Investment Strategies

What is Goldman Sachs' forecast for gold prices by the end of 2025?

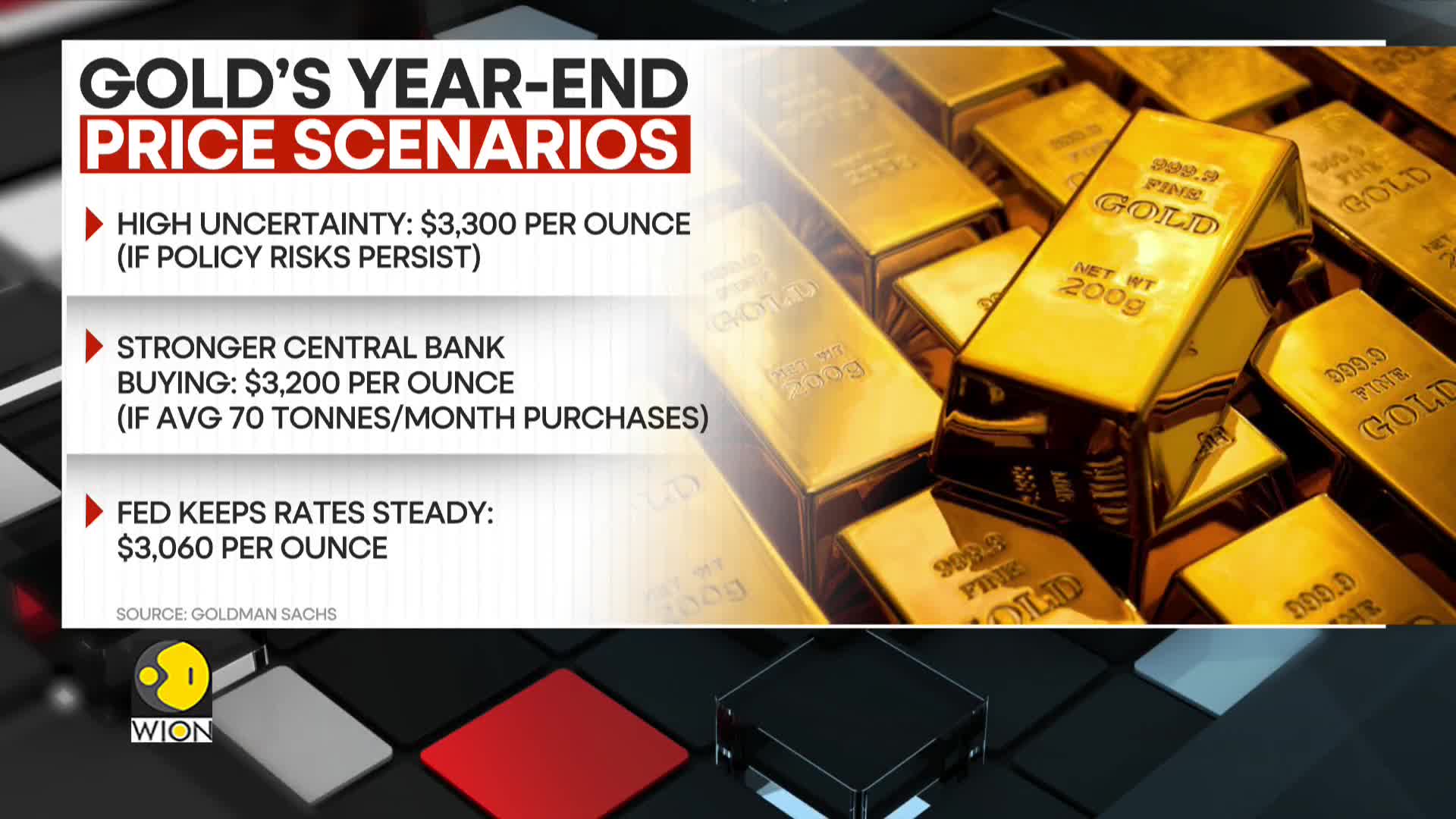

According to Goldman Sachs, gold prices could potentially surge to $3,300 per ounce by the end of the year, primarily driven by ongoing high uncertainty in the financial markets. This bullish forecast is specifically influenced by concerns regarding tariffs and monetary policy risks that are expected to persist. The investment bank believes that prolonged economic and policy uncertainties will create favorable conditions for gold's appreciation as investors seek safe-haven assets. This projection represents a significant potential upside from current gold prices as the precious metal continues to be viewed as a hedge against financial instability.

Watch clip answer (00:14m)What is Goldman Sachs' forecast for gold prices and what factors are driving this prediction?

Goldman Sachs has revised its gold price forecast upward, primarily due to sustained central bank demand, which is expected to add 9% to gold prices by the end of the year. The bank has increased its assumption for monthly central bank gold purchases to 50 tonnes, up from its previous estimate of 41 tonnes. According to Goldman, this structural demand, combined with gradually increasing ETF holdings as interest rates decline, should outweigh any potential price drag from normalizing investor positioning, supporting their bullish outlook for gold.

Watch clip answer (00:30m)What is Goldman Sachs' gold price forecast for 2025 and what factors could drive it higher?

Goldman Sachs has raised its gold price forecast to $3,100 per ounce by the end of 2025, citing concerns over US fiscal sustainability as a key driver. According to their analysis, if these fiscal concerns escalate further, gold could rise an additional 5% to reach $3,250 per ounce by December 2025. The forecast is supported by growing fears of inflation and fiscal instability, which could trigger higher speculative positioning and stronger ETF inflows in the gold market. This outlook reflects gold's traditional role as a hedge against economic uncertainty, with the potential for significant price appreciation as investors seek safe-haven assets amid financial risks.

Watch clip answer (00:19m)What goods does India export to Qatar and what are their trade goals?

India's diverse exports to Qatar encompass a wide range of products including copper, construction materials, food items (cereals, vegetables, fruits, spices), electrical machinery, textiles and garments, chemicals, and precious stones. These products form the foundation of the current bilateral trade relationship between the two nations. Looking forward, both countries have established ambitious goals to strengthen their economic ties. India and Qatar aim to double their trade volumes to reach $28 billion within the next 55 years, highlighting the long-term commitment to their partnership and the significant potential for growth in their commercial relationship.

Watch clip answer (00:26m)What is the current state of trade between India and Qatar, and what are their future trade goals?

Currently, bilateral trade between India and Qatar stands at $18.77 billion, with LNG being the major contributor. Qatar accounts for 48% of India's LNG imports, establishing its role as a key energy partner. India exports diverse products to Qatar including copper, construction materials, cereals, vegetables, textiles, garments, and precious stones. Looking ahead, both countries aim to double their trade volumes to $28 billion within the next five years. Additionally, discussions are underway for a potential free trade agreement which could further strengthen economic ties between the two nations.

Watch clip answer (00:53m)What is the important lesson regarding meme coins?

The crucial lesson is to 'beware of meme coins.' The clip highlights a controversy involving Argentina's president who promoted a volatile meme cryptocurrency, resulting in massive investor losses. This demonstrates the speculative and risky nature of meme coins, even when endorsed by prominent figures like world leaders. The incident serves as a cautionary tale about potential market manipulations and the dangers of cryptocurrency investments based solely on high-profile endorsements rather than fundamental value.

Watch clip answer (00:08m)