US Economy

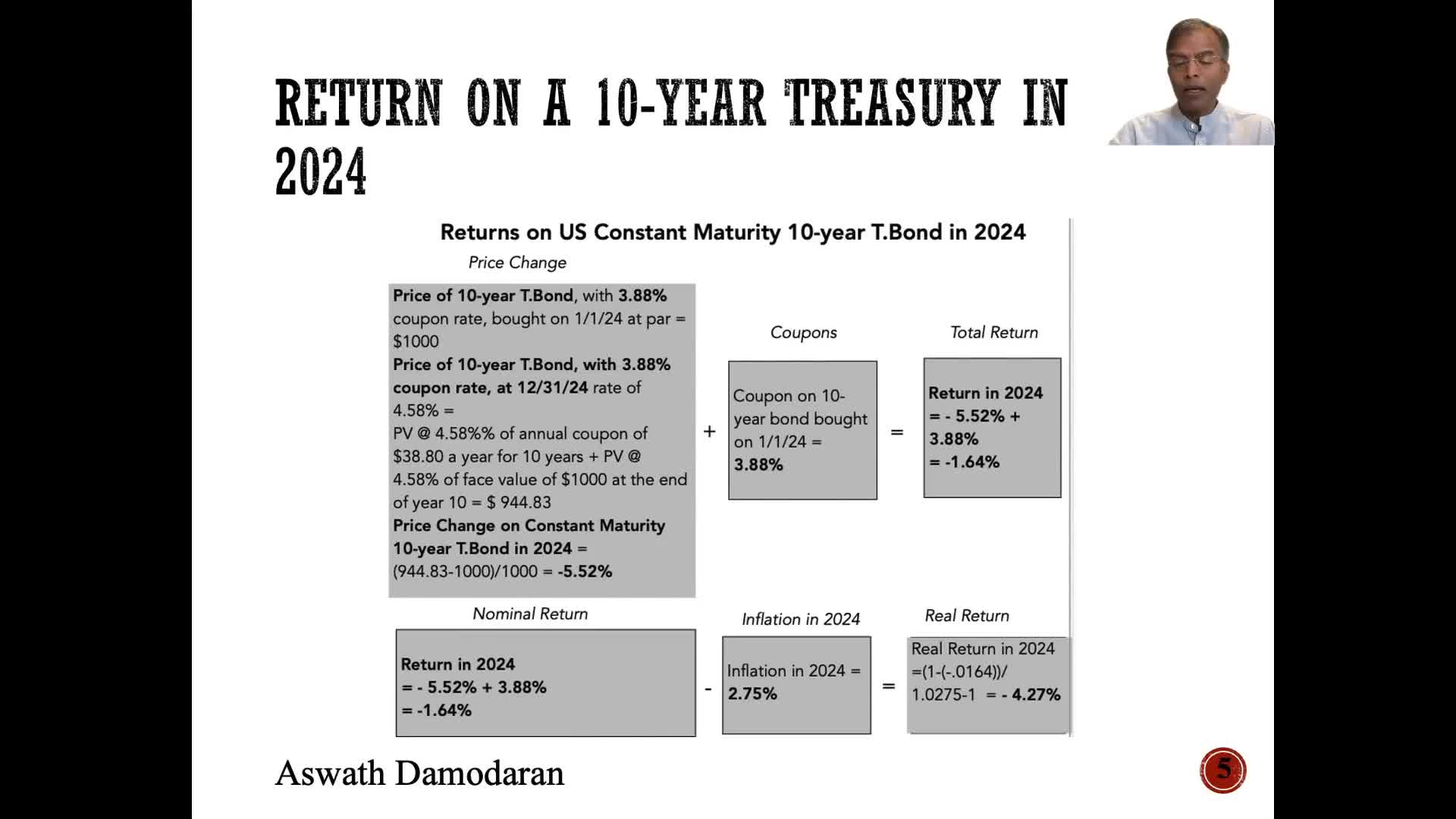

What is the intrinsic risk-free rate and how does it explain interest rate movements?

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

Watch clip answer (00:24m)What was the rationale behind the Clinton administration's decision to support China's entry into the World Trade Organization?

During the Clinton administration, officials supported China joining the WTO for several key reasons. They believed integration into the global trade system would make China more democratic and collaborative. Additionally, they anticipated that Chinese manufacturing would produce inexpensive products beneficial to American consumers. However, this decision had significant consequences, particularly for manufacturing regions in states like Missouri, North Carolina, and Pennsylvania, which subsequently lost approximately 3 million manufacturing jobs as production shifted overseas, creating a substantial US trade deficit.

Watch clip answer (02:02m)How will American consumer behavior change in the coming decades compared to the past 30 years?

According to David Wessel, American consumers will likely shift from being spendthrift to more thrifty for the next couple of decades. This behavioral change will force the rest of the world to rely more on domestic demand and less on exporting to the United States. Additionally, Wessel predicts an era of greater skepticism toward markets, with increased faith and reliance on government regulation to maintain economic stability. This represents a significant departure from previous beliefs that sophisticated market participants with their own money at stake would keep the system honest.

Watch clip answer (00:51m)Do you think the S&P 500 is a sell at its current record high, particularly with the upcoming election?

No, Leon Cooperman doesn't believe the S&P 500 is a sell at its current level. He notes that conditions typically preceding market downturns (recession, accelerating inflation, hostile Fed, geopolitical events) are not present. The market appears stable with consumer confidence high, strong retail sales and employment, and decent corporate profits. Cooperman does express concern about two factors: the alarming rate of debt buildup in the country and the political shift to the left. He's also worried about market structure changes, including the elimination of the uptick rule and reduced stabilizing forces. Despite these concerns, he believes the market is 'okay' for the near future.

Watch clip answer (02:51m)Will prices rise because of Trump's tariffs?

The transcript reveals uncertainty about whether Trump's tariffs will increase consumer prices. When directly questioned, an economic advisor from Trump's team avoids giving a definitive answer, stating that 'prices fluctuate' and claiming to be 'confident' there won't be strong evidence of price effects from tariffs. However, experts in the discussion express concerns about these tariffs creating business uncertainty that could hurt US investment. The news analysts note that prices for gas and groceries have already risen and may increase further if the tariffs are implemented. The discussion also highlights how these policies might impact international trade relationships and alliances.

Watch clip answer (03:25m)What is the expected impact of Trump's proposed tariffs on prices and jobs?

According to President Trump, while prices might go up somewhat in the short term, the long-term effect would be positive with prices eventually going down. He emphasized that jobs will increase 'tremendously,' creating employment opportunities 'for everybody.' Frank Holland of CNBC explained that tariffs are essentially taxes on imported goods paid by businesses and typically passed on to consumers. However, there's uncertainty about implementation, as the administration is conducting a study due by April 1, suggesting a strategic approach targeting specific trading partners rather than universal tariffs. This tailored approach could potentially boost the US economy and increase foreign investment, leading to the job growth Trump referenced.

Watch clip answer (02:07m)