Financial Analysis

What are the different types of revenue streams and why are they important for businesses?

Revenue streams represent the various ways businesses generate income, categorized as operating revenues (from core business activities like Coca-Cola selling drinks) and non-operating revenues (from side activities like interest, rent, and dividends). These streams follow different models: transaction-based (one-time payments), service (time-based billing), project (large one-time tasks), and recurring revenue (subscription or licensing fees). Understanding these revenue streams is crucial for financial analysts as they significantly impact business evaluation and forecasting. Each type has unique implications for cash flow predictability—recurring revenues provide consistent income, while transaction-based and project revenues fluctuate with demand. This knowledge helps analysts accurately evaluate business sustainability and develop appropriate forecasting models for different revenue types.

Watch clip answer (04:18m)What is ROI and how is it calculated in project management?

Return on Investment (ROI) is a widely used measure of investment value in project management. It's calculated as the ratio of net income to total cost—specifically, (total income minus total cost) divided by total cost. This is typically expressed as a percentage by multiplying the fraction by 100. An ROI greater than 100% represents a positive return, indicating you get more out than you put in, while an ROI less than 100% represents a loss. Despite its popularity across business, public, and non-profit sectors, ROI has a key limitation: it doesn't account for the timing of costs and profits, which is especially important for long-term projects.

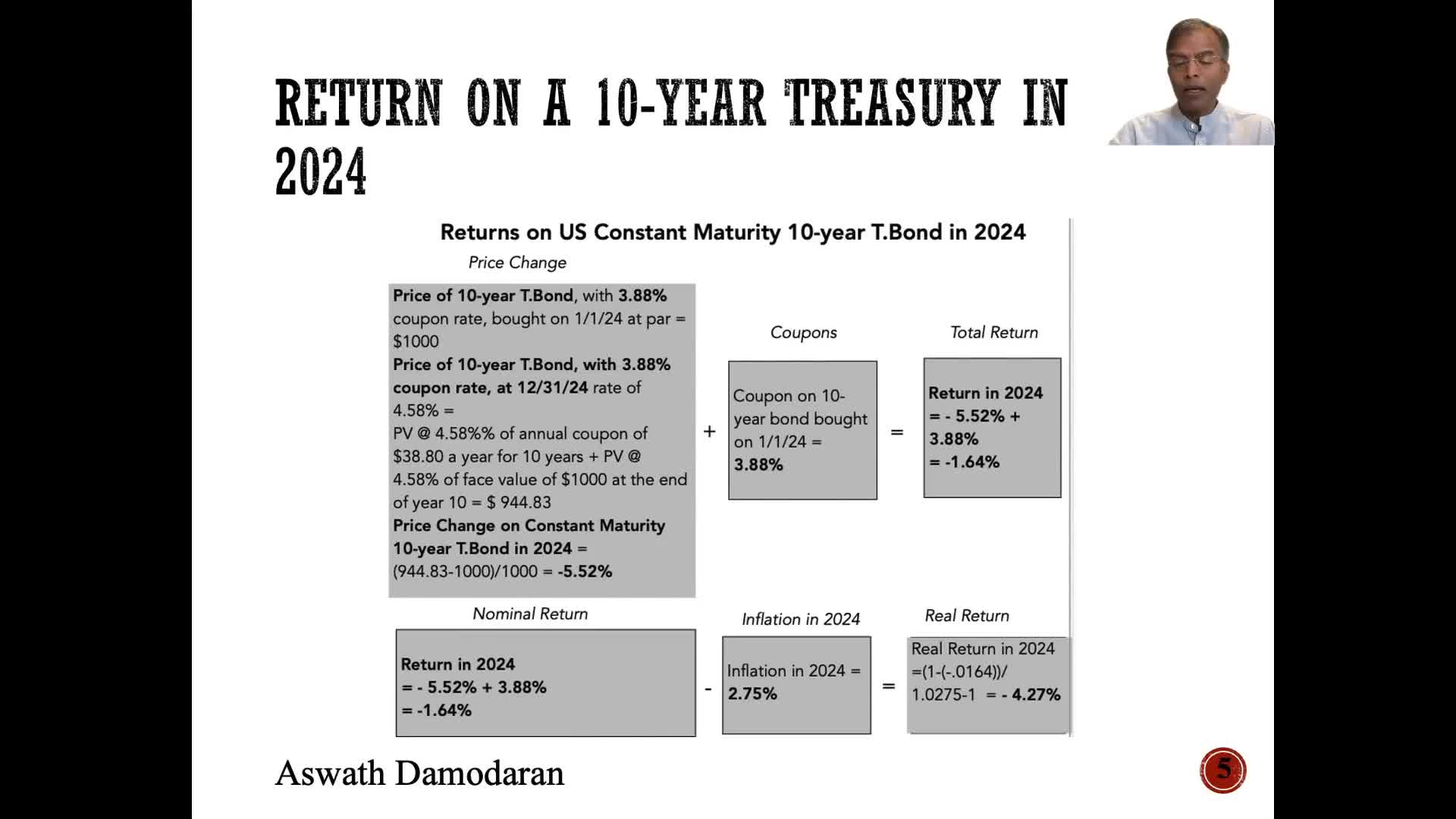

Watch clip answer (03:26m)What is the intrinsic risk-free rate and how does it explain interest rate movements?

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

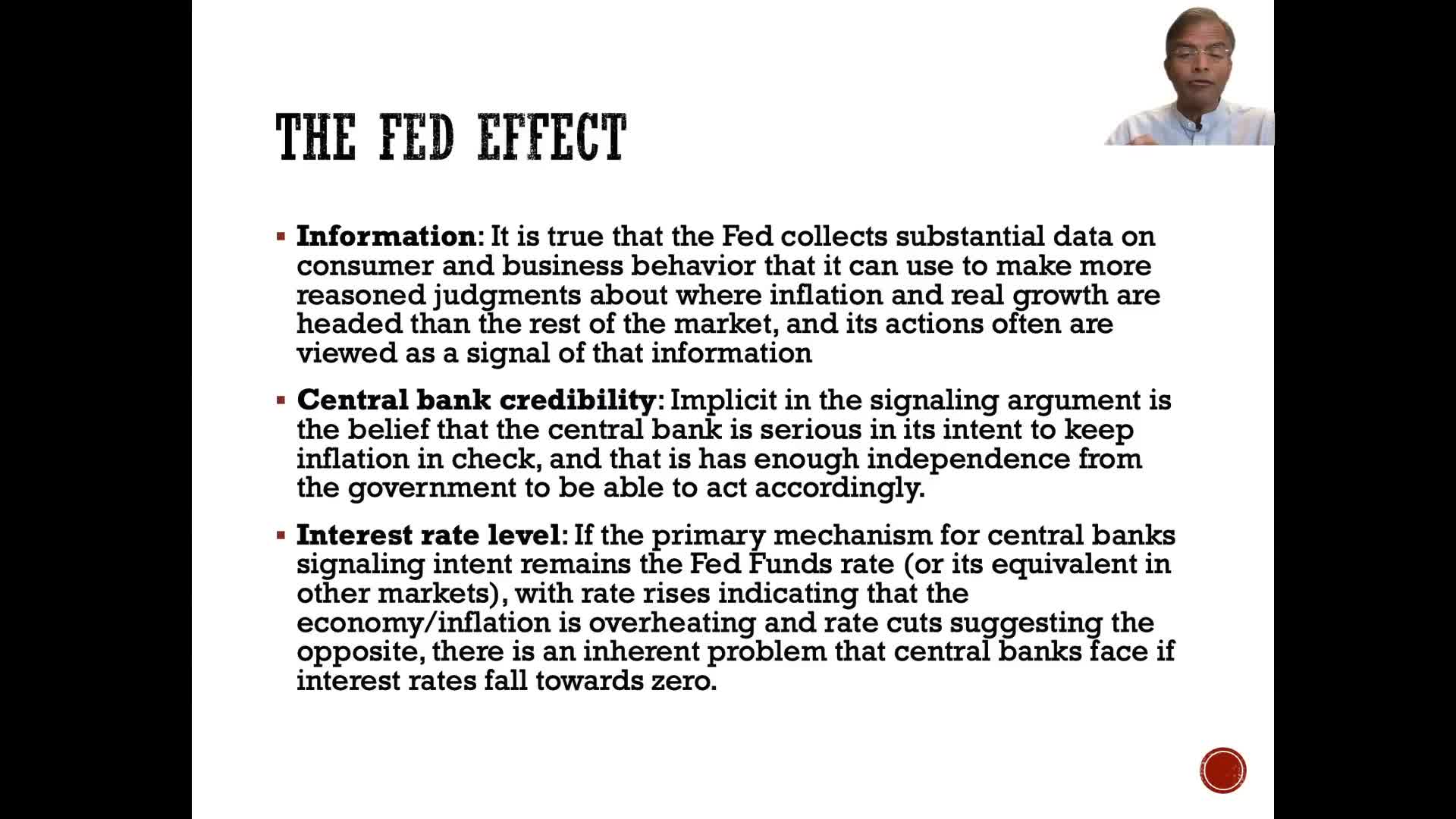

Watch clip answer (00:24m)How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

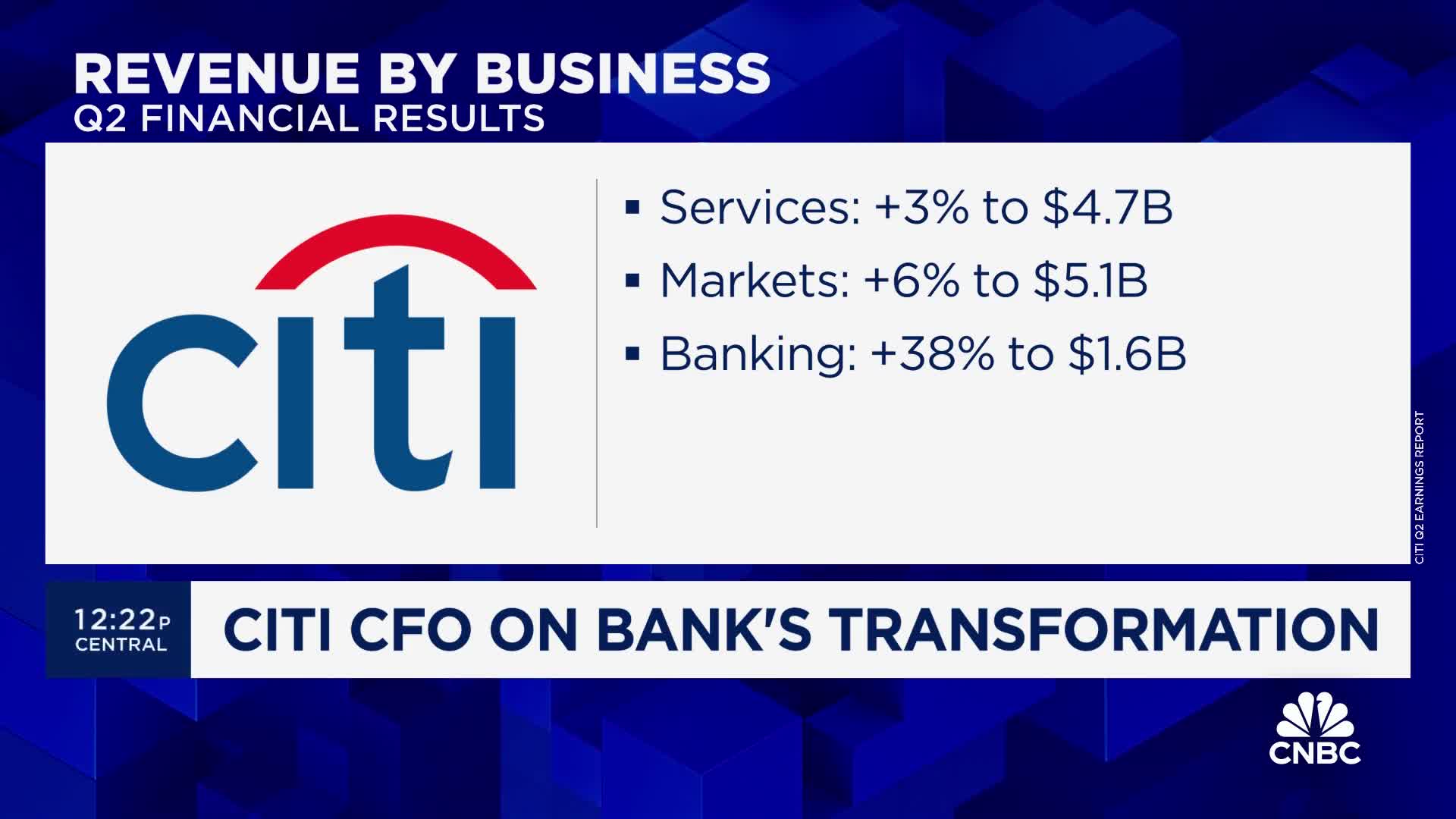

Watch clip answer (01:00m)Is Citigroup adequately provisioned for an economic slowdown?

According to Mark Mason, Citigroup is well-provisioned for virtually any economic scenario with over $22 billion in reserves against their loans, representing a 2.7-2.8% funded loan ratio. Their stress scenarios incorporate various economic conditions, including a base case assuming 5% unemployment and downside scenarios with 6.8% unemployment. While consumer credit losses have increased as part of expected normalization, corporate losses remain minimal due to their high-quality corporate loan book. Mason noted an interesting dichotomy in consumer behavior, with higher FICO score customers increasing spending while lower FICO consumers are reducing payment rates and increasing borrowing activity.

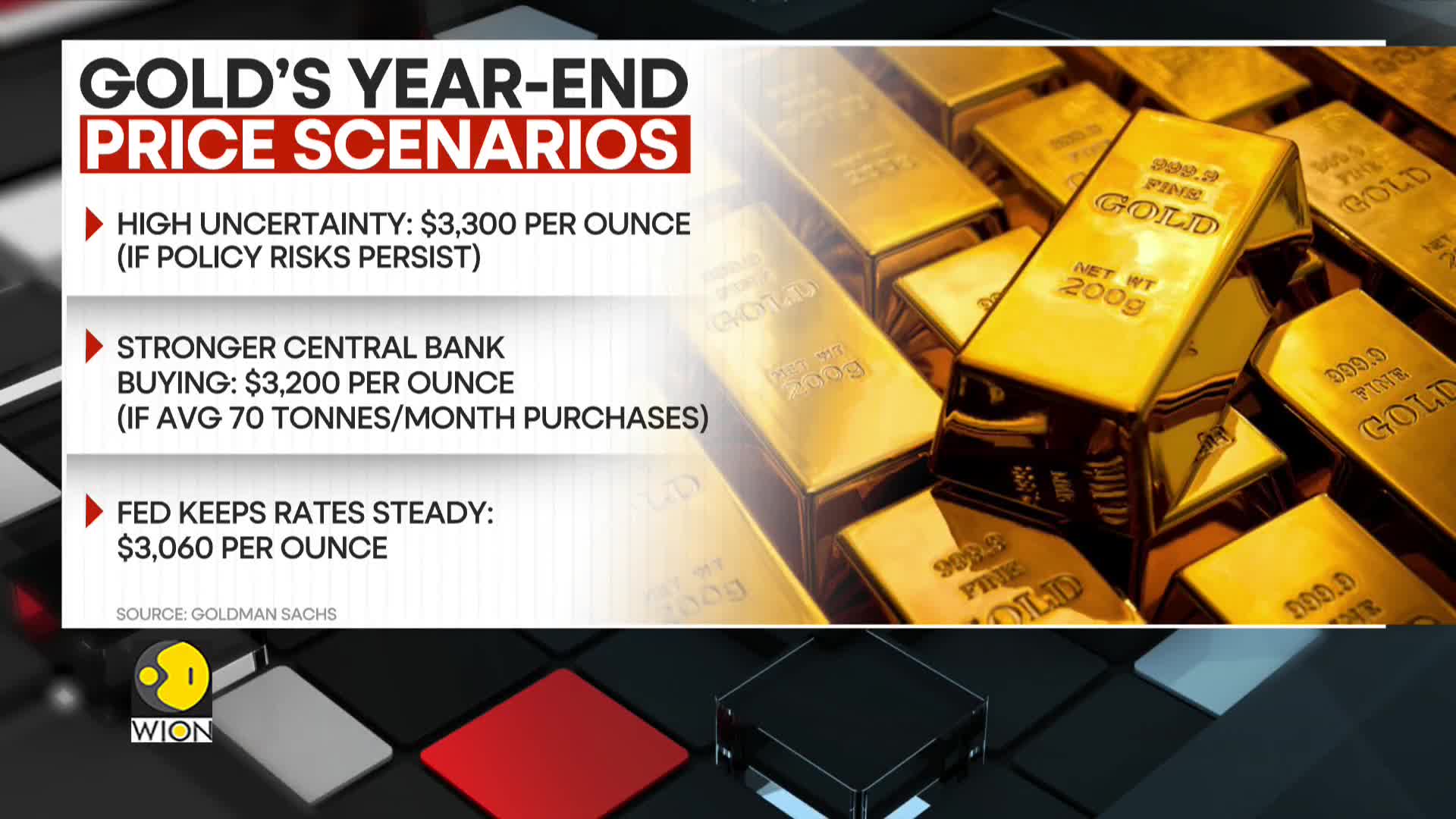

Watch clip answer (02:48m)Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)