Remote Work

How does the European Central Bank's hybrid work policy differ from other major companies?

The European Central Bank has extended its hybrid work policy for two additional years, allowing staff to work remotely for up to 110 days annually. This approach stands in stark contrast to companies like J.P. Morgan and Amazon, which are implementing mandatory office return policies for their employees. While many major corporations are pushing for a full return to office, the ECB is maintaining workplace flexibility, demonstrating a different response to evolving work practices based on employee preferences and global workplace trends.

Watch clip answer (00:15m)How is the European Central Bank's hybrid work policy different from other major companies?

The European Central Bank has extended its hybrid work policy for two additional years, allowing employees to work remotely for up to 110 days annually, demonstrating a commitment to workplace flexibility. This approach stands in stark contrast to major corporations like J.P. Morgan and Amazon, which are mandating returns to office work. While many large companies are pushing for traditional in-office arrangements, the ECB is maintaining a flexible work environment that balances remote and in-person collaboration. This policy reflects the ECB's responsiveness to evolving workplace trends and employee preferences in the post-pandemic era.

Watch clip answer (00:15m)Why is it important to file tax returns early this year?

Filing tax returns early this year is particularly important due to potential IRS staffing changes that could affect processing times. According to personal finance reporter Medora Lee, taxpayers should opt for direct deposit when filing, as this is the fastest way to receive tax refunds. The news anchor emphasizes this point, stating "If there's a year to do it early, it's this year," highlighting the unusual urgency for the current tax season. By filing early and choosing direct deposit, taxpayers can avoid potential delays and receive their refunds more quickly.

Watch clip answer (00:10m)Who is eligible for home office deductions after the 2018 tax reforms?

After the 2018 tax reforms, home office deductions are no longer available to regular remote workers who are W2 employees. These deductions are now limited to self-employed individuals who are not employed by a company, or those who have a second job outside their primary W2 position. To qualify, individuals must exclusively use a specific space in their home for work purposes. This means the area must be dedicated solely to business activities. These eligibility requirements significantly narrowed who can claim home office expenses, making it primarily a benefit for freelancers, independent contractors, and those with side businesses.

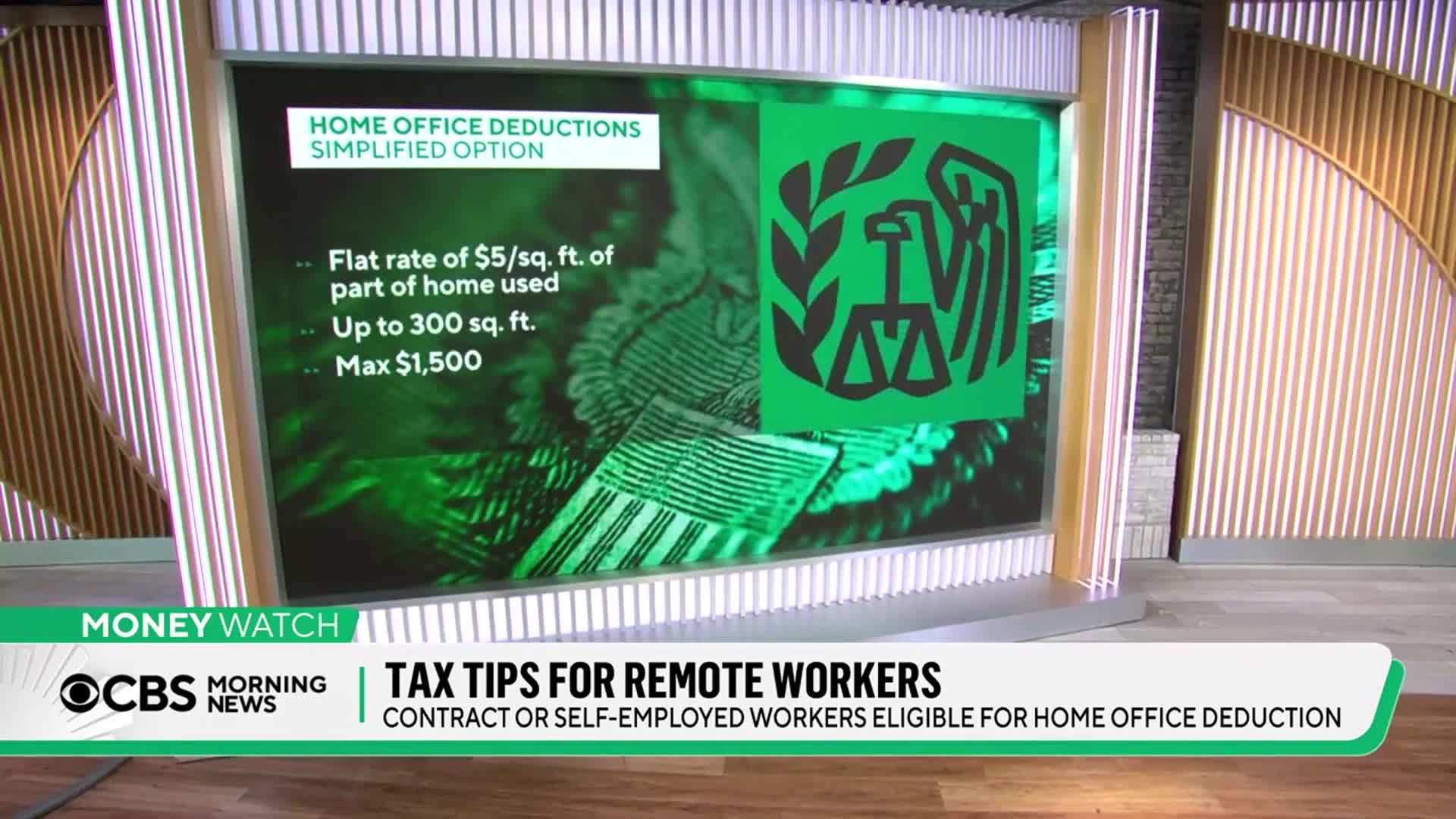

Watch clip answer (00:26m)How does the simplified home office deduction method work?

The simplified home office deduction method allows eligible taxpayers to claim $5 per square foot of their workspace, with a maximum allowable space of 300 square feet. This means the maximum deduction available through this simplified method is $1,500 ($5 × 300 square feet). This straightforward calculation method was introduced following the 2018 tax reforms to make it easier for self-employed individuals and those with secondary jobs to claim their legitimate home office expenses without complex recordkeeping requirements.

Watch clip answer (00:07m)Can remote workers claim home office tax deductions?

Since the 2018 tax reforms, most remote workers cannot claim deductions for unreimbursed expenses or home office costs. This change significantly impacts employees working from home who might have previously expected to receive tax benefits for their home workspace arrangements. While many remote workers may be considering office deductions as tax season approaches, the current tax code restricts these benefits, regardless of whether you're working from your couch, bed, or a dedicated home office space as an employee. Self-employed individuals, however, may still qualify for certain home office deductions under different rules.

Watch clip answer (00:17m)