Financial Markets

What reforms are needed to support Small and Medium-sized Enterprises (SMEs) in Europe?

Europe needs comprehensive reforms to support SMEs, which are the engines of growth, particularly in countries like Spain and Italy. First, labor and fiscal reforms are essential foundations. More critically, Europe's financial structure must change - currently, 70% of corporate funding comes from banks (versus 30% from capital markets), the opposite of the U.S. model. This bank dependency creates vulnerability when banks delever or face capital problems. To address this, Madeline Antonik proposes two key solutions: having the European Central Bank (ECB) accept SME loans as collateral, and reopening the securitization market for SMEs. These measures would help restore capital flow to these vital businesses, enabling job creation and economic growth even as Europe's banks face ongoing challenges.

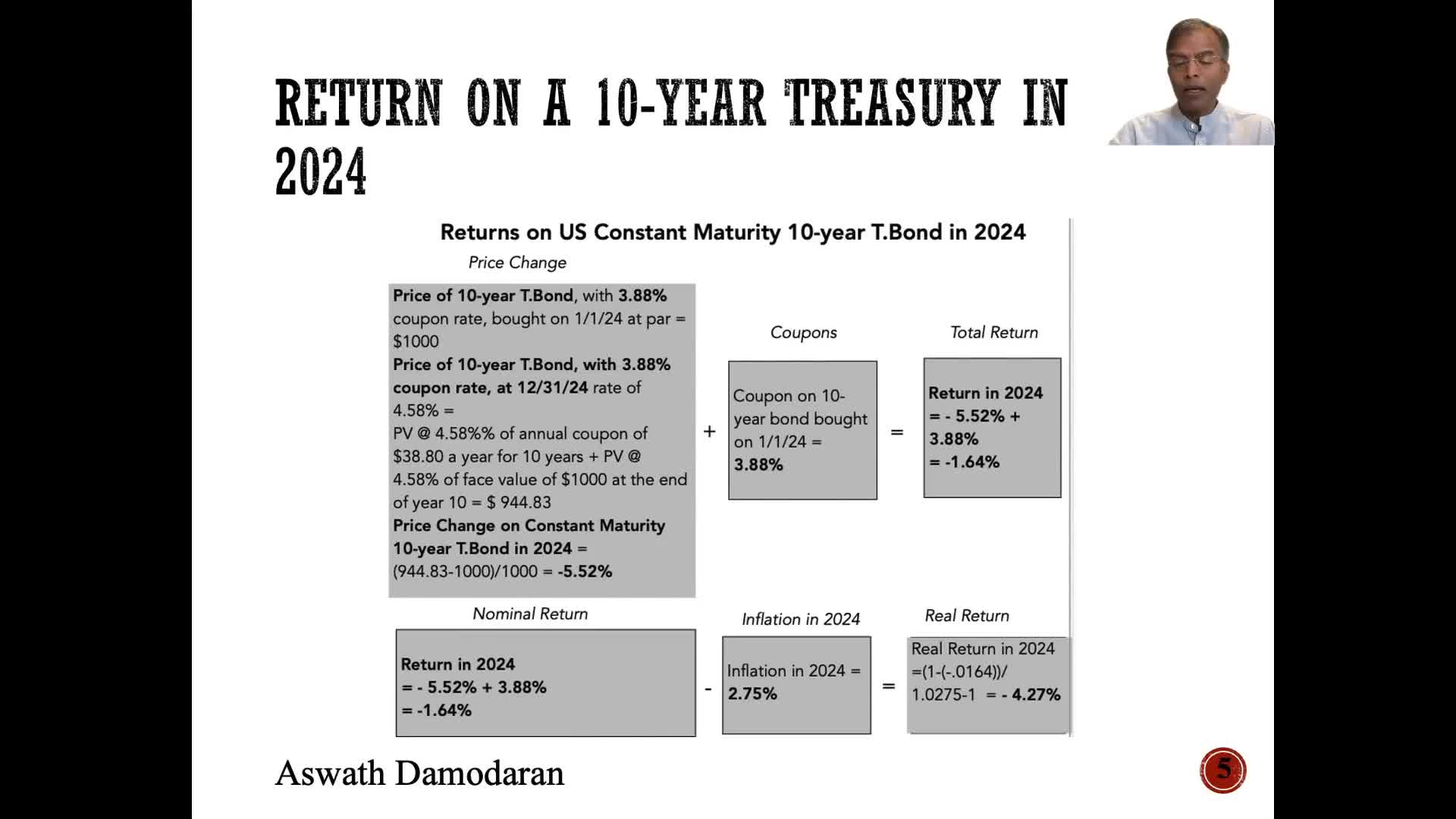

Watch clip answer (01:38m)What is the intrinsic risk-free rate and how does it explain interest rate movements?

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

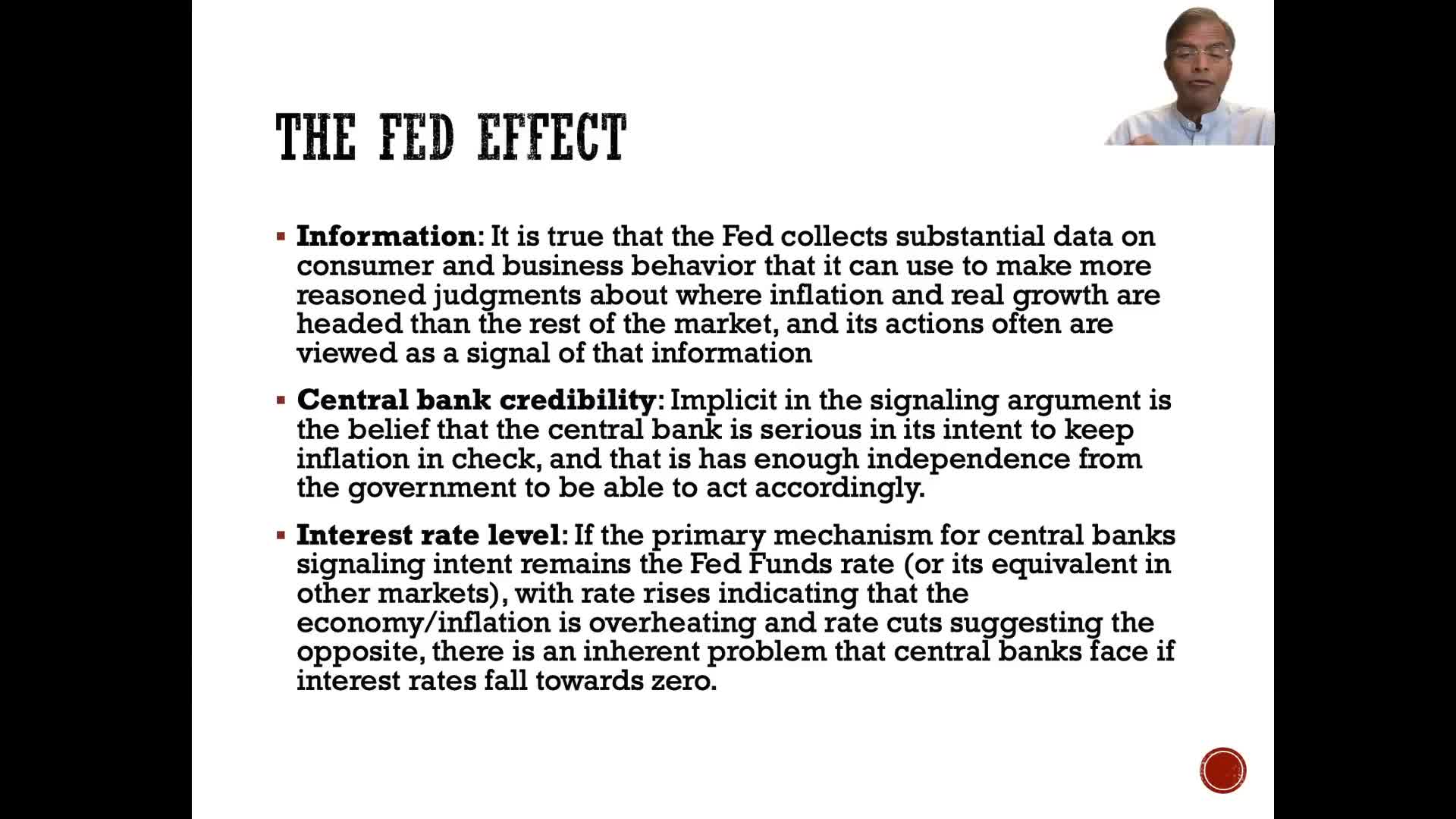

Watch clip answer (00:24m)How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

Watch clip answer (01:45m)How is Standard Chartered managing its credit loss reserves and what is the bank seeing in terms of economic recovery across Asian markets?

Standard Chartered has taken substantial precautionary credit loss reserves, including management overlays beyond what models suggest, due to pandemic uncertainties. While these reserves haven't fully materialized into actual losses, the bank maintains this cautious stance was appropriate. Early recovery indicators are positive across Asian markets, particularly in China, Hong Kong, and Singapore, where loan delinquencies that initially increased during the pandemic have declined. Other Asian countries with payment holidays are showing encouraging signs of customers becoming current on debt again. This positive trend supports the bank's plans to potentially resume distributions in early next year, subject to regulatory approval, as they remain well capitalized despite the uncertain environment.

Watch clip answer (01:49m)How did global markets respond to Trump's tariff announcements on goods from Canada, Mexico, and China?

Markets reacted negatively before trading floors even opened. The Dow plummeted by 600 points (down 1.6%), matching declines in the S&P 500 and Nasdaq. Canada's Toronto Stock Exchange futures dropped 1.3%, while European markets like Germany's DAX fell nearly 2%. Despite initial panic, markets calmed slightly when trading began after news broke that Mexico and the US had reached a temporary one-month delay on tariffs. Meanwhile, Canada announced retaliatory measures, including 25% tariffs on $155 billion worth of American goods, starting with $30 billion immediately.

Watch clip answer (03:43m)