New India Cooperative Bank

How did customers react to the Reserve Bank of India's restrictions on New India Cooperative Bank?

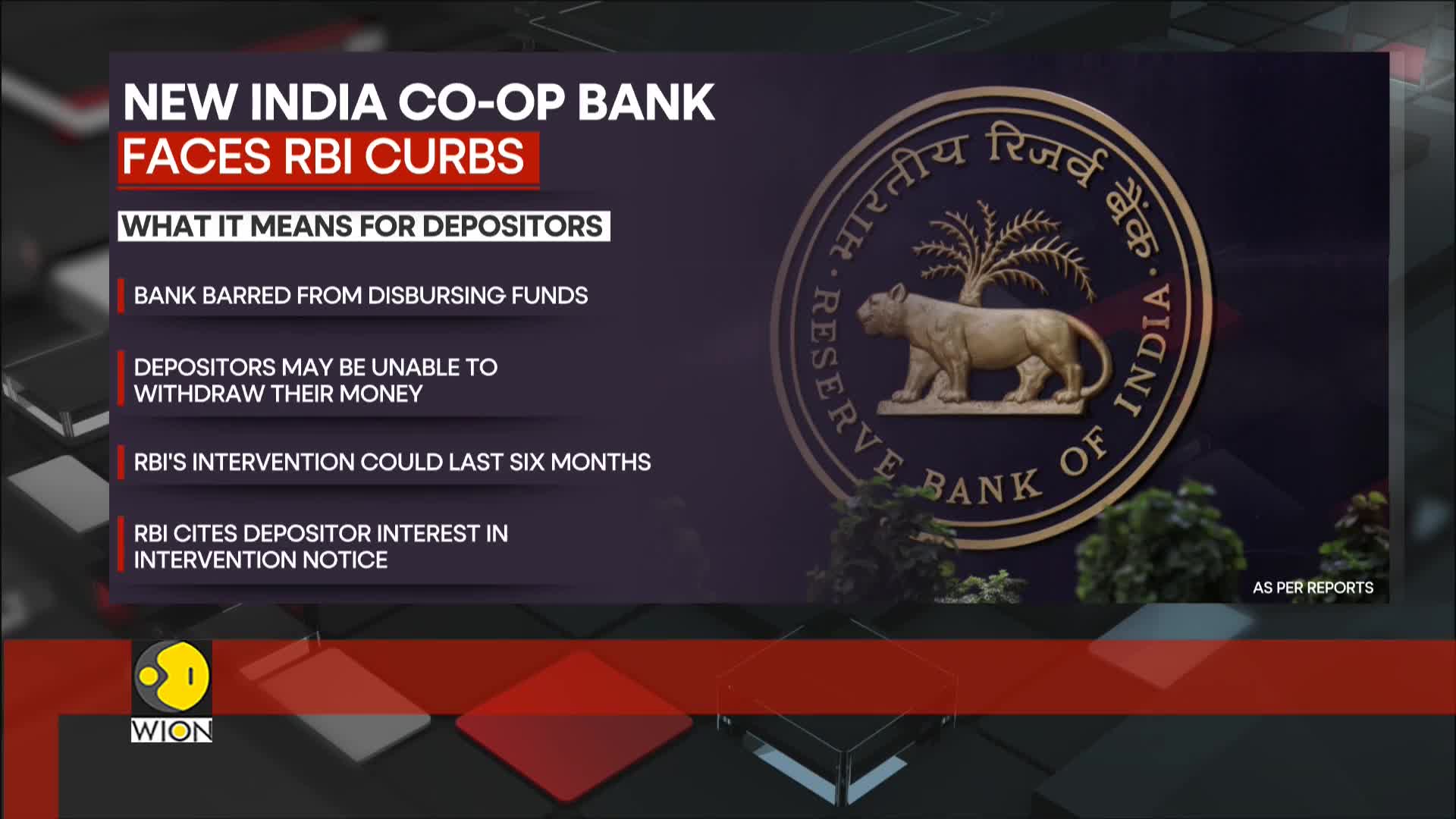

Following the announcement of RBI restrictions on New India Cooperative Bank, customers immediately rushed to the bank's branches in a state of panic. They were primarily motivated by fears that their savings could be at risk due to the bank's liquidity issues. The restrictions, effective from February 13 for six months, have significantly impacted depositors who are now unable to access their savings. This situation highlights the vulnerability of smaller financial institutions in emerging markets and has created considerable anxiety among account holders who face financial uncertainty.

Watch clip answer (00:05m)Why did the Reserve Bank of India intervene with New India Cooperative Bank?

The Reserve Bank of India intervened with New India Cooperative Bank citing 'material developments' as the reason for their action. The central bank's primary aims were to protect depositor interests and ensure financial stability amid liquidity concerns at the bank. This intervention was implemented as a protective measure to safeguard customers' savings, though it triggered immediate panic among account holders. Following the announcement, customers rushed to bank branches fearing their savings were at risk, with many expressing frustration over the lack of prior warning about the situation.

Watch clip answer (00:18m)What regulatory action has the Reserve Bank of India taken against New India Cooperative Bank, and how has it affected depositors?

The Reserve Bank of India (RBI) has imposed regulatory curbs on New India Cooperative Bank due to supervisory concerns, creating significant disruption for the institution's operations. This regulatory intervention has directly impacted the bank's branches in Mumbai and Pune, where depositors are now experiencing difficulties accessing their funds. The RBI's supervisory action has triggered a funding panic among customers, as depositors face substantial issues when attempting to withdraw their deposits. This situation reflects broader concerns about the bank's financial stability and regulatory compliance, highlighting the central bank's role in maintaining banking sector integrity through decisive supervisory measures when institutions fail to meet required standards.

Watch clip answer (00:26m)