New India Cooperative Bank

How did customers react to the RBI's restrictions on New India Cooperative Bank?

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

Watch clip answer (00:17m)What challenges are depositors facing due to the RBI restrictions on New India Cooperative Bank?

Depositors are experiencing significant financial distress due to the sudden RBI restrictions on New India Cooperative Bank. Many have expressed frustration over the lack of prior warning from the bank, leaving them unprepared for the fund disbursement limitations imposed for six months. With monthly interest payments and daily expenses to manage, customers face immediate financial hardship as they can't access their savings. The situation is particularly concerning because the bank's financial health has been under substantial pressure, yet depositors weren't adequately informed before the restrictions took effect.

Watch clip answer (00:15m)What restrictions has the Reserve Bank of India imposed on the New India Cooperative Bank and how are depositors affected?

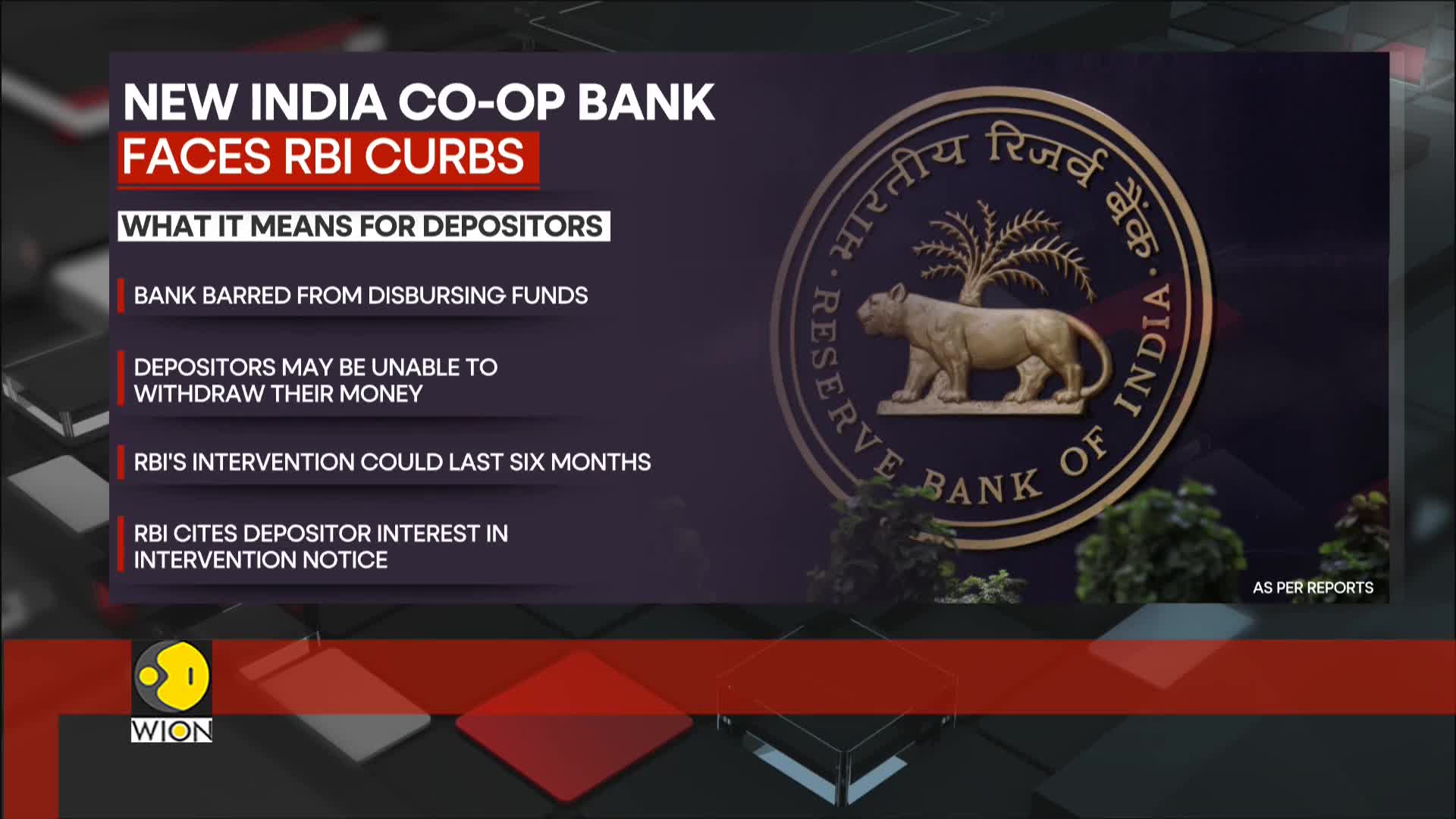

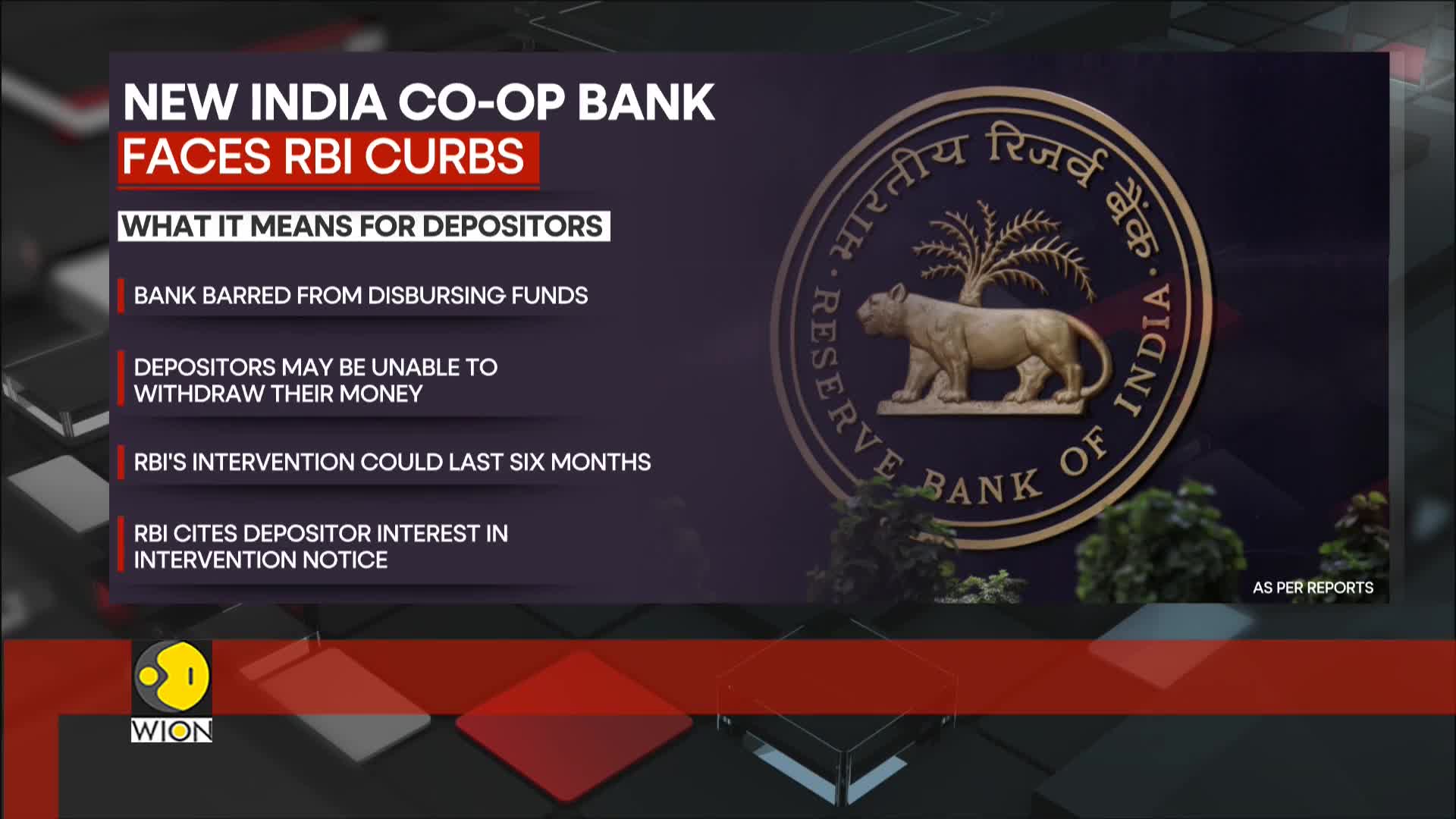

The Reserve Bank of India has imposed strict restrictions on the Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside bank branches as worried customers seek access to their savings. This regulatory action highlights the fragility of smaller financial institutions in emerging markets like India. The situation underscores the challenges faced by depositors when banking institutions face liquidity issues, leaving them in financial limbo until the restrictions are lifted or alternative arrangements are made.

Watch clip answer (00:36m)What restrictions has the RBI imposed on the New India Cooperative Bank?

The RBI has imposed restrictions on the New India Cooperative Bank effective from February 13, which will remain in place for six months pending review. The central bank cited material developments as the reason for this intervention, with the primary aim of protecting depositor interests and ensuring financial stability. During this period, the bank is prevented from disbursing funds, which has caused concern among depositors who have been lining up outside bank branches worried about accessing their savings. This regulatory action highlights the RBI's role in maintaining stability in the cooperative banking sector.

Watch clip answer (00:13m)How are depositors affected by the RBI's restrictions on New India Cooperative Bank?

Depositors are experiencing immediate financial distress due to their inability to access funds following RBI's restrictions on New India Cooperative Bank. With monthly interest payments and daily expenses to manage, many account holders face severe financial hardship as they cannot withdraw their money beyond the imposed limits. The bank's deteriorating financial health, which has been under significant pressure, has directly impacted customers who rely on these funds for their everyday needs. This situation highlights the vulnerability of depositors when regulatory actions are taken against struggling cooperative banks, leaving many in precarious financial circumstances.

Watch clip answer (00:11m)What restrictions has the Reserve Bank of India imposed on New India Cooperative Bank and why?

The Reserve Bank of India has imposed strict restrictions on Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside the bank branches. This intervention by India's central bank highlights the fragility of smaller financial institutions in emerging markets like India. The situation has created significant turbulence in India's banking sector as customers find themselves cut off from accessing their savings, demonstrating the vulnerabilities that exist within the country's cooperative banking system.

Watch clip answer (00:36m)