Securities Market

What is the intrinsic risk-free rate and how does it explain interest rate movements?

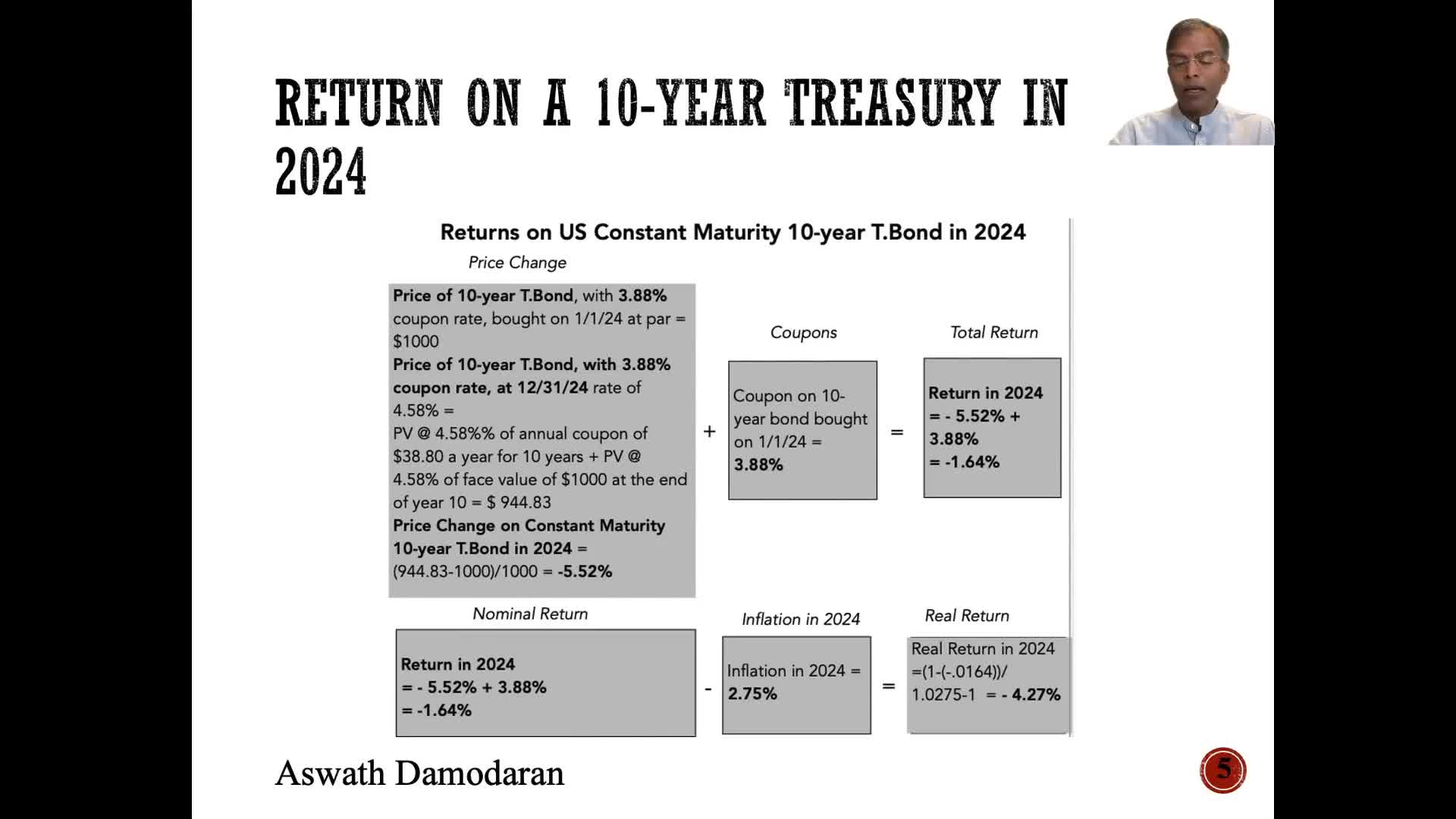

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

Watch clip answer (00:24m)Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

Watch clip answer (01:45m)How has debt shifted from banks to fund management in recent years?

From 2009 to 2016, a significant shift occurred in the management of corporate and foreign debt. Direct household investments in debt decreased from 22% to 8.6%, while fund-managed investments increased from 8.5% to 18.3%. This transfer was driven by monetary policies and regulatory constraints on banks to hold more liquid assets and less corporate debt, especially lower-rated debt. This migration of debt investments from banks to funds has created critical interconnections between these financial entities. The shift makes it increasingly important to understand the relationships between banks and non-banks, including exposure through credit lines, derivatives transactions, and overlapping portfolio holdings. This evolving landscape requires continual risk evaluation and adaptive regulatory approaches.

Watch clip answer (03:57m)How are Indian stocks performing compared to other Asian markets?

Indian stocks are showing remarkable resilience by trading higher despite a broader downtrend in Asian markets. During a volatile trading session, Indian equities have maintained positive momentum while other Asian stocks trade lower, demonstrating the relative strength of the Indian market. The Nifty index is specifically attempting to reclaim the key psychological level of 23,000, which represents an important threshold for market sentiment and investor confidence in the Indian economy.

Watch clip answer (00:09m)What were the immediate market reactions to Trump's new tariff announcements?

Stock markets reacted negatively before trading floors even opened. Futures on Canada's Toronto Stock exchange fell 1.3%, while in the U.S., the Dow plummeted by 600 points with the S&P 500 and Nasdaq dropping about 1.6% on average. Even markets in countries not directly affected responded negatively, with the German DAX and other European markets falling nearly 2%. However, when the New York Stock Exchange opened, markets calmed and only slightly dipped, likely because Mexico and the U.S. reached a temporary agreement to delay the tariffs for one month.

Watch clip answer (00:55m)How did the Indian stock markets perform in the recent trading session?

The Indian stock markets exhibited volatility, with the Sensex dropping 29.47 points to close at 75,967.39 and the Nifty50 ending 14.20 points lower. The indices tested support at 22,800 before recovering mid-session. Sector-wise, IT and energy led the gains, while FMCG and auto sectors saw corrections. Mid-cap stocks ended slightly lower, dropping 0.2%, while small-cap stocks underperformed, shedding 1.7%. Analysts anticipate sideways trading within the 22,800-23,100 range, with future movements dependent on decisive breakouts. Overall market sentiment remains cautious as investors monitor global trends.

Watch clip answer (01:16m)