Inflation Policy

What is Goldman Sachs' forecast for gold prices and what factors are driving this prediction?

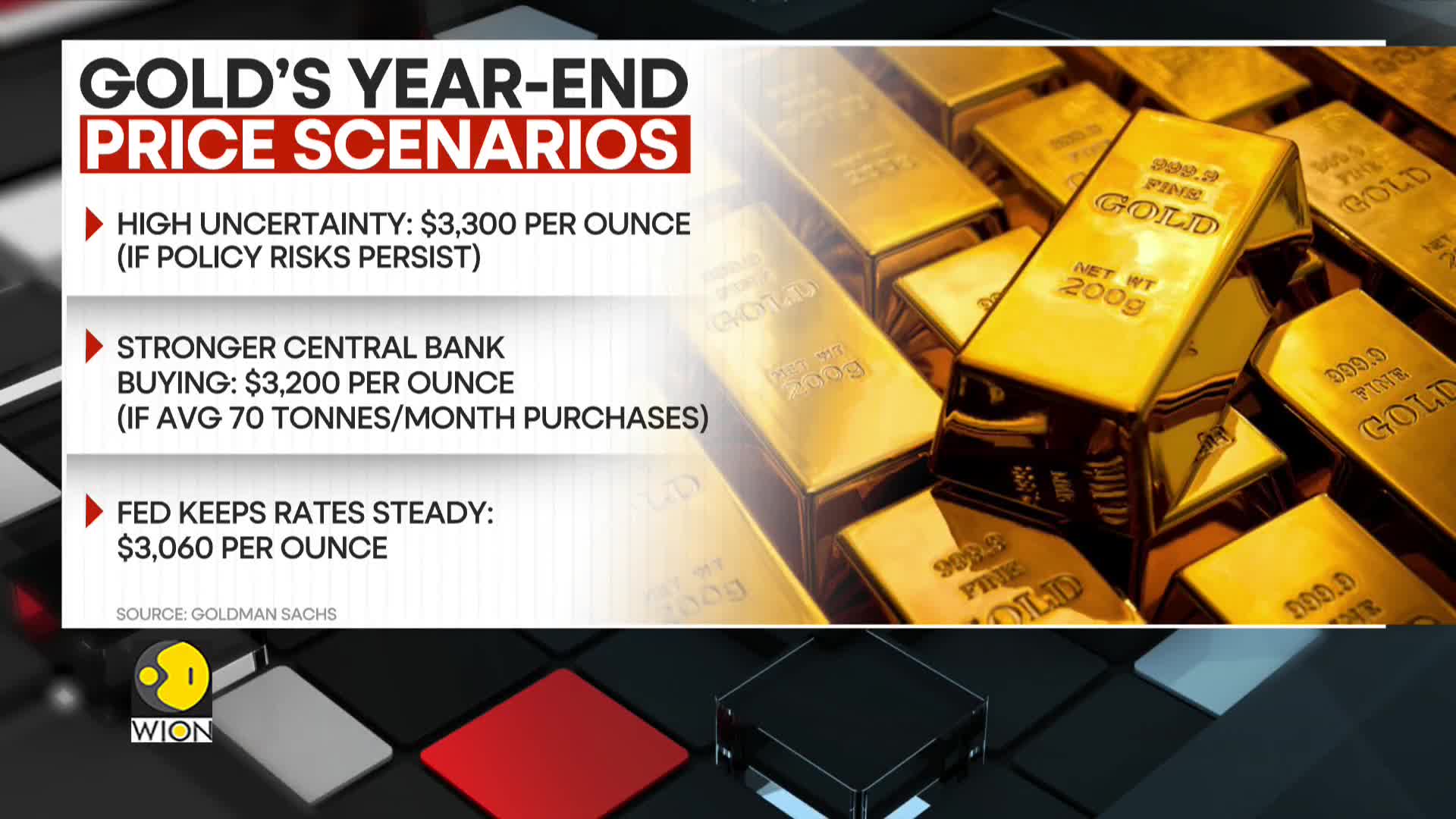

Goldman Sachs has revised its gold price forecast upward, primarily due to sustained central bank demand, which is expected to add 9% to gold prices by the end of the year. The bank has increased its assumption for monthly central bank gold purchases to 50 tonnes, up from its previous estimate of 41 tonnes. According to Goldman, this structural demand, combined with gradually increasing ETF holdings as interest rates decline, should outweigh any potential price drag from normalizing investor positioning, supporting their bullish outlook for gold.

Watch clip answer (00:30m)What is Goldman Sachs' gold price forecast for 2025 and what factors could drive it higher?

Goldman Sachs has raised its gold price forecast to $3,100 per ounce by the end of 2025, citing concerns over US fiscal sustainability as a key driver. According to their analysis, if these fiscal concerns escalate further, gold could rise an additional 5% to reach $3,250 per ounce by December 2025. The forecast is supported by growing fears of inflation and fiscal instability, which could trigger higher speculative positioning and stronger ETF inflows in the gold market. This outlook reflects gold's traditional role as a hedge against economic uncertainty, with the potential for significant price appreciation as investors seek safe-haven assets amid financial risks.

Watch clip answer (00:19m)What is Trump's perspective on inflation and the U.S. deficit?

Trump asserts that if the deficit is not brought under control, America will go bankrupt, emphasizing the importance of fiscal responsibility. He claims inflation has returned during his brief absence from office, stating 'Inflation's back' while distancing himself from responsibility for the current economic situation. Trump criticizes the previous administration for excessive spending, claiming 'They spent money like nobody's ever spent.' His comments reflect a position that prioritizes controlling government expenditure as essential for economic stability and preventing national bankruptcy.

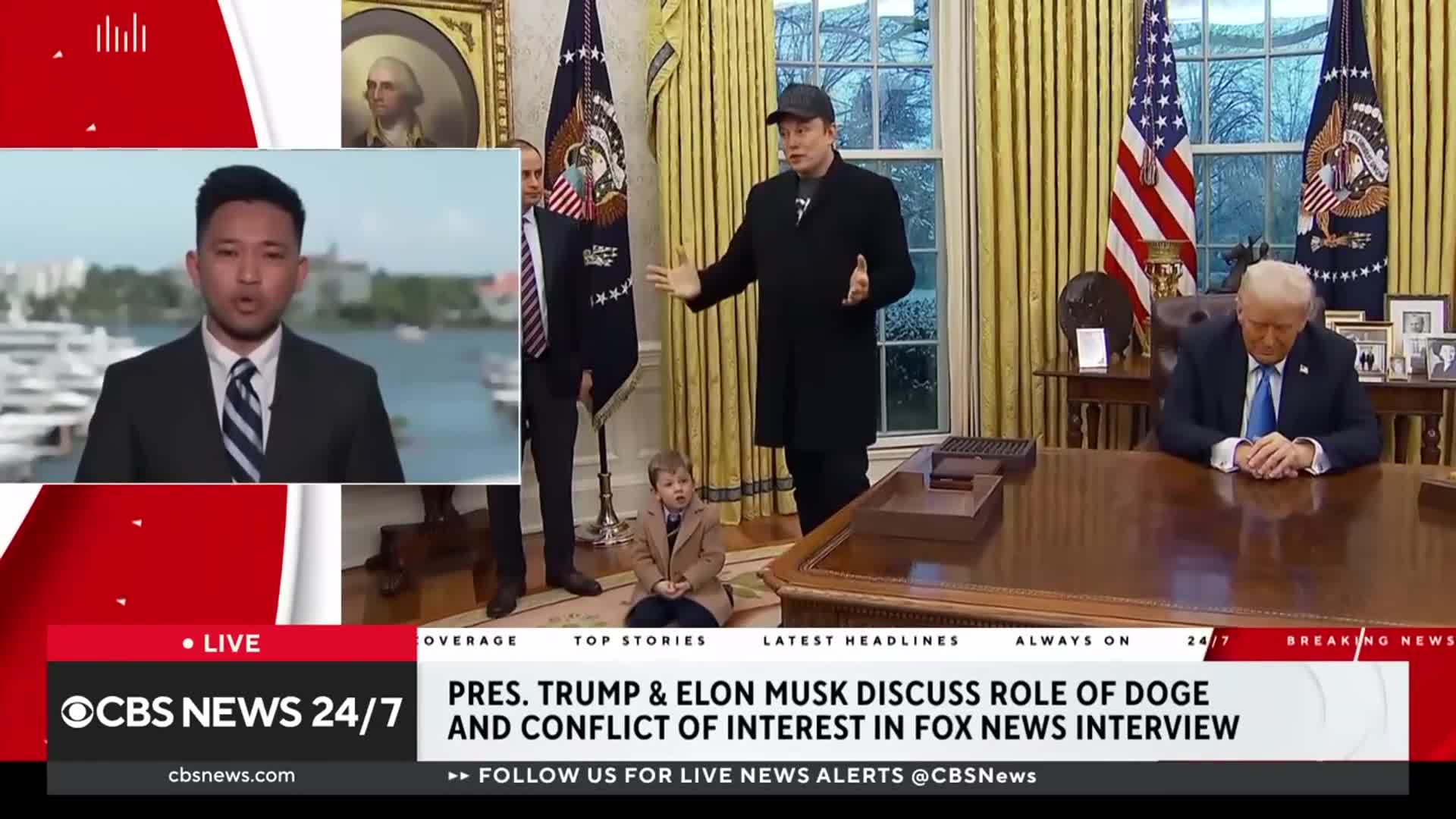

Watch clip answer (00:35m)What is President Trump's goal regarding the U.S. deficit, and why does he consider it important?

According to CBS News White House Reporter Aaron Navarro, President Trump's overall goal is to remove one trillion dollars from the U.S. deficit. This reduction is presented as a critical economic priority, with Trump warning that failure to bring the deficit under control could lead to America going bankrupt. The urgency of addressing the deficit is emphasized as being vital for the country's financial stability. Navarro describes this as 'a very important thing for people to understand,' highlighting how central this economic policy is to Trump's platform and his vision for preventing what he characterizes as potential financial disaster for the nation.

Watch clip answer (00:10m)How can inflation be effectively reduced according to Ben Shapiro?

According to Ben Shapiro, inflation is fundamentally 'too much money chasing too few goods,' and the only effective way to combat it is through increased productivity. By creating more goods and ensuring supply keeps up with demand, prices naturally decrease through market competition. Shapiro emphasizes that innovation and new products are key to a solid economic foundation rather than simply 'blowing money into the economy for the same product.' This approach creates a sustainable solution by addressing the supply side of the inflation equation instead of just manipulating monetary policy.

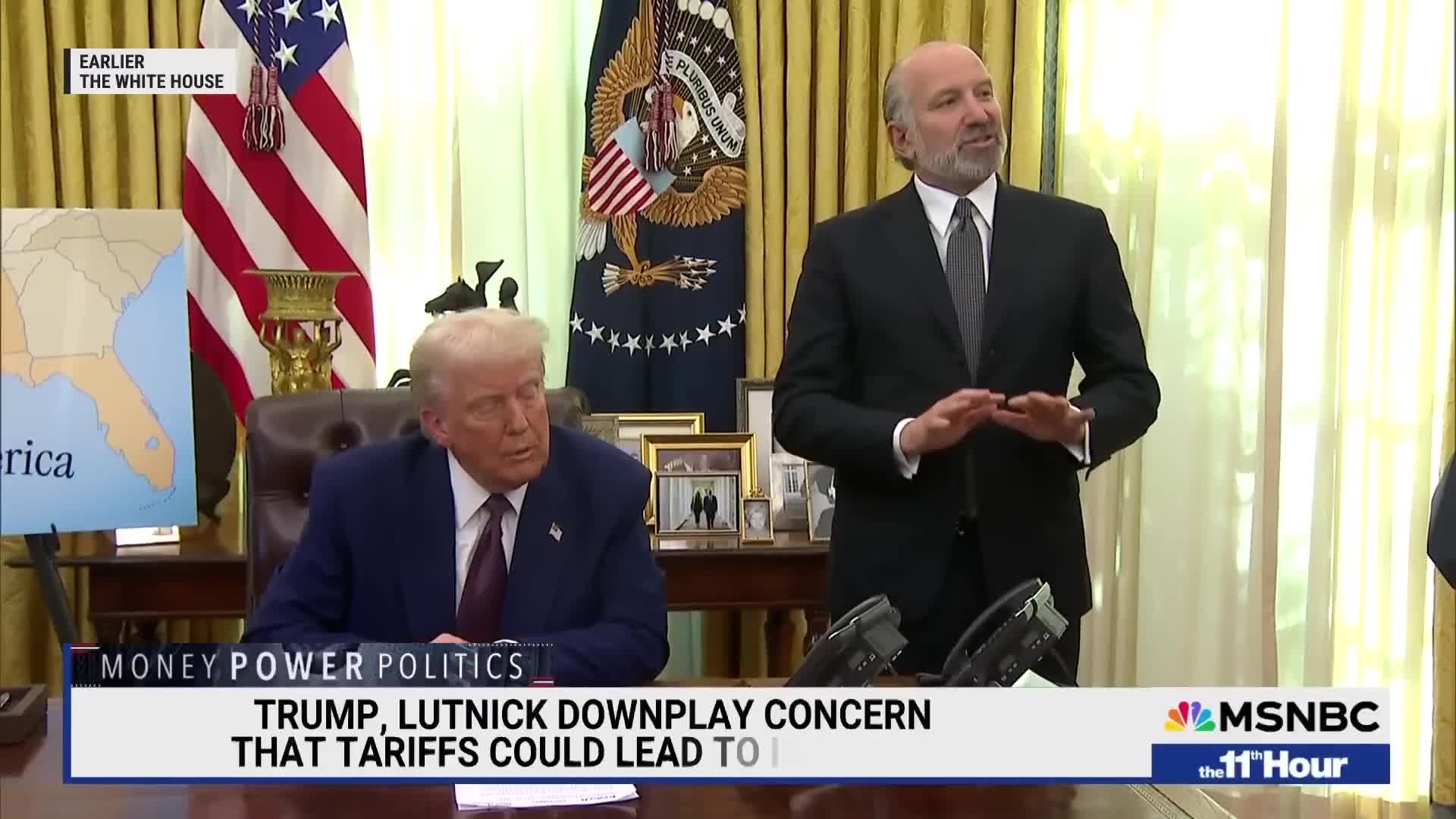

Watch clip answer (00:41m)What is President Trump's recent order regarding tariffs and when might they be implemented?

President Trump has ordered his administration to investigate imposing reciprocal tariffs on all U.S. trading partners. According to Commerce Secretary nominee Howard Lutnick, a comprehensive country-by-country study will be completed by April 1st, after which the President would implement the final tariff decisions. This move comes at a challenging time as inflation is once again heating up in the economy, which increases the stakes for Trump's trade strategy. The administration appears to be positioning these tariffs as a way to 'even the score' with other countries, though the timing raises questions about potential economic impacts amid rising inflation.

Watch clip answer (00:24m)