Interest Rates

What is the intrinsic risk-free rate and how does it explain interest rate movements?

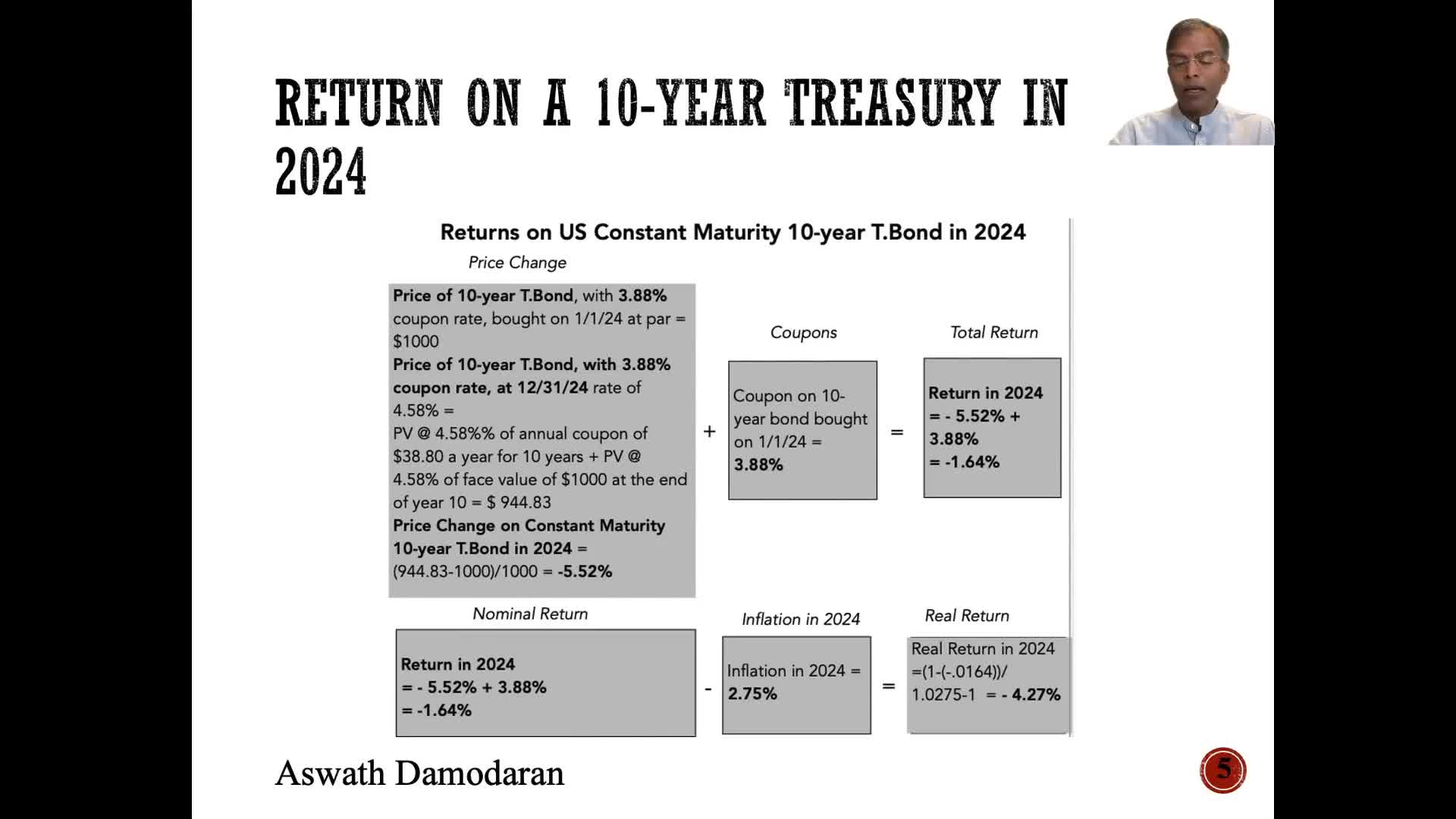

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

Watch clip answer (00:24m)How do changes in interest rates affect company valuations?

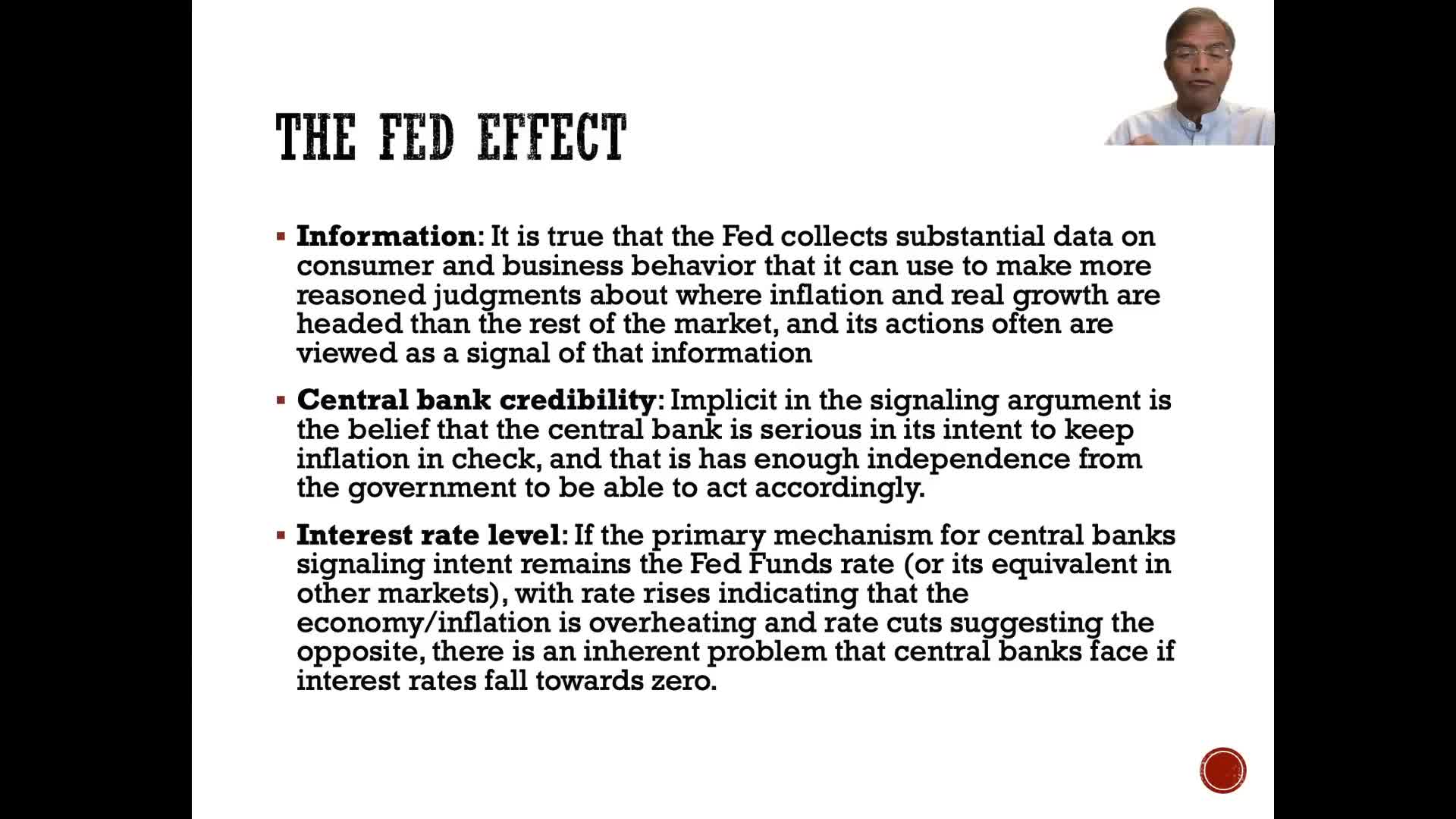

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

Watch clip answer (01:45m)Is Citigroup adequately provisioned for an economic slowdown?

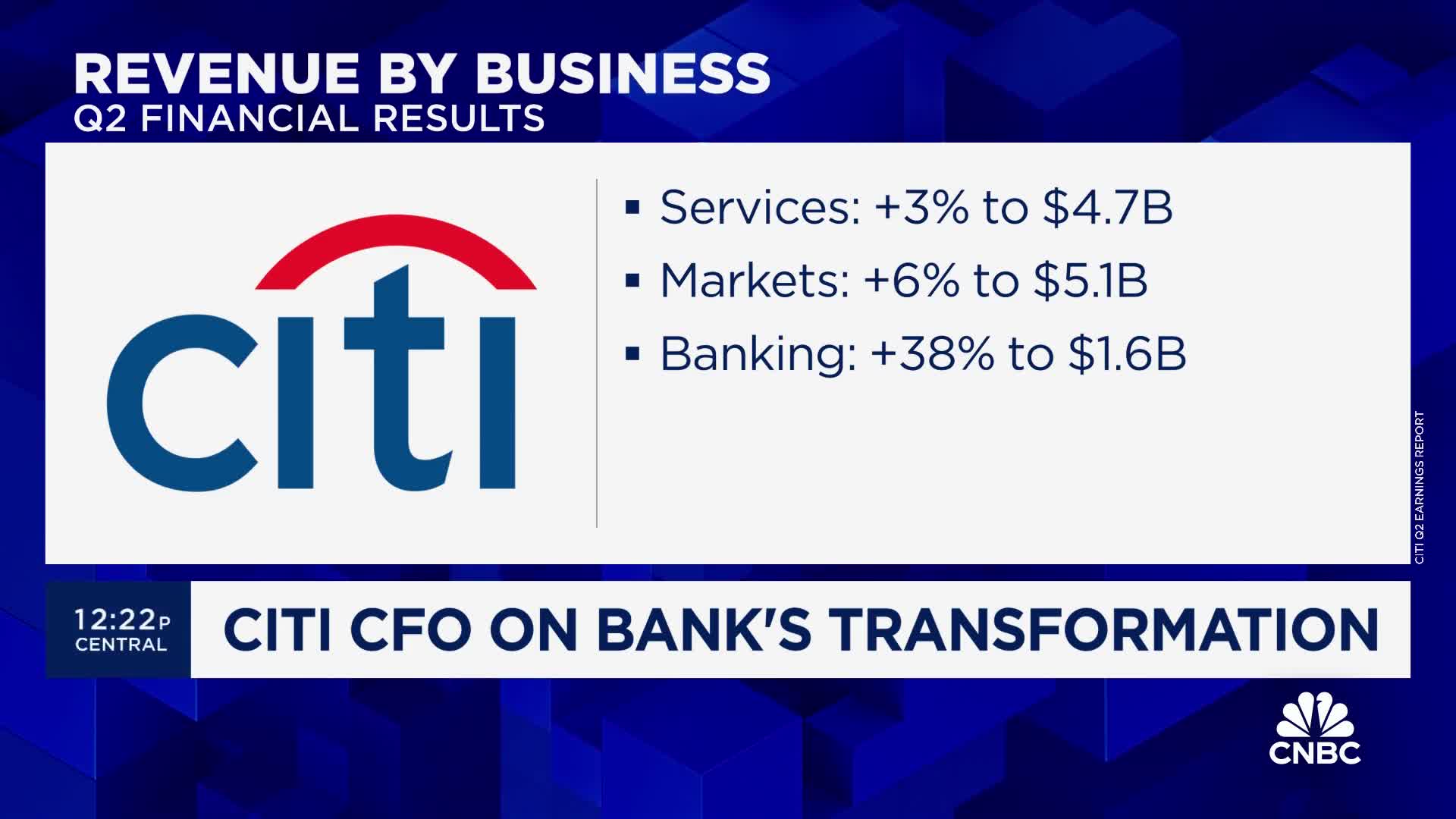

According to Mark Mason, Citigroup is well-provisioned for virtually any economic scenario with over $22 billion in reserves against their loans, representing a 2.7-2.8% funded loan ratio. Their stress scenarios incorporate various economic conditions, including a base case assuming 5% unemployment and downside scenarios with 6.8% unemployment. While consumer credit losses have increased as part of expected normalization, corporate losses remain minimal due to their high-quality corporate loan book. Mason noted an interesting dichotomy in consumer behavior, with higher FICO score customers increasing spending while lower FICO consumers are reducing payment rates and increasing borrowing activity.

Watch clip answer (02:48m)What does the decline in homebuilder sentiment mean for the housing market and potential homebuyers?

The decline in homebuilder sentiment to a five-month low indicates that builders lack incentive to construct more houses, resulting in an even tighter housing supply. This sentiment index measures current sales, buyer traffic, and expected sales over the next six months—all of which are declining. For potential homebuyers, this creates a challenging market with persistently high interest rates and elevated prices. The situation is particularly problematic because increased housing supply is the key solution to high prices, but this reading suggests supply will remain constrained in the near future, further limiting options for those looking to purchase homes.

Watch clip answer (00:49m)What does the decline in homebuilder sentiment mean for the housing market and potential home buyers?

The drop in homebuilder sentiment to a five-month low indicates that homebuilders don't see incentives to build more houses, resulting in even less supply in an already constrained market. This directly impacts potential home buyers who are facing a triple challenge: high interest rates that aren't expected to decrease soon, persistently high prices, and now a further reduction in housing supply. The homebuilder sentiment index, which measures current sales, buyer traffic, and future sales expectations, suggests that supply relief isn't coming anytime soon, leaving the housing market in a difficult position where the only solution - increased supply - appears increasingly unlikely.

Watch clip answer (00:45m)