Financial Markets

What are the two key phases of personal finance according to Scott Galloway, and how should people approach them?

According to Scott Galloway, personal finance consists of two key phases: investing and harvesting. The investing phase occurs during younger years when individuals should save money to deploy capital that grows while they sleep, providing future security. During this phase, market downturns are actually beneficial as they create opportunities to purchase assets at lower prices. The harvesting phase comes later in life when one begins spending more than earning, living off accumulated investments. Galloway criticizes current economic policies that artificially support markets through government intervention, which prevents younger generations from experiencing the natural investment opportunities that market cycles would normally provide.

Watch clip answer (00:58m)What is the current state of venture capital liquidity in Silicon Valley?

Silicon Valley is experiencing a serious liquidity crisis. While the 1990s averaged 130 IPOs per year for emerging growth companies, recent statistics show only three venture-backed IPOs in the first half of this year. Over 5,000 venture-backed companies funded since 2004 have had no exits (either through IPOs or acquisitions). This represents a broken liquidity cycle that typically operated on a four to six-year timeframe. The situation reflects the impact of the deep recession, which has affected both financial markets and the real economy, creating a liquidity drought in the venture capital sector.

Watch clip answer (02:29m)How has debt shifted from banks to fund management in recent years?

From 2009 to 2016, a significant shift occurred in the management of corporate and foreign debt. Direct household investments in debt decreased from 22% to 8.6%, while fund-managed investments increased from 8.5% to 18.3%. This transfer was driven by monetary policies and regulatory constraints on banks to hold more liquid assets and less corporate debt, especially lower-rated debt. This migration of debt investments from banks to funds has created critical interconnections between these financial entities. The shift makes it increasingly important to understand the relationships between banks and non-banks, including exposure through credit lines, derivatives transactions, and overlapping portfolio holdings. This evolving landscape requires continual risk evaluation and adaptive regulatory approaches.

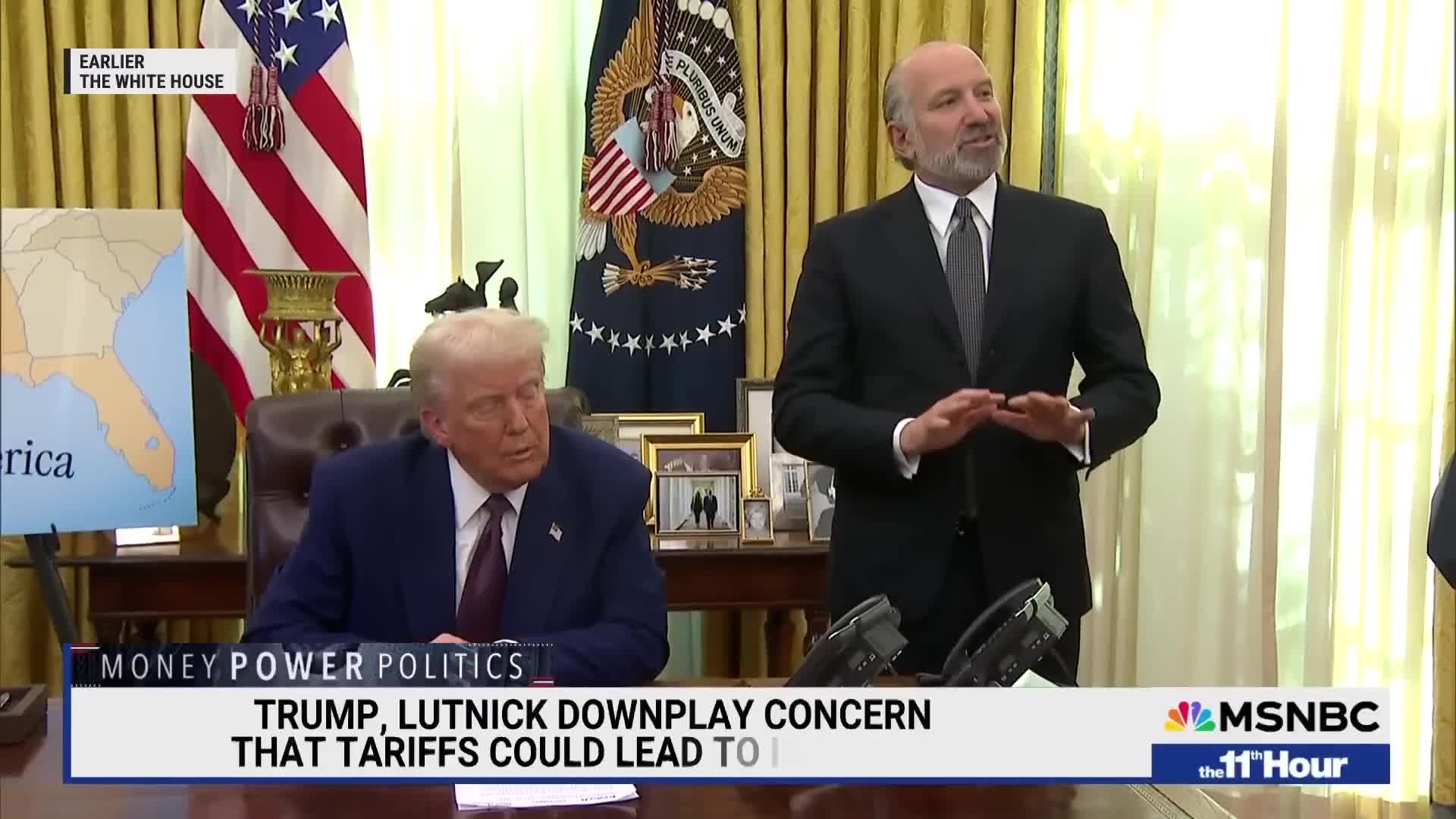

Watch clip answer (03:57m)How did the markets react to Trump's delay in tariff implementation?

The markets reacted very positively to the announcement that the tariff study wouldn't be completed until April 1, with tariffs potentially not being implemented until sometime after that date. This delay in the implementation of potential new tariffs was received as a relief by market participants. As Bill Cohan explains, this postponement gives businesses and investors more time to prepare and adjust strategies, reducing immediate economic uncertainty. The market's positive response indicates that concerns about tariffs' inflationary impact and potential disruption to global trade had been weighing on investor sentiment.

Watch clip answer (00:15m)How did defense stocks perform compared to tech stocks in the recent market?

While heavyweight tech stocks experienced declines, defense stocks continued to gain ground in the broader market, showing notable resilience. This divergent performance occurred alongside positive movement in mid and small cap indexes, with the BSE Mid cap index adding 1.2% and the small cap index surging by a more substantial 2.4%. This pattern indicates a rotation of investor interest from technology into defense sectors, potentially reflecting changing market sentiments and sector-specific dynamics.

Watch clip answer (00:13m)How did Asian markets perform on Wednesday?

Asian markets closed with mixed results on Wednesday as investors responded to recent earnings releases and economic indicators. Japan's Nikkei 225 showed gains, buoyed by strong corporate earnings, while Chinese markets struggled amid continued economic uncertainty. In India, the benchmark indices ended slightly lower after a volatile trading session. The Nifty index declined as heavyweight tech stocks faced downward pressure, though defense stocks continued to show strength in the broader market. This mixed performance reflects varying regional economic conditions and sector-specific trends across Asian markets.

Watch clip answer (00:27m)