Investment Strategies

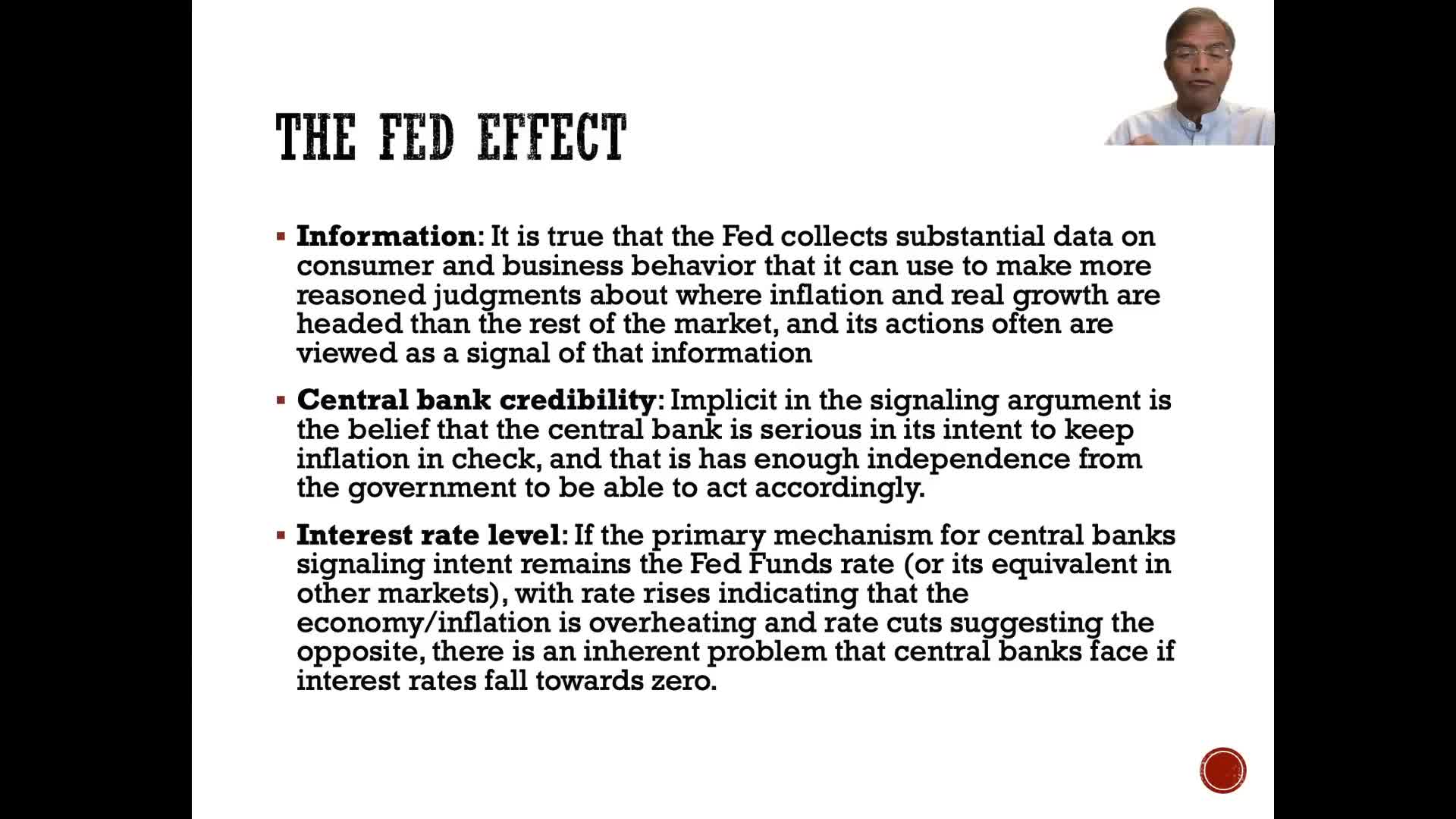

How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)What challenges did Brian Chesky face when pitching Airbnb to angel investors?

Brian Chesky encountered significant rejection when seeking angel investment for Airbnb. Out of approximately 15 angel investors he approached, nearly half didn't even reply to his emails. Among those who responded, many rejected the concept, claiming it didn't fit their investment thesis despite being consumer internet companies, or stating the market wasn't big enough. One investor simply wasn't excited about the travel category. The challenges culminated in a particularly awkward meeting with angel investor Mike Maples, where Chesky arrived without a presentation deck, planning to showcase their newly launched website. Unfortunately, the website didn't work during the meeting, leaving Chesky struggling to explain the concept for an hour while the investor had difficulty understanding the vision.

Watch clip answer (01:22m)What is the scale and focus of Blackstone's investments in India?

Blackstone has established itself as the largest private market investor in India, having invested over $15 billion in the country over 15 years, with a remarkable $6 billion invested just in the last year alone, indicating an accelerating pace. Technology has emerged as Blackstone's single largest area of investment in India, spanning both private equity investments in companies like Telenet, Task, and IBS Software, and real estate holdings. In the real estate sector, Blackstone has become India's largest commercial landlord, owning 120 million square feet of property including a majority of IT parks, with major technology companies like IBM and Cognizant as tenants.

Watch clip answer (01:05m)What is seed capital and why is it important for startups?

Seed capital is the initial money entrepreneurs use to start their businesses. It's the first step in transforming an innovative idea into a viable business, usually provided by family, friends, early shareholders, or angel investors. Seed capital funds essential startup activities such as market research, prototype development, and legal costs, bridging the gap between having an idea and building a functioning business. While investing in seed funding is risky as it involves early-stage companies without revenue, it offers potential for significant returns, as demonstrated by Peter Thiel's $500,000 investment in Facebook that later earned over $1 billion.

Watch clip answer (01:53m)Why is it important for entrepreneurs to align with the right investors?

Fred Wilson emphasizes that entrepreneurs should seek investors who are truly aligned with their vision, not just those offering capital. He advises entrepreneurs to ask investors about their motivations, ensuring they're investing for the right reasons - because they believe in you, your vision, and genuinely want to work with you. While entrepreneurs often focus on securing funds to pursue their business plans, the relationship must be built on more than just money. The right investor partnership is founded on shared values, mutual interest, and authentic support, which ultimately contributes to the success of the venture.

Watch clip answer (01:08m)What are the two key phases of personal finance according to Scott Galloway, and how should people approach them?

According to Scott Galloway, personal finance consists of two key phases: investing and harvesting. The investing phase occurs during younger years when individuals should save money to deploy capital that grows while they sleep, providing future security. During this phase, market downturns are actually beneficial as they create opportunities to purchase assets at lower prices. The harvesting phase comes later in life when one begins spending more than earning, living off accumulated investments. Galloway criticizes current economic policies that artificially support markets through government intervention, which prevents younger generations from experiencing the natural investment opportunities that market cycles would normally provide.

Watch clip answer (00:58m)