Business Financial Strategy

A **business financial strategy** is vital for optimizing a company's financial resources to achieve both short- and long-term objectives, ensuring sustainable growth and financial stability. This strategic framework primarily encompasses **financial planning**, which includes assessing current financial conditions, forecasting future revenues and expenses, and preparing for potential financial risks. Effective financial planning allows businesses to allocate resources strategically, manage risks adeptly, and set realistic goals, all of which are essential for successful **cash flow management** and **business budgeting**. Critical components of an effective financial strategy include techniques such as **capital budgeting**, which evaluates the profitability and risk of investments, and **working capital management**, which ensures liquidity for day-to-day operations. Recently, advancements in technology have significantly transformed the landscape of business financial strategy. The integration of artificial intelligence (AI), automation, and cloud platforms into **financial planning and analysis (FP&A)** processes enables organizations to streamline manual tasks, increase forecasting accuracy, and enhance reporting efficiency. Notably, as many as 70% of finance teams are now utilizing cloud-based systems, which promote agility and foster collaboration across departments. This evolving approach emphasizes flexibility in budgeting and strategic insights that drive cost reductions and operational efficiencies. By leveraging robust data foundations and remaining aligned with broader business goals, organizations can navigate financial uncertainties and seize growth opportunities. In this environment, a well-crafted business financial strategy becomes an essential tool for ensuring resiliency and competitiveness in a dynamic marketplace.

What are the different types of revenue streams and why are they important for businesses?

Revenue streams represent the various ways businesses generate income, categorized as operating revenues (from core business activities like Coca-Cola selling drinks) and non-operating revenues (from side activities like interest, rent, and dividends). These streams follow different models: transaction-based (one-time payments), service (time-based billing), project (large one-time tasks), and recurring revenue (subscription or licensing fees). Understanding these revenue streams is crucial for financial analysts as they significantly impact business evaluation and forecasting. Each type has unique implications for cash flow predictability—recurring revenues provide consistent income, while transaction-based and project revenues fluctuate with demand. This knowledge helps analysts accurately evaluate business sustainability and develop appropriate forecasting models for different revenue types.

Watch clip answer (04:18m)How do changes in interest rates affect company valuations?

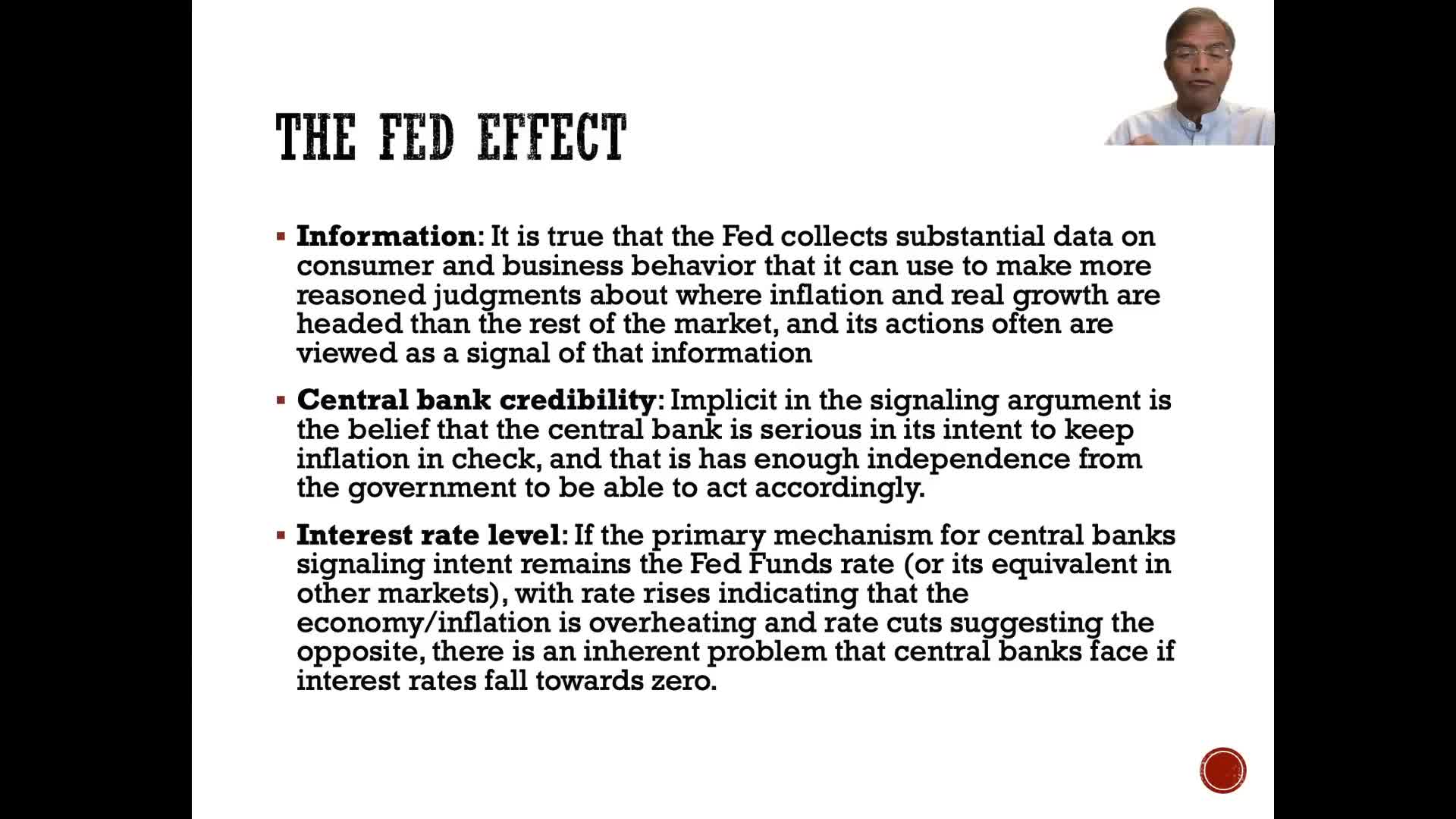

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

Watch clip answer (01:00m)Why do most startups fail?

According to Robin Banerjee, nine out of ten startups fail primarily due to three critical factors. First, they lack a Unique Selling Proposition (USP), often merely copying existing businesses without offering anything distinctive. Second, they have poor operations, failing to focus on customer usability and practical implementation of their ideas. Third, startups frequently fail in financial planning - they don't properly estimate how much money they need or understand basic financial requirements like maintaining sufficient cash balance. Additionally, many startups struggle with effective human resource management.

Watch clip answer (01:47m)How was Zoom's funding allocated across different rounds, and what was the total amount raised?

Zoom raised a total of $145.5 million across multiple funding rounds from seed to Series D. The initial seed funding of $3 million came from Silicon Valley angel investors, former Cisco and WebEx executives. The Series A and B money was primarily invested in sales and R&D teams to build Zoom's foundation, with investments from notable firms like Qualcomm Venture, ME Cloud venture, and others. Interestingly, the Series C and D round money remained largely untouched in the bank, as Zoom had already generated sufficient cash flow to fund its operations. This allowed the company to invest in backend operations and marketing without depleting its raised capital, demonstrating Zoom's efficient business model and strong financial management.

Watch clip answer (01:17m)Why is being self-funded important to a sustainable business?

Being self-funded means a business operates with money it has earned rather than money it's been given. Jason Fried explains that this creates a natural constraint that prevents waste and encourages efficiency. When companies have limited resources, they're more careful with spending, similar to rationing water on a hike rather than wastefully consuming when resources appear unlimited. Self-funded companies tend to maintain leaner structures with fewer management layers, which allows them to move faster and make better decisions. This approach emphasizes profitability over metrics like user growth or revenue that might obscure financial reality. For 37signals, profitability has been the primary focus for 24 years, ensuring they can sustainably remain in business regardless of market conditions.

Watch clip answer (02:33m)Why do most startups fail in India?

Nine out of ten startups fail primarily due to three key factors. First, they lack a unique selling proposition (USP), often simply copying existing businesses like Flipkart or Amazon without offering anything distinctive to attract customers. Second, they have poor operational execution, failing to focus on practical implementation and customer usability. Third, they mismanage finances, often underestimating how much capital they need and failing to maintain adequate cash reserves for their first year of operation.

Watch clip answer (01:31m)