Remote Work

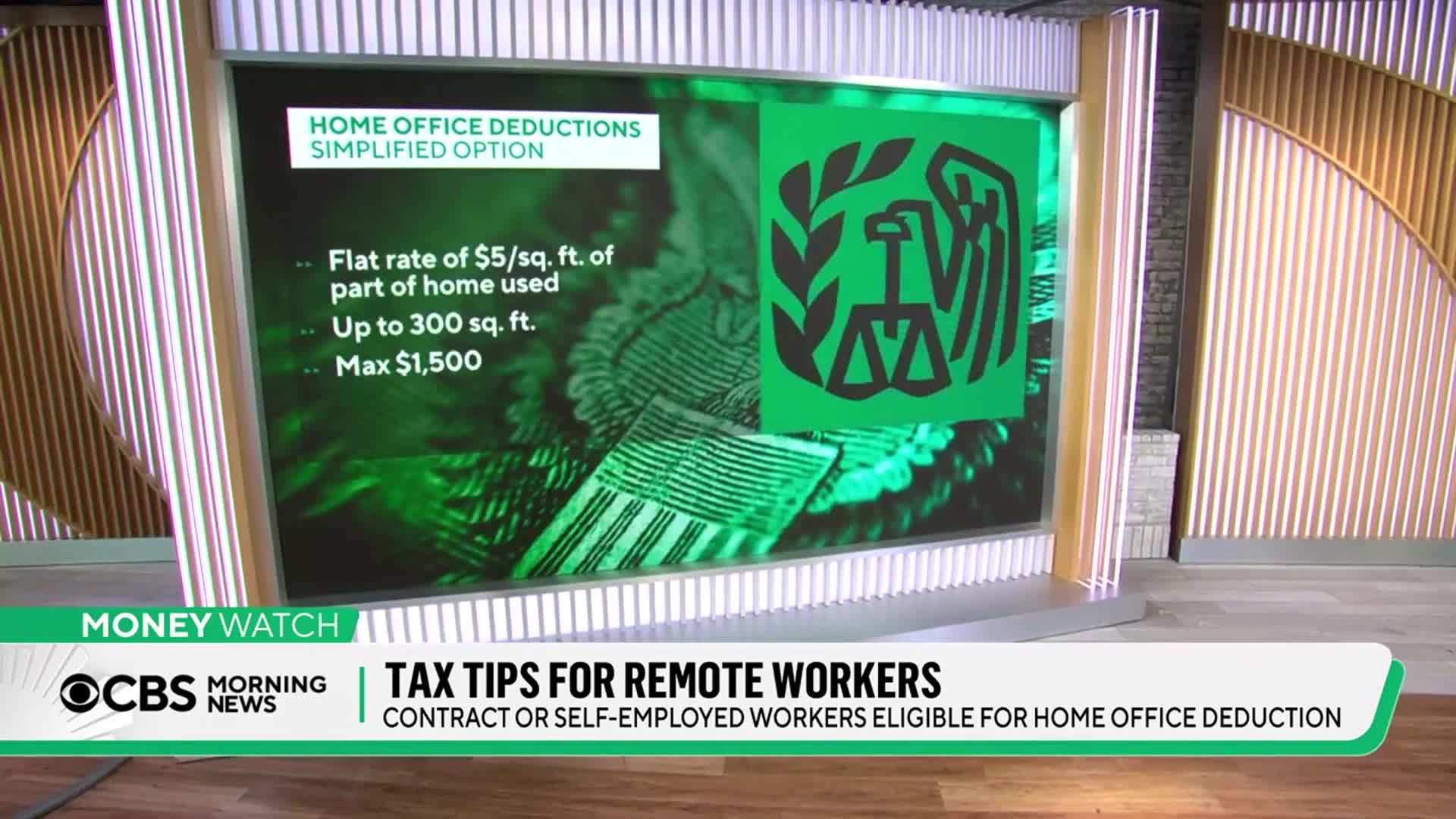

What expenses can self-employed remote workers deduct from their taxes for a home office?

Self-employed remote workers can deduct much more than just basic office equipment. Beyond cell phones, laptops, printers and supplies, they can deduct a portion of their rent or mortgage, real estate taxes, homeowners insurance, and utilities based on the percentage of home used exclusively for business. For example, if 20% of your home serves exclusively as an office, you can deduct 20% of these housing-related expenses from your taxes. Proper documentation is essential when claiming these deductions, as all expenses must be thoroughly recorded to support your tax claims.

Watch clip answer (00:32m)What are federal employees doing on social media during work hours, and what are the implications of this behavior?

Federal employees are actively posting on social media platforms like Reddit during work hours, with peak activity occurring in the middle of the workday rather than during personal time. A subreddit called Fed News has documented evidence of this behavior, including screenshots of federal workers discussing strategies to "clog up the works" as a form of workplace revolt. This behavior raises serious concerns about government accountability and workplace productivity. The discussion references the "Art of Simple Sabotage," suggesting that some federal employees may be deliberately disrupting workplace efficiency. The hosts argue that requiring remote workers to return to physical offices could significantly reduce this type of unproductive behavior. The broader implications include damaged public perception of government employees and questions about the appropriate use of taxpayer-funded work time for personal online activities.

Watch clip answer (00:40m)