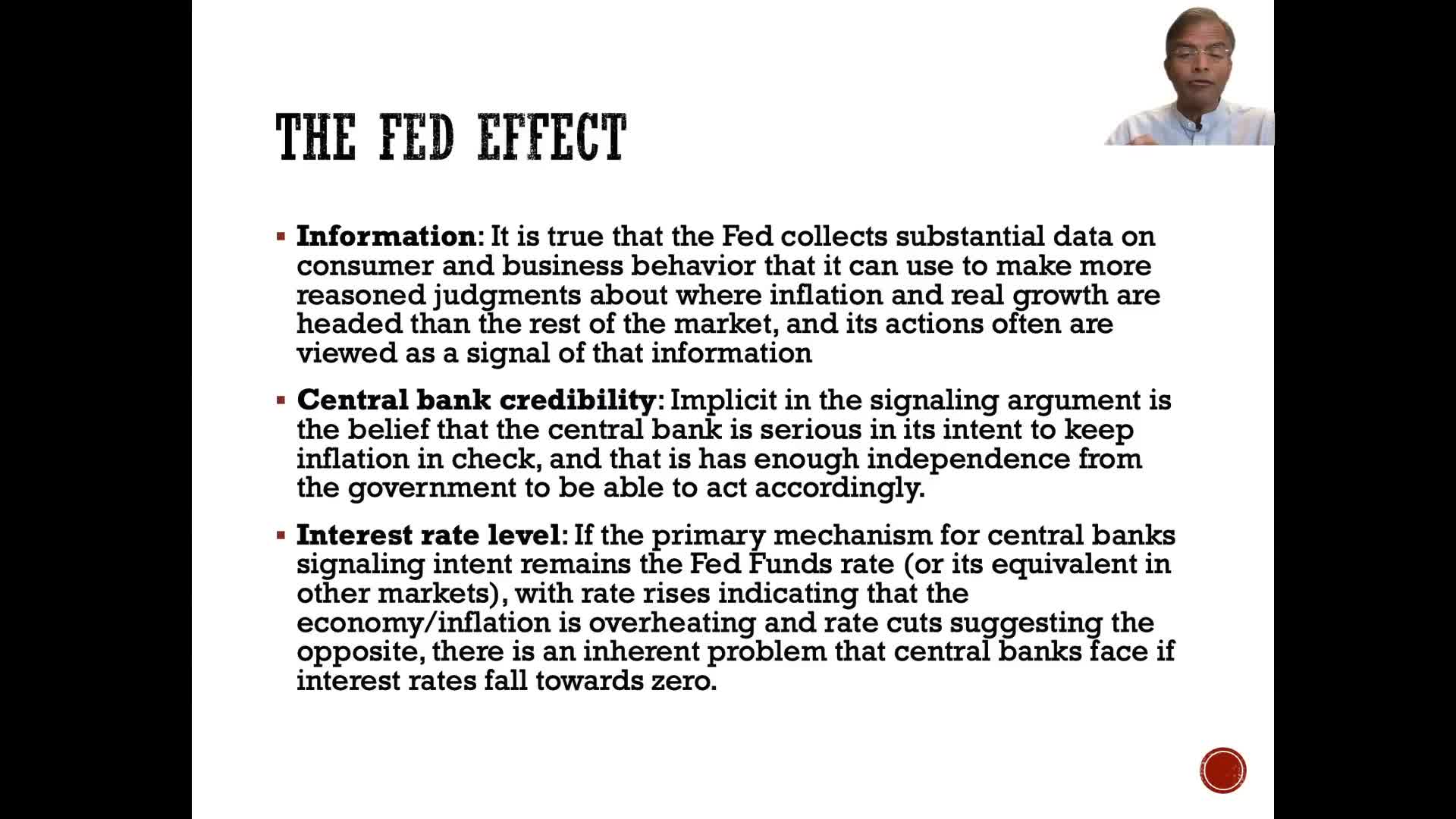

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

Watch clip answer (00:24m)How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

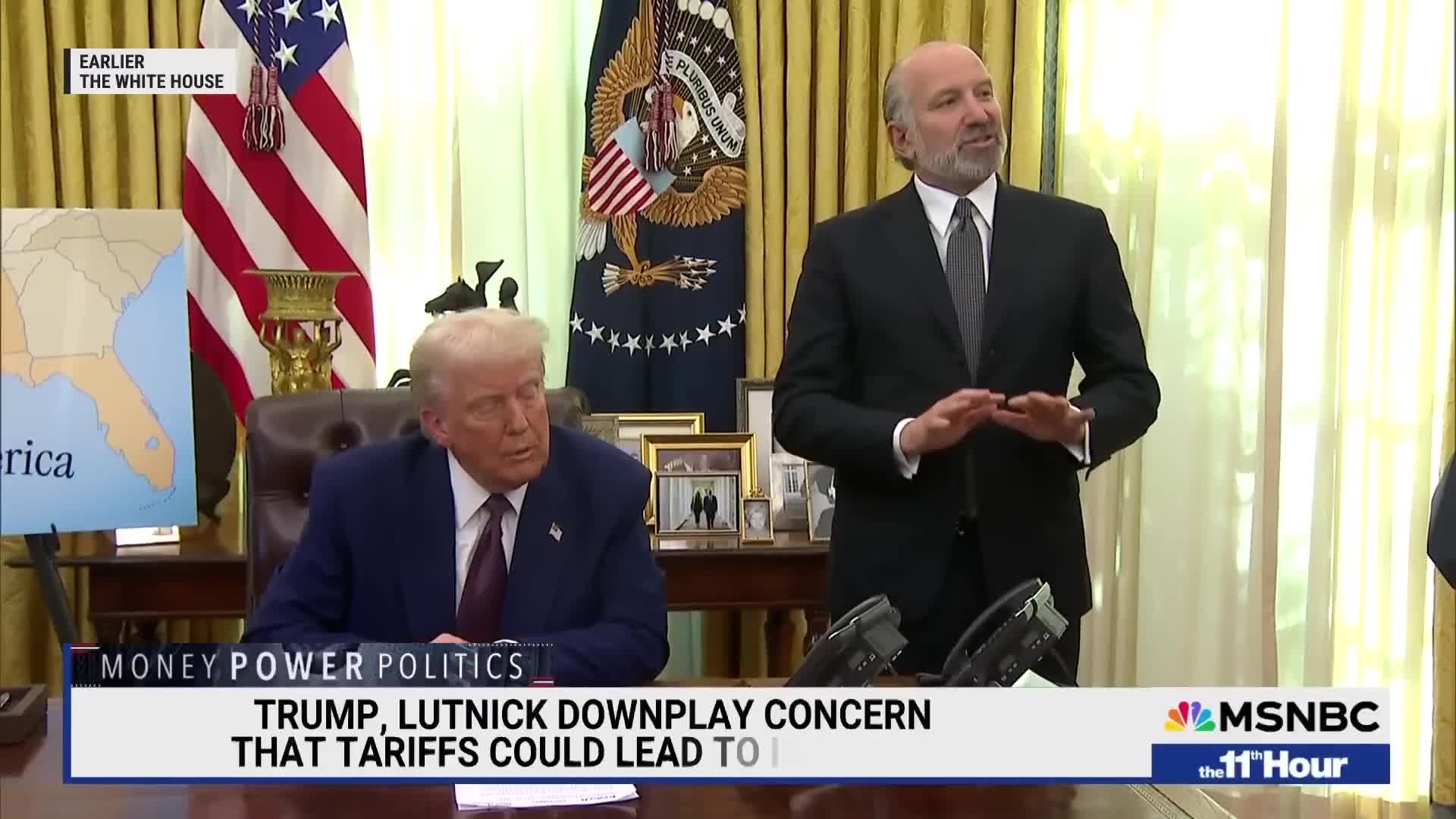

Watch clip answer (01:45m)Will prices rise because of Trump's tariffs?

The transcript reveals uncertainty about whether Trump's tariffs will increase consumer prices. When directly questioned, an economic advisor from Trump's team avoids giving a definitive answer, stating that 'prices fluctuate' and claiming to be 'confident' there won't be strong evidence of price effects from tariffs. However, experts in the discussion express concerns about these tariffs creating business uncertainty that could hurt US investment. The news analysts note that prices for gas and groceries have already risen and may increase further if the tariffs are implemented. The discussion also highlights how these policies might impact international trade relationships and alliances.

Watch clip answer (03:25m)How did the markets react to Trump's delay in tariff implementation?

The markets reacted very positively to the announcement that the tariff study wouldn't be completed until April 1, with tariffs potentially not being implemented until sometime after that date. This delay in the implementation of potential new tariffs was received as a relief by market participants. As Bill Cohan explains, this postponement gives businesses and investors more time to prepare and adjust strategies, reducing immediate economic uncertainty. The market's positive response indicates that concerns about tariffs' inflationary impact and potential disruption to global trade had been weighing on investor sentiment.

Watch clip answer (00:15m)What tax reforms is Donald Trump proposing to provide economic relief to Americans?

Donald Trump is proposing comprehensive tax cuts across the board to provide urgent relief to Americans affected by inflation. His specific proposals include eliminating taxes on tips, overtime pay, and Social Security benefits for seniors. Additionally, he wants to make interest payments on car loans tax-deductible, but only for vehicles manufactured in America. These measures are part of his broader economic plan to stimulate growth and deliver financial relief to Americans struggling with rising costs.

Watch clip answer (01:38m)