Economic Policy

Economic policy encompasses the strategies and actions undertaken by governments to influence their nation's economy. It is critical in steering economic growth, controlling inflation, reducing unemployment, and addressing income inequality. Broadly categorized into two main types—**fiscal policy**, which includes government spending and taxation, and **monetary policy**, which focuses on managing the money supply and interest rates—these policies serve as essential tools for economic stabilization and growth. Understanding the mechanisms and implications of these policies is vital, especially in a landscape marked by frequent shifts in global and domestic economic conditions. Recent discussions around economic policy have highlighted concerns over inflation, trade tensions, and the potential for recession, particularly in light of aggressive tariff strategies seen in various countries. These elements underscore a need for careful fiscal management and strategic decision-making to safeguard economic stability. Furthermore, policymakers are increasingly interested in sustainable practices, aimed at bolstering confidence and encouraging investment during periods of uncertainty. With international cooperation becoming vital amidst geopolitical strains, the relevance of sound economic policy frameworks cannot be overstated. As we navigate this complex environment, it remains crucial for both citizens and businesses to understand how economic policies impact their day-to-day lives and long-term prospects.

What is the significance of the Franco-German collaboration in addressing Europe's economic challenges?

The Franco-German collaboration represents a traditional but vital approach to European consensus-building. As Laurence Boone explains, this partnership is working to bridge divisions between northern, southern, and eastern European interests, creating a stronger declaration than previous efforts like Meissenberg when fragmentation was occurring between regions. This collaboration sets the stage for addressing critical fiscal issues, including potential European-level taxation mechanisms. Adam Tooze highlights how this opens discussions on tax loopholes, wealth auditing systems, and carbon pricing. Meanwhile, Moritz Schularick points to the long-term implications where joint debt issuance creates incentives for developing European-level taxes to service this common debt rather than burdening national budgets.

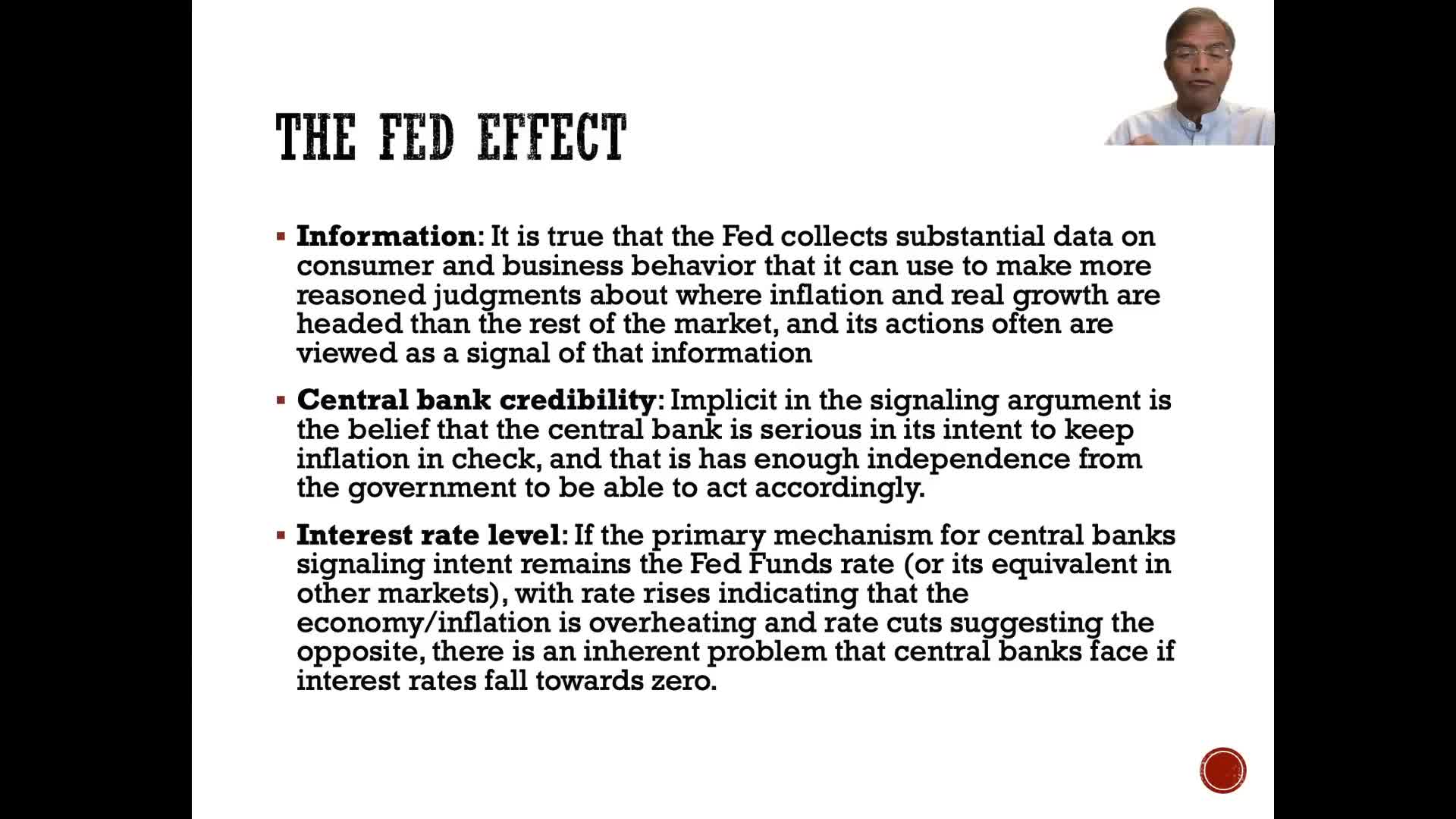

Watch clip answer (03:12m)How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)What are the benefits of promoting women entrepreneurship according to Lilith Asatriyan?

According to Lilith Asatriyan, promoting women entrepreneurship creates multiple benefits. When women gain economic sustainability, they become more self-confident, which positively impacts their families by providing more opportunities beyond social issues. Women's economic engagement is crucial for overall development, as it ensures higher GDP growth at both country and global levels. Moreover, women's involvement in the economic sector benefits not just women themselves but the entire population. As Lilith explains, investing in women entrepreneurs enhances economic growth while simultaneously improving family welfare. This is why organizations like hers work to provide services, encourage supportive approaches, and advocate for policies that promote women's entrepreneurship development in Armenia.

Watch clip answer (03:19m)What characterizes the U.S. economy and what changes does Gary Cohn anticipate after COVID-19?

The U.S. is fundamentally a consumption-based economy, with 80% of employment and GDP driven by consumer behavior. Americans are accustomed to consuming through entertainment, dining out, and shopping. However, Cohn believes the pandemic has exposed the need for strategic changes, particularly returning to domestic manufacturing of essential goods. While confident that consumers will eventually return to normal habits like visiting theme parks, he emphasizes that companies must be incentivized to produce strategically important items within the United States to ensure self-sufficiency in critical sectors.

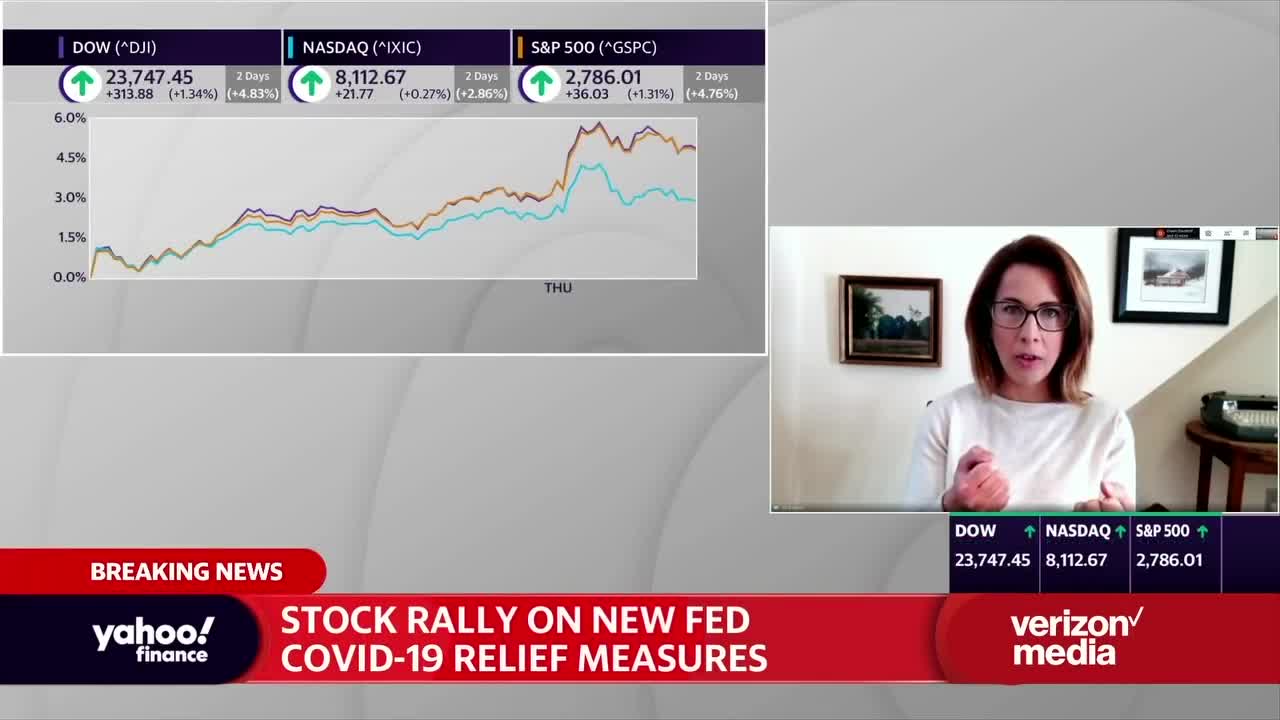

Watch clip answer (01:33m)How did global markets respond to Trump's tariff announcements on goods from Canada, Mexico, and China?

Markets reacted negatively before trading floors even opened. The Dow plummeted by 600 points (down 1.6%), matching declines in the S&P 500 and Nasdaq. Canada's Toronto Stock Exchange futures dropped 1.3%, while European markets like Germany's DAX fell nearly 2%. Despite initial panic, markets calmed slightly when trading began after news broke that Mexico and the US had reached a temporary one-month delay on tariffs. Meanwhile, Canada announced retaliatory measures, including 25% tariffs on $155 billion worth of American goods, starting with $30 billion immediately.

Watch clip answer (03:43m)How do the changes in MSME classification help businesses grow?

The revised MSME classification allows businesses to expand without losing critical benefits. Previously, companies had to remain small to maintain access to government subsidies, tax perks, and low-interest loans. Now, with significantly increased investment thresholds (2.5 crores for micro, 25 crores for small, and 125 crores for medium enterprises) and higher turnover limits, businesses can scale up substantially while still qualifying as MSMEs. This change essentially removes the growth ceiling that forced businesses to artificially limit their expansion. The government's message is clear: 'Don't hold back. Grow as much as you want and we would still have your back.' This represents a transformative shift toward enabling small businesses to become bigger, stronger, and more profitable while continuing to enjoy MSME benefits.

Watch clip answer (01:48m)