Consumer Finance

Consumer finance encompasses a wide array of financial products and services that enable individuals to effectively manage their spending, borrowing, and saving for personal needs. It includes options such as personal loans, credit cards, installment plans, and increasingly popular Buy Now, Pay Later (BNPL) programs. These financing solutions allow consumers to make purchases they might not be able to afford upfront by extending payments over time, thus improving cash flow management and purchasing power. In recent developments, the consumer finance sector has witnessed significant upticks in various lending categories, amidst a backdrop of economic uncertainty and evolving consumer behaviors. The relevance of consumer finance is underscored by the ongoing shifts in consumer credit trends and spending patterns, highlighted in recent reports. Notably, lending categories like auto loans and personal loans are seeing steady growth, with delinquency rates showing slight improvements, suggesting a more favorable credit environment. Demand for flexible financing options is increasing, particularly as younger demographics, including Gen Z, embrace digital payment methods and seek alternatives to traditional credit products. This landscape reflects not only the current resilience of consumer finances but also the adaptation of financial institutions to meet the diverse needs of modern consumers. As economic conditions fluctuate, understanding trends in budgeting apps and credit score improvement becomes critical for effectively navigating personal finance.

How can machine learning models improve credit scoring compared to traditional methods?

Machine learning models improve credit scoring by collating data across multiple sources including credit bureaus, bank accounts, money laundering statuses, and alternative payment histories. Unlike traditional credit scoring techniques, these ML models consider additional factors like monthly rental commitments that are typically overlooked. The model can explain which features are most important for credit decisions in layman's language, providing transparency. This approach creates a more sophisticated risk profiling system that delivers personalized credit recommendations, making the process more inclusive for applicants who might be underserved by conventional scoring methods.

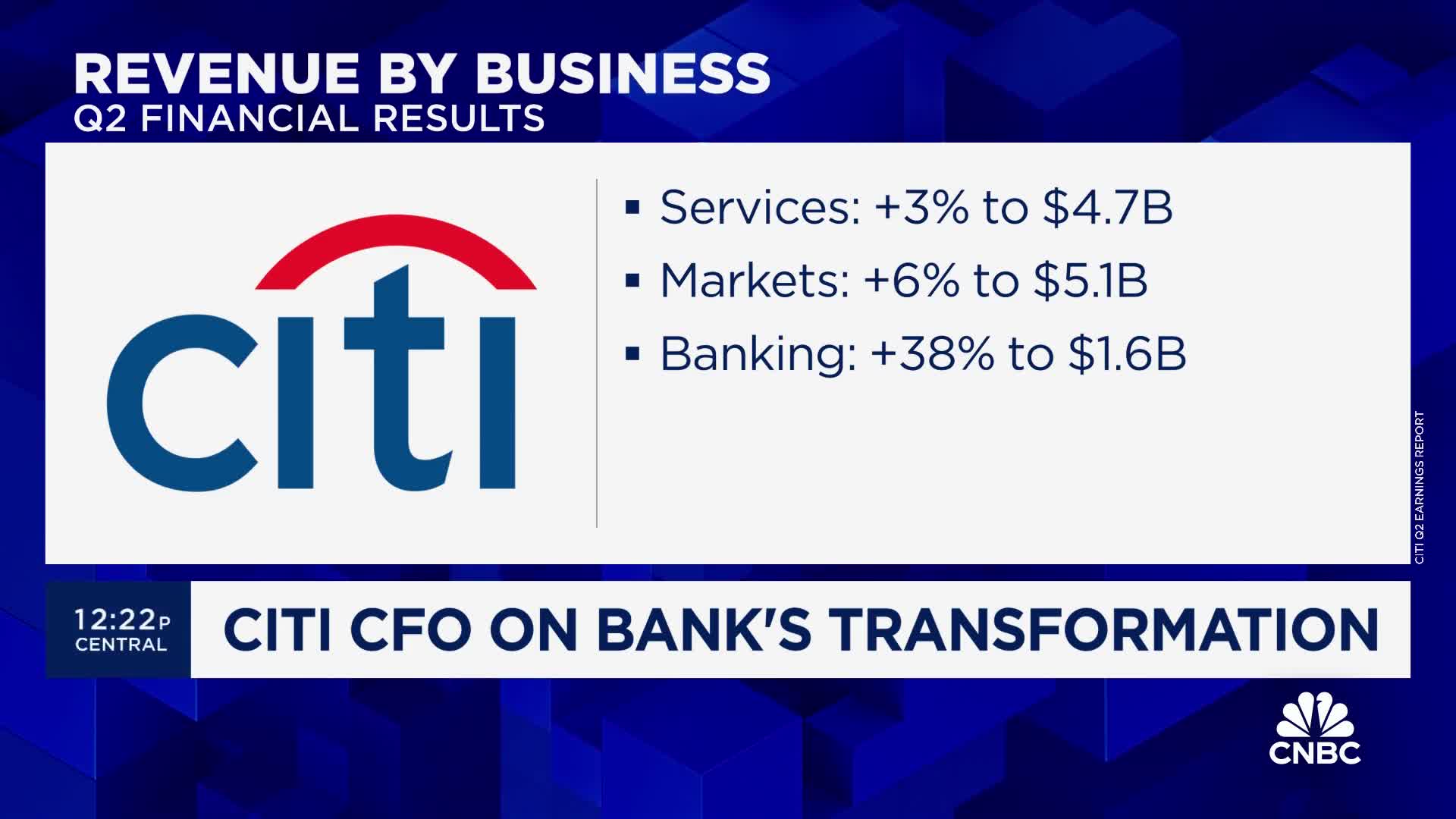

Watch clip answer (01:39m)Is Citigroup adequately provisioned for an economic slowdown?

According to Mark Mason, Citigroup is well-provisioned for virtually any economic scenario with over $22 billion in reserves against their loans, representing a 2.7-2.8% funded loan ratio. Their stress scenarios incorporate various economic conditions, including a base case assuming 5% unemployment and downside scenarios with 6.8% unemployment. While consumer credit losses have increased as part of expected normalization, corporate losses remain minimal due to their high-quality corporate loan book. Mason noted an interesting dichotomy in consumer behavior, with higher FICO score customers increasing spending while lower FICO consumers are reducing payment rates and increasing borrowing activity.

Watch clip answer (02:48m)What will George Camel's free webinar teach people about breaking the paycheck-to-paycheck cycle?

George Camel's webinar will teach participants practical strategies to break the paycheck-to-paycheck cycle in just 90 days. The session focuses on finding hidden money in your budget and creating financial margin, even for those who are already debt-free. Participants will learn unique ways to save more, spend less, and free up resources to pursue financial goals. The free, virtual webinar scheduled for September 16th at 1pm Eastern/12pm Central will use the EveryDollar platform to demonstrate these techniques. Registration is available at everydollar.com/webinar, and those who can't attend live can watch the replay later.

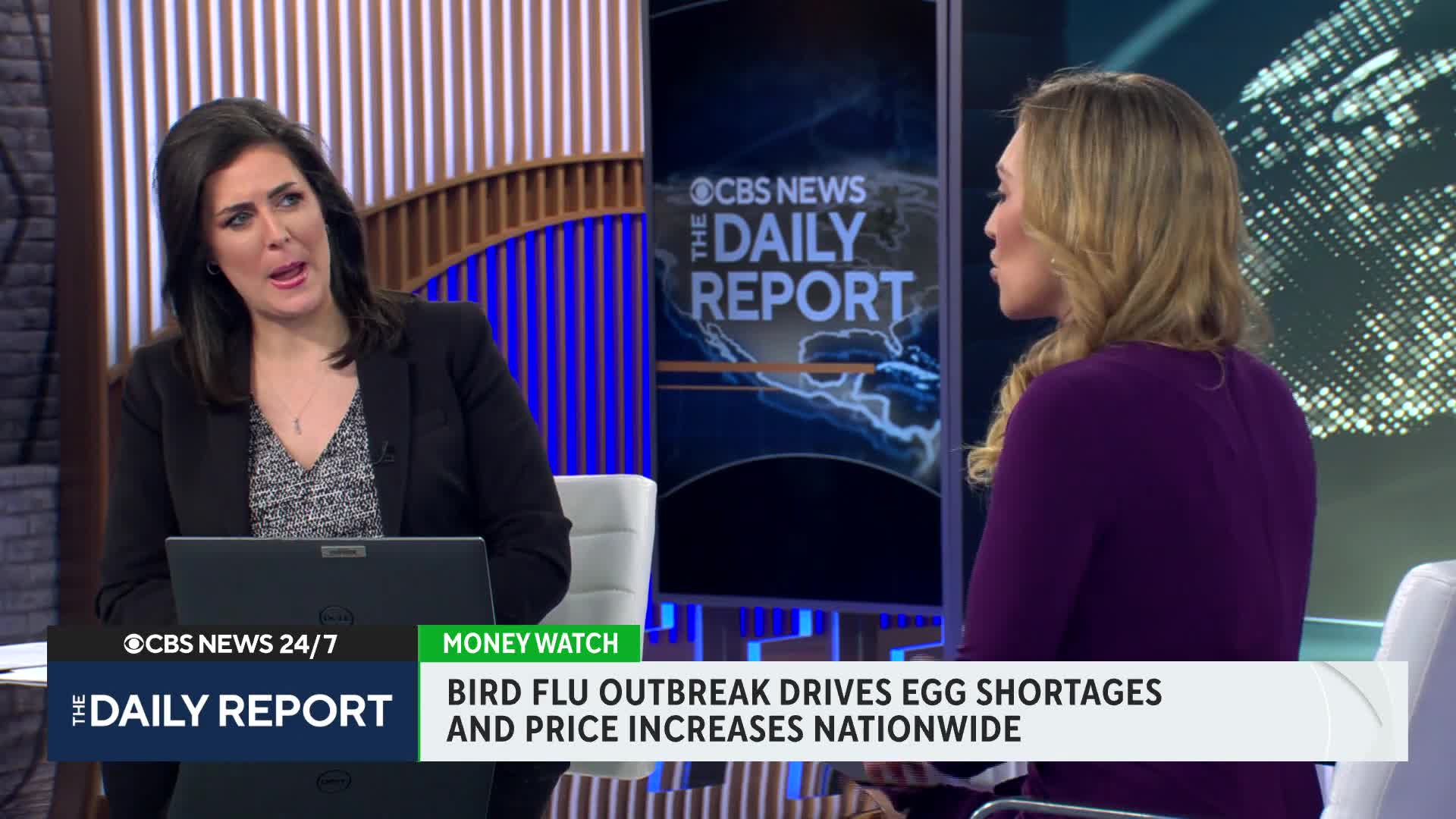

Watch clip answer (00:43m)What is the impact of rising egg prices on the economy and consumer behavior?

Rising egg prices (up 219% since 2019 to $4.95 per dozen) have created widespread economic ripple effects. Restaurants are adding surcharges to breakfast items, as demonstrated by Waffle House implementing a 50-cent fee. Consumers are changing their cooking habits, avoiding egg-heavy recipes, and shifting to alternative proteins like ground beef and tofu when possible. These price increases affect numerous sectors as eggs are an ingredient in many foods. As consumers seek substitutes, demand increases for other proteins, potentially raising their prices as well. With the USDA forecasting another 20% increase by year-end, this 'eggflation' continues to shape purchasing decisions and impact food businesses throughout the economy.

Watch clip answer (02:02m)How have egg prices changed since before the pandemic?

The price of a dozen eggs has dramatically increased since the pre-pandemic era. According to CBS News analysis of U.S. Bureau of Labor Statistics data, a dozen eggs cost just $1.55 in 2019 before the pandemic. Prices then surged dramatically to $4.82 in 2023, before temporarily dropping to $2.52 later that year. As of the current reporting period, egg prices have risen again to $4.95 per dozen, representing a more than 300% increase from pre-pandemic levels. This significant price increase reflects broader inflation trends affecting household grocery budgets across the country.

Watch clip answer (00:22m)What is the impact of rising egg prices on the economy?

Rising egg prices (averaging $4.95 per dozen) create widespread economic ripple effects. When egg costs increase, it affects restaurants (with businesses like Waffle House adding surcharges), food manufacturing, and consumer behavior. The impact extends to other food categories as demand shifts to alternative proteins, causing their prices to rise as well. Consumers may forego making dishes requiring eggs, reducing sales of complementary ingredients. With the USDA predicting another 20% egg price increase by year-end, these effects will continue to stress household budgets. This ongoing inflation explains why many Americans aren't feeling economic relief, despite recovery efforts since the pandemic.

Watch clip answer (01:51m)