Economic Trends

Economic trends play a crucial role in understanding the dynamic landscape of global finance, shaping everything from market behavior to policy decisions. These trends encompass a variety of economic indicators, including inflation rates forecasts, employment figures, and trade balances, which collectively inform stakeholders about the health of economies worldwide. Recently, there has been a notable trend of slowing growth across major markets, with projections indicating a decline in global GDP growth rates to approximately 2.4-3.2%. Policymakers face the challenge of navigating heightened uncertainties stemming from geopolitical tensions, particularly between the U.S. and China, which further complicate economic forecasting. As businesses and investors seek clarity, market trends analysis becomes essential. Understanding leading economic indicators, such as consumer confidence and inflation rates, allows for more strategic planning and investment. Recent reports highlight critical factors influencing these trends, including the impact of rising protectionism and tariff pressures on international trade dynamics. For instance, tariff increases have raised production costs and disrupted supply chains, leading to increased concerns about potential stagflation—a period characterized by stagnant economic growth combined with inflation. By monitoring these economic indicators and broader trends, analysts and stakeholders can better position themselves to respond to ongoing shifts in the global economy, ensuring they are equipped to adapt and thrive in an increasingly complex environment.

How will American consumer behavior change in the coming decades compared to the past 30 years?

According to David Wessel, American consumers will likely shift from being spendthrift to more thrifty for the next couple of decades. This behavioral change will force the rest of the world to rely more on domestic demand and less on exporting to the United States. Additionally, Wessel predicts an era of greater skepticism toward markets, with increased faith and reliance on government regulation to maintain economic stability. This represents a significant departure from previous beliefs that sophisticated market participants with their own money at stake would keep the system honest.

Watch clip answer (00:51m)What characterizes the U.S. economy and what changes does Gary Cohn anticipate after COVID-19?

The U.S. is fundamentally a consumption-based economy, with 80% of employment and GDP driven by consumer behavior. Americans are accustomed to consuming through entertainment, dining out, and shopping. However, Cohn believes the pandemic has exposed the need for strategic changes, particularly returning to domestic manufacturing of essential goods. While confident that consumers will eventually return to normal habits like visiting theme parks, he emphasizes that companies must be incentivized to produce strategically important items within the United States to ensure self-sufficiency in critical sectors.

Watch clip answer (01:33m)Is Citigroup adequately provisioned for an economic slowdown?

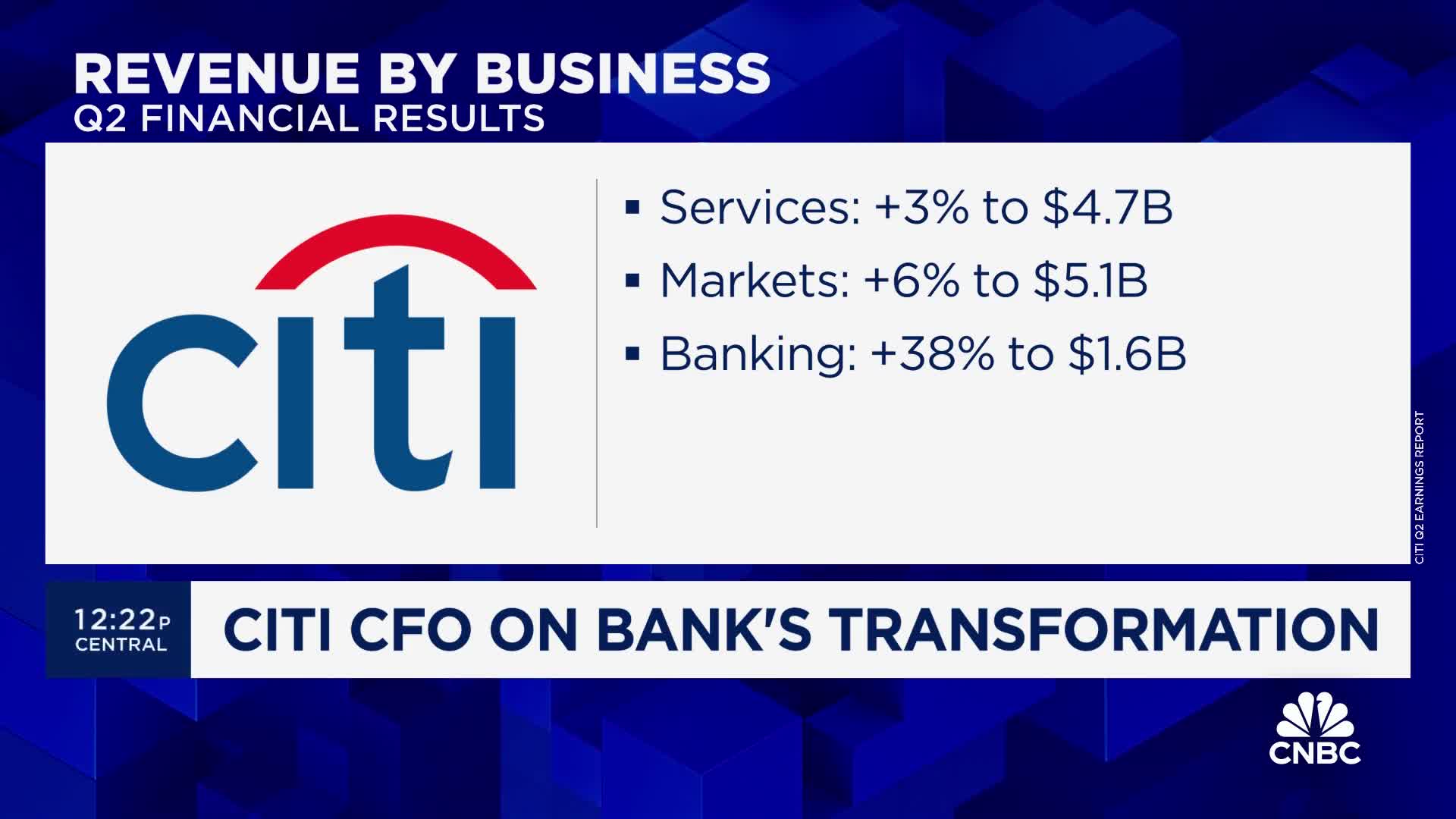

According to Mark Mason, Citigroup is well-provisioned for virtually any economic scenario with over $22 billion in reserves against their loans, representing a 2.7-2.8% funded loan ratio. Their stress scenarios incorporate various economic conditions, including a base case assuming 5% unemployment and downside scenarios with 6.8% unemployment. While consumer credit losses have increased as part of expected normalization, corporate losses remain minimal due to their high-quality corporate loan book. Mason noted an interesting dichotomy in consumer behavior, with higher FICO score customers increasing spending while lower FICO consumers are reducing payment rates and increasing borrowing activity.

Watch clip answer (02:48m)What is the current state of venture capital liquidity in Silicon Valley?

Silicon Valley is experiencing a serious liquidity crisis. While the 1990s averaged 130 IPOs per year for emerging growth companies, recent statistics show only three venture-backed IPOs in the first half of this year. Over 5,000 venture-backed companies funded since 2004 have had no exits (either through IPOs or acquisitions). This represents a broken liquidity cycle that typically operated on a four to six-year timeframe. The situation reflects the impact of the deep recession, which has affected both financial markets and the real economy, creating a liquidity drought in the venture capital sector.

Watch clip answer (02:29m)Do you think the S&P 500 is a sell at its current record high, particularly with the upcoming election?

No, Leon Cooperman doesn't believe the S&P 500 is a sell at its current level. He notes that conditions typically preceding market downturns (recession, accelerating inflation, hostile Fed, geopolitical events) are not present. The market appears stable with consumer confidence high, strong retail sales and employment, and decent corporate profits. Cooperman does express concern about two factors: the alarming rate of debt buildup in the country and the political shift to the left. He's also worried about market structure changes, including the elimination of the uptick rule and reduced stabilizing forces. Despite these concerns, he believes the market is 'okay' for the near future.

Watch clip answer (02:51m)What books does Tim O'Reilly recommend for understanding the problems with our current financial system?

Tim O'Reilly highlights two important books that explore economic challenges: 'Makers and Takers' by Rana Faroohar and 'The Golden Passport' by Duff MacDonald. MacDonald's work examines how Harvard Business School spread financial ideology, while Faroohar's book identifies the root cause of economic problems. According to Faroohar, the financial system has stopped serving the real economy and now primarily serves itself, which she identifies as the single biggest unexplored reason for long-term slower growth and income inequality. These insights challenge commerce professionals to reconsider how financial systems should function in relation to the broader economy.

Watch clip answer (00:29m)