Consumer Finance

Consumer finance encompasses a wide array of financial products and services that enable individuals to effectively manage their spending, borrowing, and saving for personal needs. It includes options such as personal loans, credit cards, installment plans, and increasingly popular Buy Now, Pay Later (BNPL) programs. These financing solutions allow consumers to make purchases they might not be able to afford upfront by extending payments over time, thus improving cash flow management and purchasing power. In recent developments, the consumer finance sector has witnessed significant upticks in various lending categories, amidst a backdrop of economic uncertainty and evolving consumer behaviors. The relevance of consumer finance is underscored by the ongoing shifts in consumer credit trends and spending patterns, highlighted in recent reports. Notably, lending categories like auto loans and personal loans are seeing steady growth, with delinquency rates showing slight improvements, suggesting a more favorable credit environment. Demand for flexible financing options is increasing, particularly as younger demographics, including Gen Z, embrace digital payment methods and seek alternatives to traditional credit products. This landscape reflects not only the current resilience of consumer finances but also the adaptation of financial institutions to meet the diverse needs of modern consumers. As economic conditions fluctuate, understanding trends in budgeting apps and credit score improvement becomes critical for effectively navigating personal finance.

How have egg prices changed in recent years in the United States?

Egg prices in the U.S. have experienced dramatic fluctuations, rising from $1.55 in 2019 to a peak average of $4.82 in 2023 during the 'eggflation' crisis. This significant price increase represented more than a 200% jump in just four years, substantially impacting grocery costs for American households. However, relief eventually came as prices later dropped to $2.52, though still remaining higher than pre-inflation levels. This volatility in egg prices has influenced consumer behavior, pushing some Americans toward alternative protein sources like ground beef and tofu while reflecting broader inflation challenges in the economy.

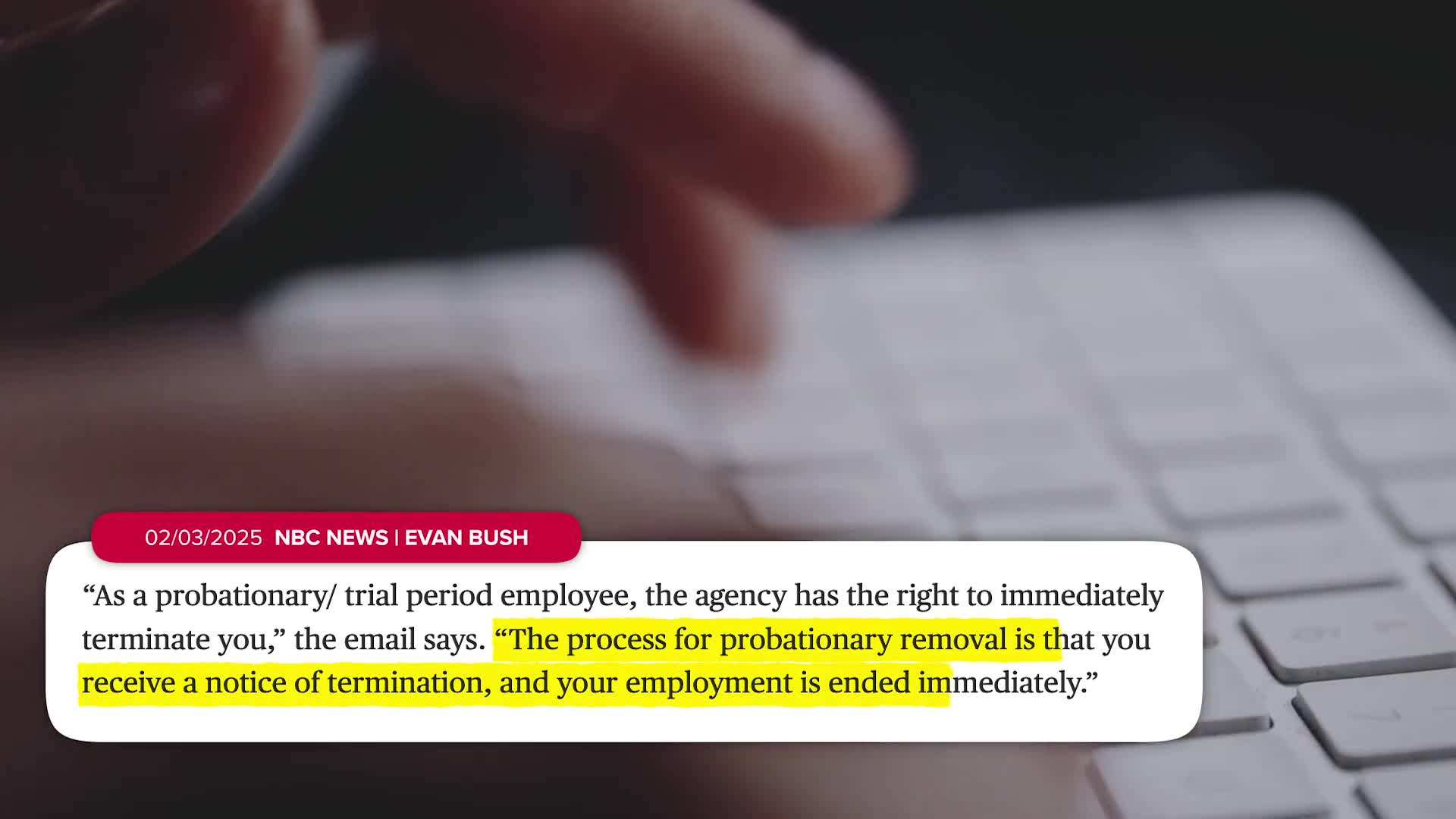

Watch clip answer (00:05m)What federal agencies is Donald Trump targeting in his efforts to remake the federal government?

Donald Trump is focusing his efforts on reshaping three key federal agencies: the Environmental Protection Agency (EPA), the Department of Education, and the Consumer Financial Protection Bureau (CFPB). These agencies appear to be central targets in what Trump describes as remaking the federal government, or what critics might characterize as breaking it. Philip DeFranco notes that there are "fires all over the place" in this context, suggesting widespread and significant changes being implemented or proposed across the federal government structure. The targeted agencies represent important regulatory and public service functions in environmental protection, education policy, and consumer financial safeguards.

Watch clip answer (00:13m)What challenges is China's property sector currently facing?

China's property sector is currently under significant pressure from high debt levels and insolvency among major developers. This crisis has resulted in a substantial 12.9% drop in property sales by floor area in 2024, indicating a severe downturn in the market. The property decline has wide-ranging effects, particularly impacting the middle class through falling rental income and diminished consumer confidence throughout the Chinese economy.

Watch clip answer (00:16m)What are the key details and potential impacts of the Capital One and Discover merger?

Shareholders have approved a $35 billion merger between Capital One and Discover, which would make Capital One the largest credit card issuer in the United States. This significant consolidation in the financial services industry represents a strategic move to enhance Capital One's market position. According to experts, the merger could deliver several consumer benefits, including expanded payment access locations where customers can use their cards. Additionally, the combined entity may potentially offer lower interest rates to consumers, making credit more affordable. The deal marks a major shift in the credit card landscape that could reshape competition in the industry.

Watch clip answer (00:16m)What would the Capital One and Discover merger mean for the credit card industry and consumers?

The merger would create scale and cost synergies, propelling Capital One to become the largest credit card issuer in the U.S. By acquiring Discover's payment network infrastructure, Capital One would reduce dependency on Visa and MasterCard, allowing them to better compete with these dominant players who control 76% of the market. For consumers, benefits include increased access to ATM locations and potentially better credit offers with lower rates. However, some analysts caution that reduced competition from consolidation could potentially have negative impacts, which is why regulatory approval remains a key hurdle for this significant industry transformation.

Watch clip answer (01:21m)What would Capital One buying Discover mean for the credit card industry and consumers?

Capital One's acquisition of Discover aims to create the largest credit card issuer in the United States, potentially enhancing competition against dominant players like Visa and MasterCard. This merger could benefit consumers through expanded ATM access and possibly improved financial offers as the combined entity gains more market leverage. However, the deal faces significant regulatory scrutiny as concerns about reduced competition in the broader financial services market remain. The acquisition's ultimate impact depends on federal approval, which will weigh potential consumer benefits against competitive implications in the credit card landscape.

Watch clip answer (00:07m)