Economic Trends

Economic trends play a crucial role in understanding the dynamic landscape of global finance, shaping everything from market behavior to policy decisions. These trends encompass a variety of economic indicators, including inflation rates forecasts, employment figures, and trade balances, which collectively inform stakeholders about the health of economies worldwide. Recently, there has been a notable trend of slowing growth across major markets, with projections indicating a decline in global GDP growth rates to approximately 2.4-3.2%. Policymakers face the challenge of navigating heightened uncertainties stemming from geopolitical tensions, particularly between the U.S. and China, which further complicate economic forecasting. As businesses and investors seek clarity, market trends analysis becomes essential. Understanding leading economic indicators, such as consumer confidence and inflation rates, allows for more strategic planning and investment. Recent reports highlight critical factors influencing these trends, including the impact of rising protectionism and tariff pressures on international trade dynamics. For instance, tariff increases have raised production costs and disrupted supply chains, leading to increased concerns about potential stagflation—a period characterized by stagnant economic growth combined with inflation. By monitoring these economic indicators and broader trends, analysts and stakeholders can better position themselves to respond to ongoing shifts in the global economy, ensuring they are equipped to adapt and thrive in an increasingly complex environment.

What is the significance of the Franco-German collaboration in addressing Europe's economic challenges?

The Franco-German collaboration represents a traditional but vital approach to European consensus-building. As Laurence Boone explains, this partnership is working to bridge divisions between northern, southern, and eastern European interests, creating a stronger declaration than previous efforts like Meissenberg when fragmentation was occurring between regions. This collaboration sets the stage for addressing critical fiscal issues, including potential European-level taxation mechanisms. Adam Tooze highlights how this opens discussions on tax loopholes, wealth auditing systems, and carbon pricing. Meanwhile, Moritz Schularick points to the long-term implications where joint debt issuance creates incentives for developing European-level taxes to service this common debt rather than burdening national budgets.

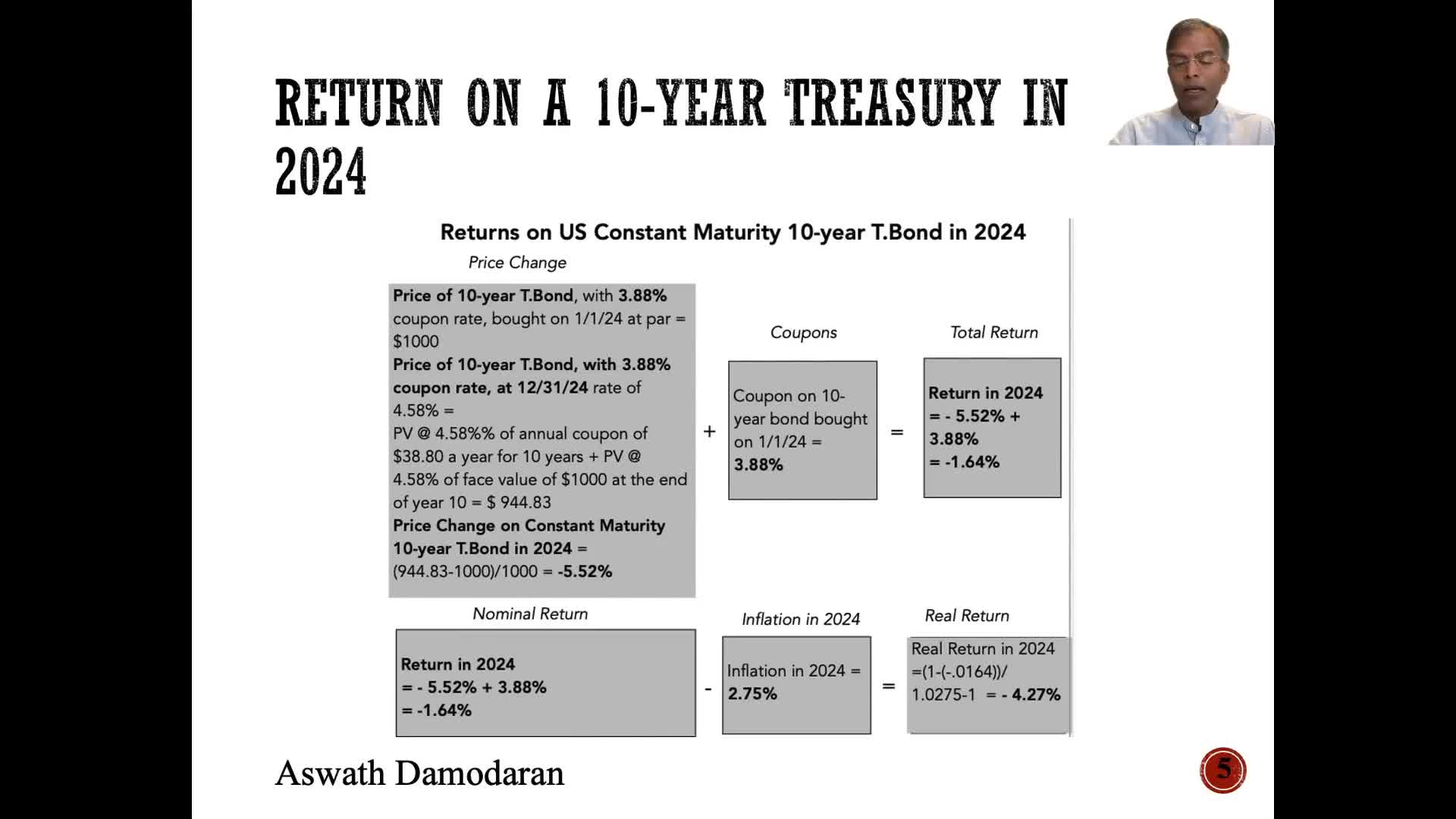

Watch clip answer (03:12m)What is the intrinsic risk-free rate and how does it explain interest rate movements?

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

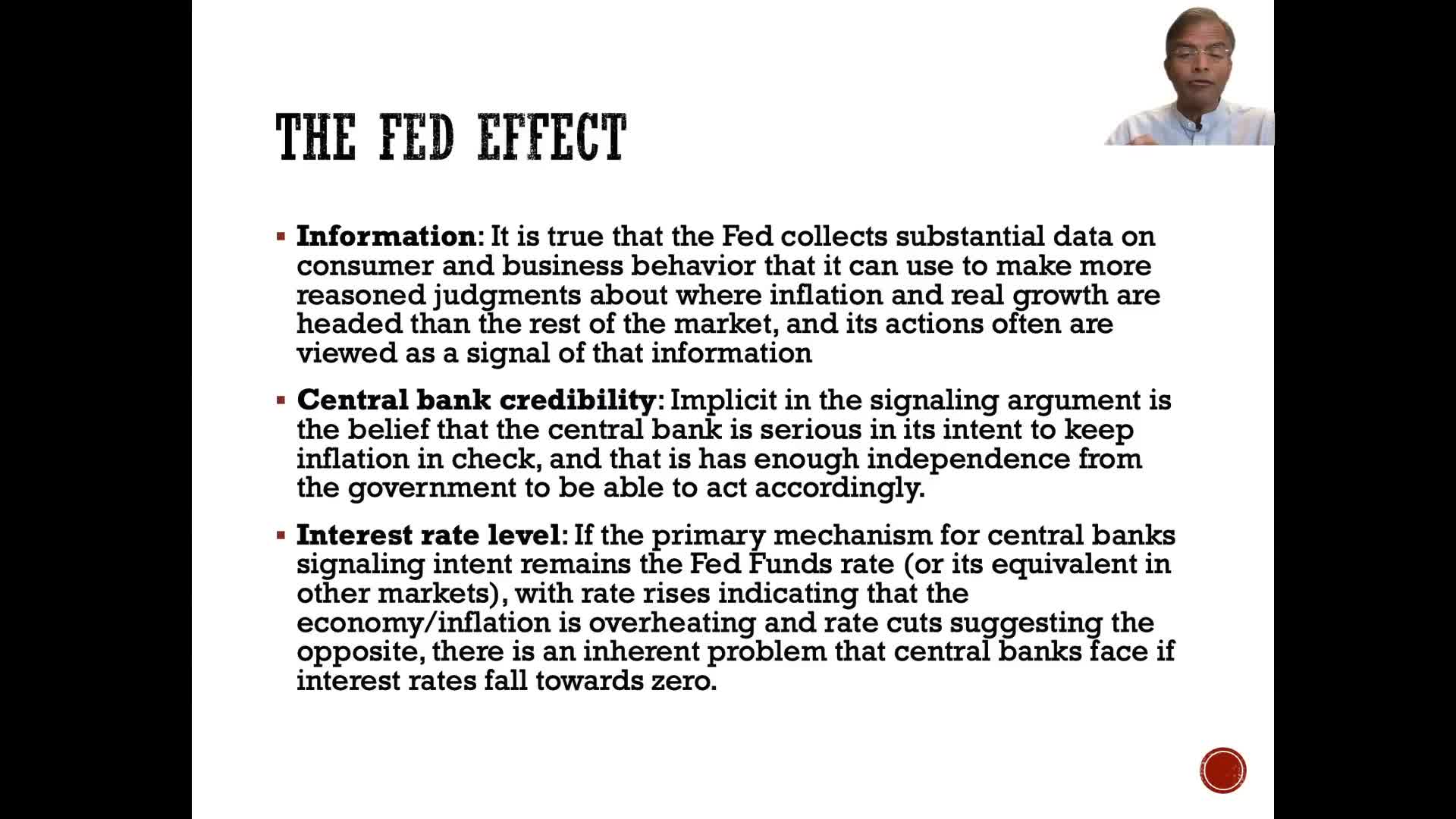

Watch clip answer (00:24m)How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)Who are the top five richest entrepreneurs in India according to Forbes?

According to Forbes, India's top five richest entrepreneurs begin with Mukesh Ambani of Reliance Industries at number one with $116 billion, leading in oil, gas, and retail. Gautama Dani holds the second position with $84 billion in infrastructure and energy, while Shiv Nadar, founder of tech giant ACL, ranks third with $36.9 billion. Completing the list are Savitri Jindal and family at fourth place with $33.5 billion from their steel and infrastructure business, and Dilip Shangvi of Sun Pharma at fifth with $26.7 billion. These business leaders represent the pinnacle of entrepreneurial success in India's dynamic economy.

Watch clip answer (00:46m)How is Standard Chartered managing its credit loss reserves and what is the bank seeing in terms of economic recovery across Asian markets?

Standard Chartered has taken substantial precautionary credit loss reserves, including management overlays beyond what models suggest, due to pandemic uncertainties. While these reserves haven't fully materialized into actual losses, the bank maintains this cautious stance was appropriate. Early recovery indicators are positive across Asian markets, particularly in China, Hong Kong, and Singapore, where loan delinquencies that initially increased during the pandemic have declined. Other Asian countries with payment holidays are showing encouraging signs of customers becoming current on debt again. This positive trend supports the bank's plans to potentially resume distributions in early next year, subject to regulatory approval, as they remain well capitalized despite the uncertain environment.

Watch clip answer (01:49m)What was the rationale behind the Clinton administration's decision to support China's entry into the World Trade Organization?

During the Clinton administration, officials supported China joining the WTO for several key reasons. They believed integration into the global trade system would make China more democratic and collaborative. Additionally, they anticipated that Chinese manufacturing would produce inexpensive products beneficial to American consumers. However, this decision had significant consequences, particularly for manufacturing regions in states like Missouri, North Carolina, and Pennsylvania, which subsequently lost approximately 3 million manufacturing jobs as production shifted overseas, creating a substantial US trade deficit.

Watch clip answer (02:02m)