Investment Strategies

How did defense stocks perform compared to tech stocks in the recent market?

While heavyweight tech stocks experienced declines, defense stocks continued to gain ground in the broader market, showing notable resilience. This divergent performance occurred alongside positive movement in mid and small cap indexes, with the BSE Mid cap index adding 1.2% and the small cap index surging by a more substantial 2.4%. This pattern indicates a rotation of investor interest from technology into defense sectors, potentially reflecting changing market sentiments and sector-specific dynamics.

Watch clip answer (00:13m)How did President Javier Milei defend himself against criticism for promoting a cryptocurrency that led to investor losses?

President Milei responded by likening cryptocurrency investments to gambling, arguing that investors knowingly put their money at risk. He shifted responsibility to the investors, stating that if people chose to invest, then any resulting losses were their own fault, similar to gambling at a casino. Despite accusations, Milei denies actively promoting the Dollar Libra cryptocurrency, claiming he was merely sharing information about it. He maintains that investing was ultimately people's personal choice, and he bears no responsibility for their decisions to invest in the volatile currency that subsequently crashed.

Watch clip answer (00:19m)How did President Milei respond to criticism over promoting a cryptocurrency that later crashed?

President Milei responded by deflecting responsibility, arguing that investors who lost money should blame themselves rather than him. He likened cryptocurrency investment to gambling at a casino, stating that when people put their money at risk, the consequences are their responsibility alone. Despite facing calls for impeachment, Milei denied that he was actively promoting the cryptocurrency. Instead, he claimed he was merely sharing information about it, and that it was ultimately people's choice whether to invest or not. This defense attempts to distance himself from accountability while investigations into the matter continue.

Watch clip answer (00:19m)Is it better to invest in Bitcoin directly or in mining companies after the 2024 Bitcoin halving?

The 2024 Bitcoin halving presents a complex investment landscape. Despite cutting miner revenue by 50%, Bitcoin's expected rising demand makes it an attractive long-term investment option. However, mining companies face significant challenges with reduced revenue per unit of hash power. For investors, this creates a fundamental decision between investing directly in Bitcoin, which benefits from increasing scarcity and demand, or in mining companies that extract it. While Bitcoin itself may offer more straightforward exposure to price appreciation, mining investments require considering operational challenges alongside potential industry consolidation opportunities in the post-halving environment.

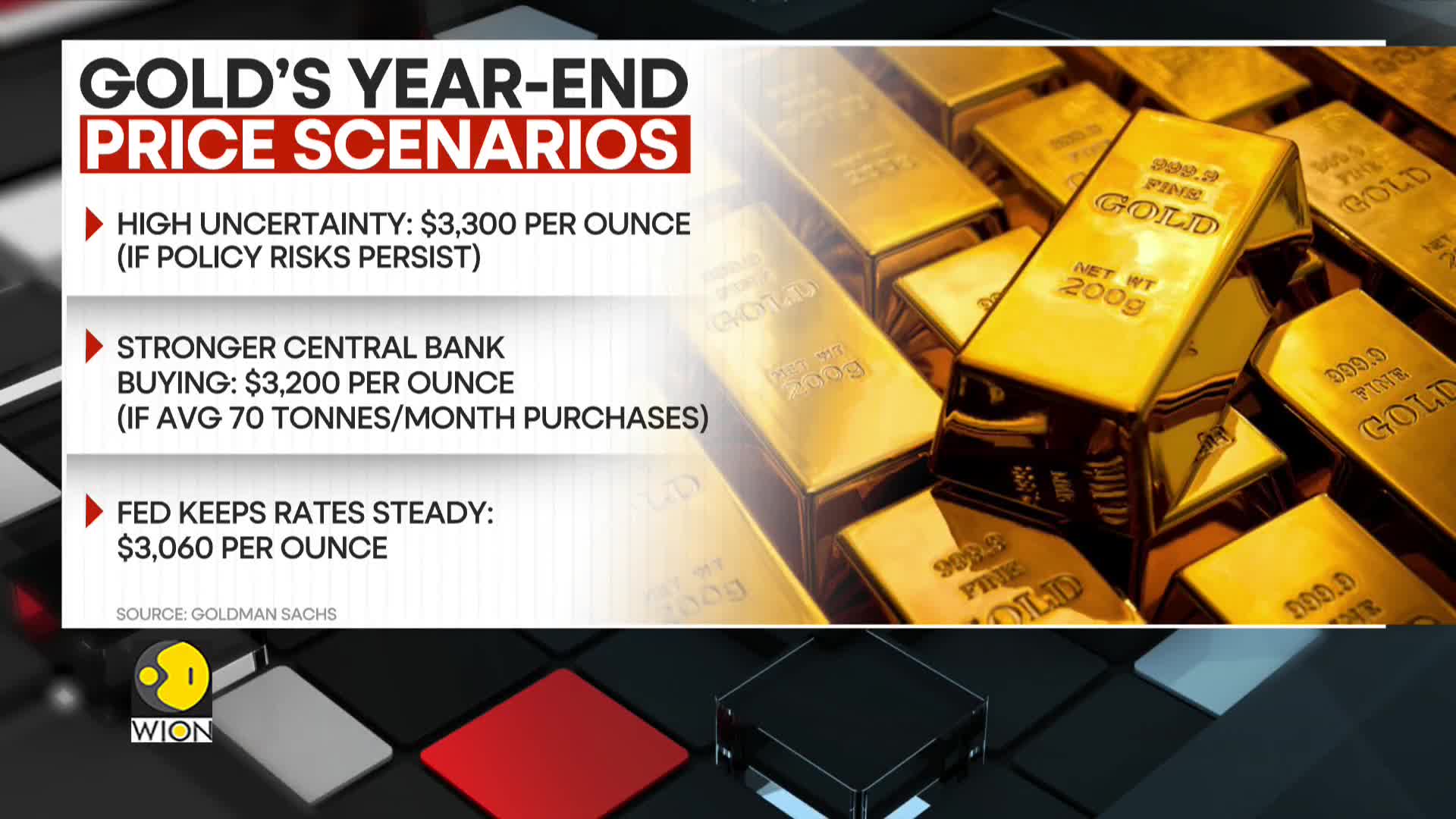

Watch clip answer (00:31m)Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)What is Goldman Sachs' revised forecast for gold prices in 2025 and what factors are driving this change?

Goldman Sachs has increased its year-end 2025 gold price forecast to $3,100 per ounce, up from its previous estimate of $2,890. This upward revision is primarily attributed to sustained central bank demand for gold, which is expected to continue driving market prices higher. The investment bank projects that this central bank demand will add approximately 9% to gold prices by the end of the year, reflecting growing institutional confidence in gold as a strategic asset amid various economic uncertainties.

Watch clip answer (00:19m)