Gold prices

Why should investors buy gold and gold mining stocks now instead of waiting for pullbacks?

Peter Schiff advises investors not to wait for pullbacks in gold prices, emphasizing that pullbacks will likely be quick and shallow. He notes that gold has reached new highs ($2,204 per ounce) and predicts gold mining stocks could explode higher by 10-20% in a single day as the market recognizes the Fed's inevitable rate cuts. Schiff argues that rate cuts are coming not because inflation is defeated, but because the country is broke and facing potential financial and banking crises. This environment creates a strong bullish case for precious metals as inflation will continue. His key message is clear: the sooner investors buy gold and silver, the cheaper it will be, as these assets have a long upward trajectory ahead.

Watch clip answer (01:45m)Why does Goldman Sachs consider gold a valuable investment?

Goldman Sachs emphasizes that gold serves as a crucial hedge against multiple economic challenges in today's volatile market. Specifically, gold provides protection against financial and recessionary risks that could impact investment portfolios. Additionally, gold's value as a strategic asset is enhanced during periods of trade tensions and Federal Reserve policy uncertainty. This protective quality explains why Goldman has raised its forecast to $3,100 per ounce by the end of 2025, with increased central bank purchasing expected to reach 50 tonnes monthly.

Watch clip answer (00:10m)What is Goldman Sachs' revised forecast for gold prices in 2025 and what factors are driving this change?

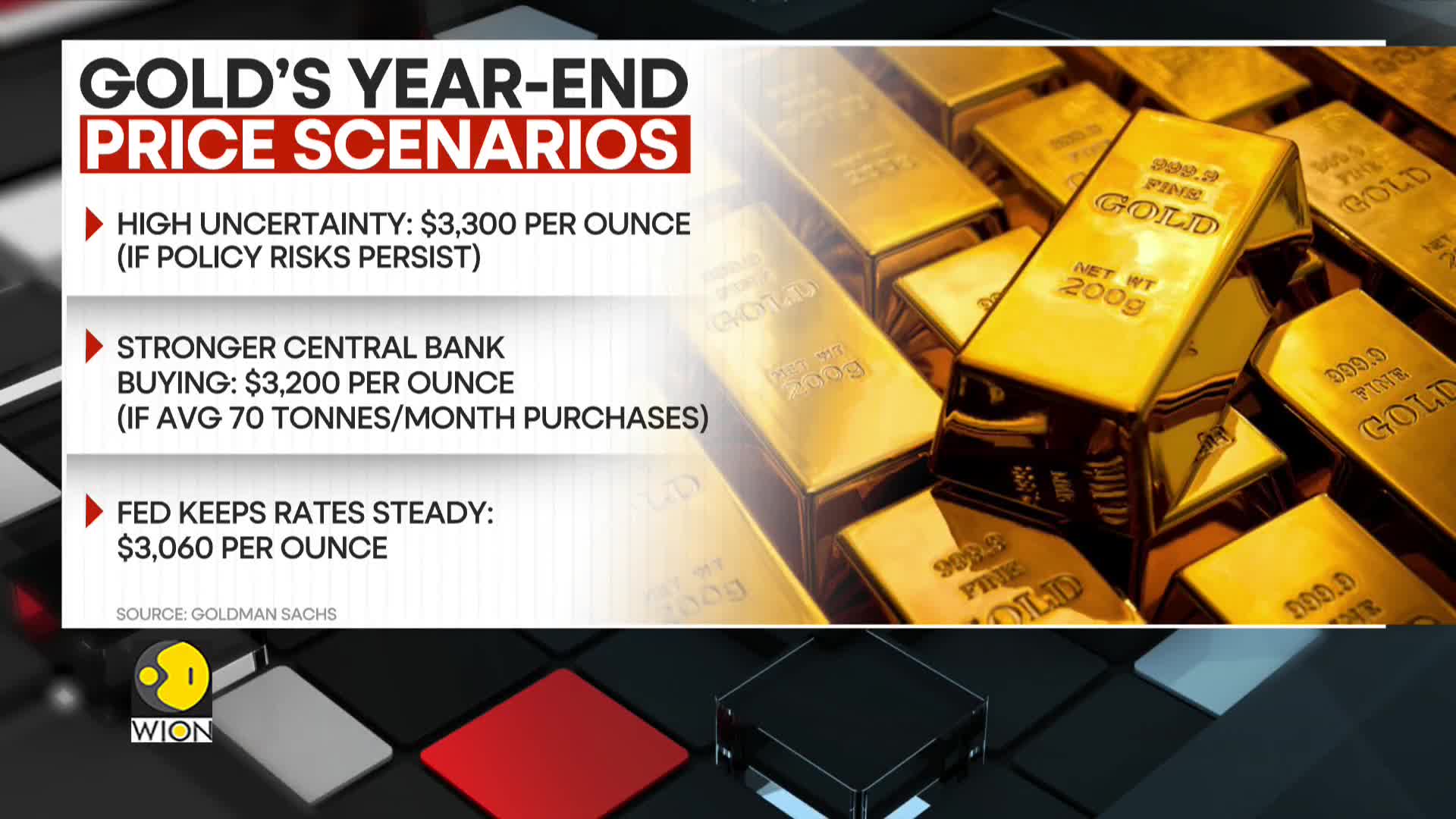

Goldman Sachs has increased its year-end 2025 gold price forecast to $3,100 per ounce, up from its previous estimate of $2,890. This upward revision is primarily attributed to sustained central bank demand for gold, which is expected to continue driving market prices higher. The investment bank projects that this central bank demand will add approximately 9% to gold prices by the end of the year, reflecting growing institutional confidence in gold as a strategic asset amid various economic uncertainties.

Watch clip answer (00:19m)What is Goldman Sachs' forecast for gold prices by the end of 2025?

According to Goldman Sachs, gold prices could potentially surge to $3,300 per ounce by the end of the year, primarily driven by ongoing high uncertainty in the financial markets. This bullish forecast is specifically influenced by concerns regarding tariffs and monetary policy risks that are expected to persist. The investment bank believes that prolonged economic and policy uncertainties will create favorable conditions for gold's appreciation as investors seek safe-haven assets. This projection represents a significant potential upside from current gold prices as the precious metal continues to be viewed as a hedge against financial instability.

Watch clip answer (00:14m)What is Goldman Sachs' forecast for gold prices and what factors are driving this prediction?

Goldman Sachs has revised its gold price forecast upward, primarily due to sustained central bank demand, which is expected to add 9% to gold prices by the end of the year. The bank has increased its assumption for monthly central bank gold purchases to 50 tonnes, up from its previous estimate of 41 tonnes. According to Goldman, this structural demand, combined with gradually increasing ETF holdings as interest rates decline, should outweigh any potential price drag from normalizing investor positioning, supporting their bullish outlook for gold.

Watch clip answer (00:30m)What is Goldman Sachs' gold price forecast for 2025 and what factors could drive it higher?

Goldman Sachs has raised its gold price forecast to $3,100 per ounce by the end of 2025, citing concerns over US fiscal sustainability as a key driver. According to their analysis, if these fiscal concerns escalate further, gold could rise an additional 5% to reach $3,250 per ounce by December 2025. The forecast is supported by growing fears of inflation and fiscal instability, which could trigger higher speculative positioning and stronger ETF inflows in the gold market. This outlook reflects gold's traditional role as a hedge against economic uncertainty, with the potential for significant price appreciation as investors seek safe-haven assets amid financial risks.

Watch clip answer (00:19m)