Inflation Policy

How does Donald Trump characterize the spending on the Green New Deal and its impact on inflation?

Donald Trump criticizes the current administration for spending '$9 trillion' that they were 'given to throw out the window,' particularly on what he terms the 'green news scam.' He describes this as 'the greatest scam in the history of the country' and connects this excessive spending directly to the return of inflation. According to Trump, the current economic challenges were 'inherited' by him upon returning to office, emphasizing that inflation has returned despite only being back 'for two and a half weeks.' He argues that the administration has 'spent money like nobody has ever spent' and firmly places responsibility for inflation on these spending policies rather than his own actions.

Watch clip answer (00:26m)How has government spending contributed to inflation according to Donald Trump?

According to Donald Trump, the government has spent money recklessly, pointing to $9 trillion that was 'thrown out the window.' He claims this excessive spending has directly caused inflation to return, despite being in office for only 'two and a half weeks' at the time of the discussion. Trump specifically criticizes spending on what he calls the 'green news scam,' which he describes as 'the greatest scam in the history of the country.' He argues that this misallocation of taxpayer funds by the current administration has damaged the economy and driven inflation, while distancing himself from responsibility for these economic problems.

Watch clip answer (00:26m)What does the rise in grocery prices since 2019 tell us about U.S. economic recovery and inflation?

The dramatic increase in grocery prices reveals why many Americans aren't feeling economic relief despite apparent recovery. While essential items like eggs have soared 219% since 2019 and other staples like orange juice and sugar have seen significant price hikes, wages have only increased by 19% since January 2021. This substantial gap between wage growth and food inflation explains why consumers feel financially strained. People are falling behind economically because they're forced to spend considerably more on everyday necessities while their income hasn't kept pace, creating a disconnect between official economic recovery statistics and the financial reality experienced by average households.

Watch clip answer (00:39m)What does the decline in homebuilder sentiment mean for the housing market and potential homebuyers?

The decline in homebuilder sentiment to a five-month low indicates that builders lack incentive to construct more houses, resulting in an even tighter housing supply. This sentiment index measures current sales, buyer traffic, and expected sales over the next six months—all of which are declining. For potential homebuyers, this creates a challenging market with persistently high interest rates and elevated prices. The situation is particularly problematic because increased housing supply is the key solution to high prices, but this reading suggests supply will remain constrained in the near future, further limiting options for those looking to purchase homes.

Watch clip answer (00:49m)How have egg prices changed since before the pandemic?

The price of a dozen eggs has dramatically increased since the pre-pandemic era. According to CBS News analysis of U.S. Bureau of Labor Statistics data, a dozen eggs cost just $1.55 in 2019 before the pandemic. Prices then surged dramatically to $4.82 in 2023, before temporarily dropping to $2.52 later that year. As of the current reporting period, egg prices have risen again to $4.95 per dozen, representing a more than 300% increase from pre-pandemic levels. This significant price increase reflects broader inflation trends affecting household grocery budgets across the country.

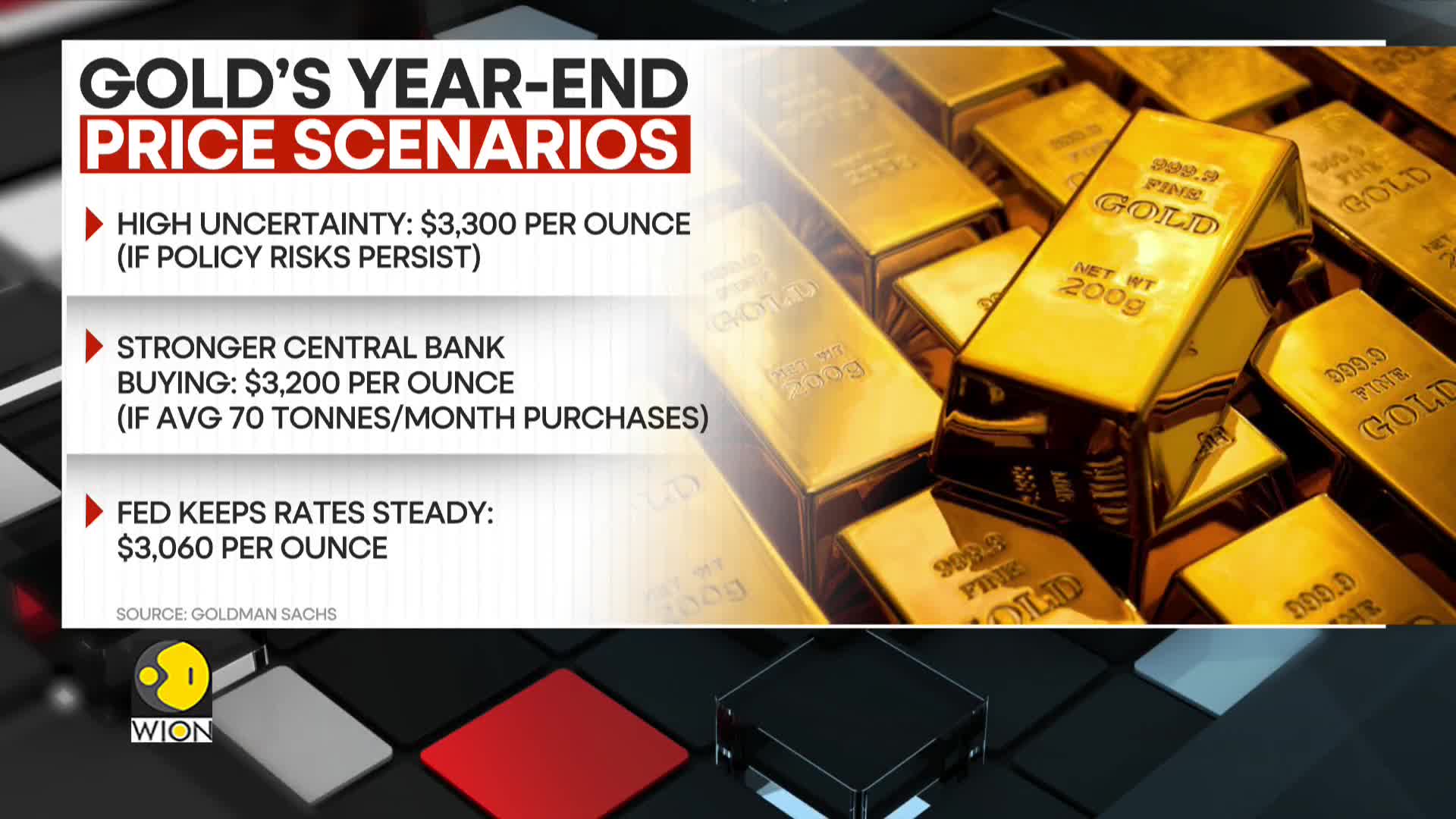

Watch clip answer (00:22m)What is Goldman Sachs' revised forecast for gold prices in 2025 and what factors are driving this change?

Goldman Sachs has increased its year-end 2025 gold price forecast to $3,100 per ounce, up from its previous estimate of $2,890. This upward revision is primarily attributed to sustained central bank demand for gold, which is expected to continue driving market prices higher. The investment bank projects that this central bank demand will add approximately 9% to gold prices by the end of the year, reflecting growing institutional confidence in gold as a strategic asset amid various economic uncertainties.

Watch clip answer (00:19m)