How can machine learning models improve credit scoring compared to traditional methods?

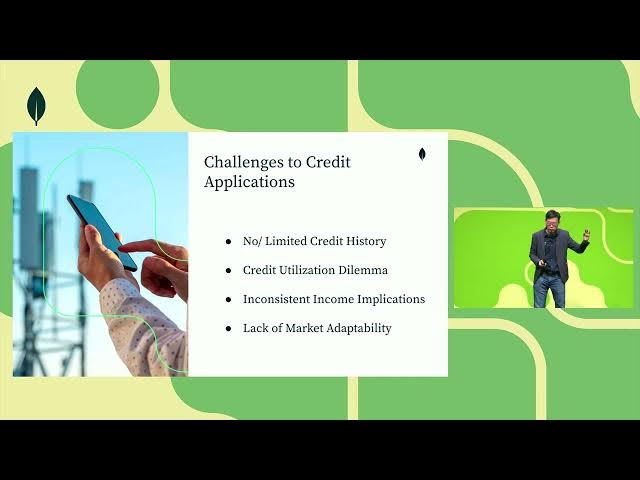

Machine learning models improve credit scoring by collating data across multiple sources including credit bureaus, bank accounts, money laundering statuses, and alternative payment histories. Unlike traditional credit scoring techniques, these ML models consider additional factors like monthly rental commitments that are typically overlooked. The model can explain which features are most important for credit decisions in layman's language, providing transparency. This approach creates a more sophisticated risk profiling system that delivers personalized credit recommendations, making the process more inclusive for applicants who might be underserved by conventional scoring methods.

People also ask

TRANSCRIPT

Load full transcript

0

From

Building a Sophisticated ML Model for Credit Risk Profiling

MongoDB·5 months ago