Financial Markets

Financial markets play a pivotal role in the global economy, serving as platforms where buyers and sellers can trade financial assets, including stocks, bonds, currencies, and derivatives. These markets facilitate essential transactions between capital providers such as investors and savers, and capital seekers like corporations and governments. The dynamics of financial markets influence investment strategies and stock market analysis, making understanding their mechanics vital for both individual and institutional investors. Recent trends indicate that as the global economy continues to evolve, the significance of online trading platforms has surged, with a keen focus on identifying the best trading platforms to optimize trading strategies. In recent assessments, financial markets have demonstrated resilience amidst challenges such as inflationary pressures and geopolitical uncertainties. A cautious yet optimistic environment has emerged, especially in mergers and acquisitions (M&A) and initial public offerings (IPOs), signaling potential opportunities for growth. With demand for investment-grade private credit and asset-backed finance on the rise, along with notable activity in equity markets, understanding the state of financial markets involves navigating a complex landscape of opportunities and risks. Key players in these markets are increasingly leveraging technology and integrating artificial intelligence into their operations, ensuring that they remain competitive in a rapidly changing financial landscape. Overall, the mechanisms of trading platforms and profound effects of market fluctuations continuously shape investment strategies and opportunities within financial markets.

What factors are currently pressuring the Indian rupee and what is its expected trading range?

The Indian rupee is currently under pressure due to multiple factors including rising crude oil prices, weak market sentiment, and foreign investor outflows, according to financial experts. These elements have collectively weighed on the currency's performance. The USD/INR pair is expected to trade within a specific range between 86.75 and 87.25. Market analysts anticipate possible interventions by the Reserve Bank of India (RBI) at weaker levels, particularly when markets open, to potentially stabilize the currency against excessive depreciation.

Watch clip answer (00:22m)What caused Philips shares to drop significantly, and what are investors currently focused on in the market?

Philips, the Dutch healthcare tech firm, experienced a sharp decline of nearly 12% in its shares following disappointing sales performance and a weak outlook for 2025. This significant drop occurred during a mixed trading day for European stocks, which came after the Stoxx 600 index had hit a record close on Tuesday. Meanwhile, investors are shifting their attention to upcoming U.S. economic indicators, specifically awaiting the Federal Reserve's FOMC meeting minutes and housing data. These economic reports are anticipated to provide critical insights that could influence direction on global market trends in the near term.

Watch clip answer (00:22m)What does Japanese trade data reveal about its economic recovery and what challenges does it face?

Japanese trade data indicates a modest economic recovery is underway in the current quarter, with a notable jump in exports suggesting positive momentum. This growth signals that Japan's economy may be gradually strengthening after recent difficulties. However, this recovery comes with significant caveats. The most concerning threat is the potential implementation of US tariffs, which casts a shadow over Japan's export-driven growth. These possible trade restrictions could undermine the fragile progress and complicate Japan's economic outlook, creating uncertainty for its continued recovery.

Watch clip answer (00:14m)What has happened to China's consumer confidence index and what does it indicate?

China's consumer confidence index has experienced a dramatic decline, dropping from 121.5 in January 2022 to 86.4 in December 2024. This sharp decrease of nearly 35 points over a three-year period signals significantly weakened consumer sentiment throughout the Chinese economy. This plummeting confidence level reflects broader economic concerns in China, particularly related to the struggling real estate sector. The decline indicates consumers are increasingly pessimistic about their financial prospects, which could lead to reduced spending and further economic challenges ahead.

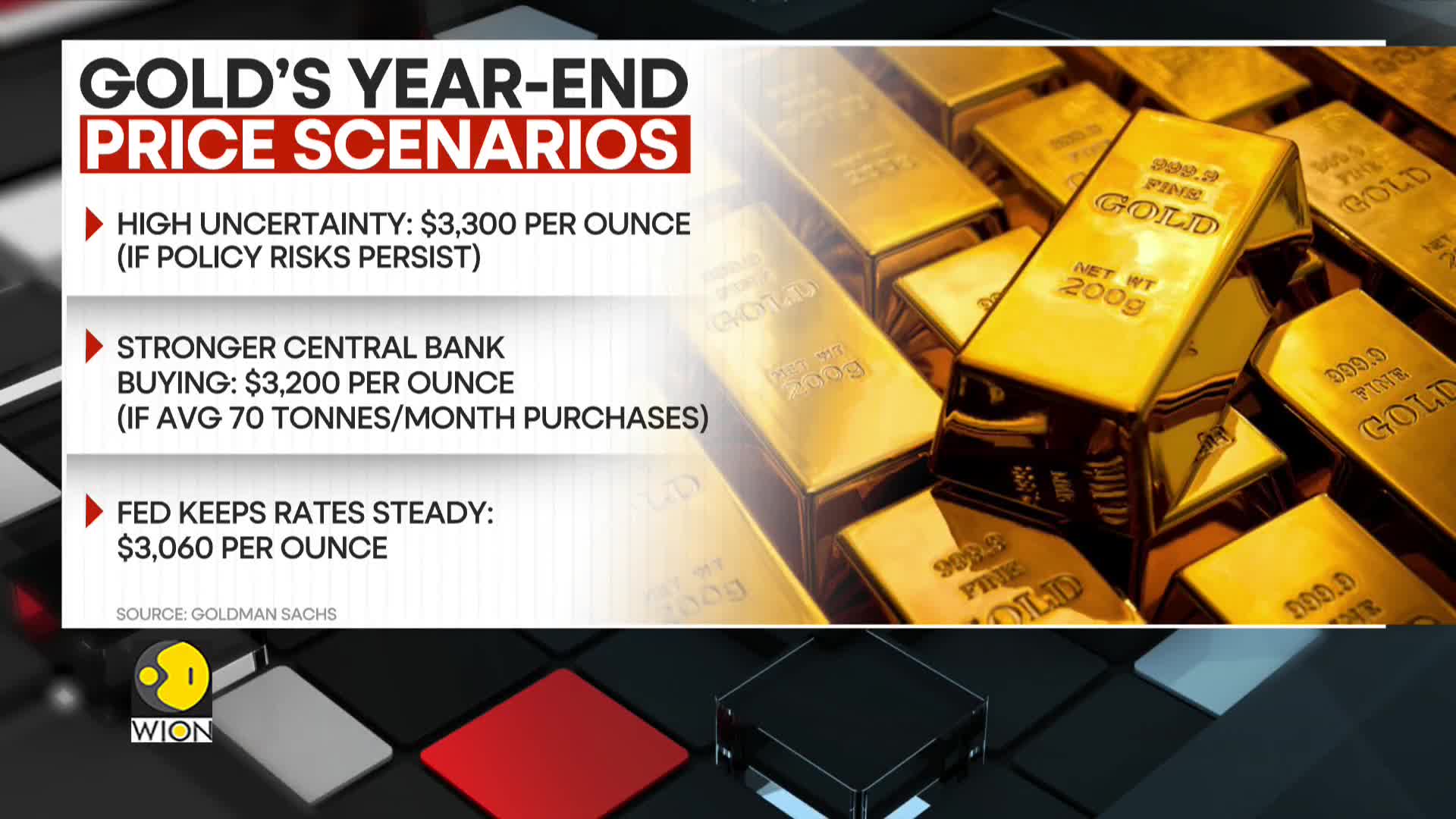

Watch clip answer (00:12m)What is Goldman Sachs' revised forecast for gold prices in 2025 and what factors are driving this change?

Goldman Sachs has increased its year-end 2025 gold price forecast to $3,100 per ounce, up from its previous estimate of $2,890. This upward revision is primarily attributed to sustained central bank demand for gold, which is expected to continue driving market prices higher. The investment bank projects that this central bank demand will add approximately 9% to gold prices by the end of the year, reflecting growing institutional confidence in gold as a strategic asset amid various economic uncertainties.

Watch clip answer (00:19m)What is Goldman Sachs' gold price forecast for 2025 and what factors could drive it higher?

Goldman Sachs has raised its gold price forecast to $3,100 per ounce by the end of 2025, citing concerns over US fiscal sustainability as a key driver. According to their analysis, if these fiscal concerns escalate further, gold could rise an additional 5% to reach $3,250 per ounce by December 2025. The forecast is supported by growing fears of inflation and fiscal instability, which could trigger higher speculative positioning and stronger ETF inflows in the gold market. This outlook reflects gold's traditional role as a hedge against economic uncertainty, with the potential for significant price appreciation as investors seek safe-haven assets amid financial risks.

Watch clip answer (00:19m)