Gold prices

What is Goldman Sachs' gold price projection for 2025 if the Federal Reserve keeps interest rates steady?

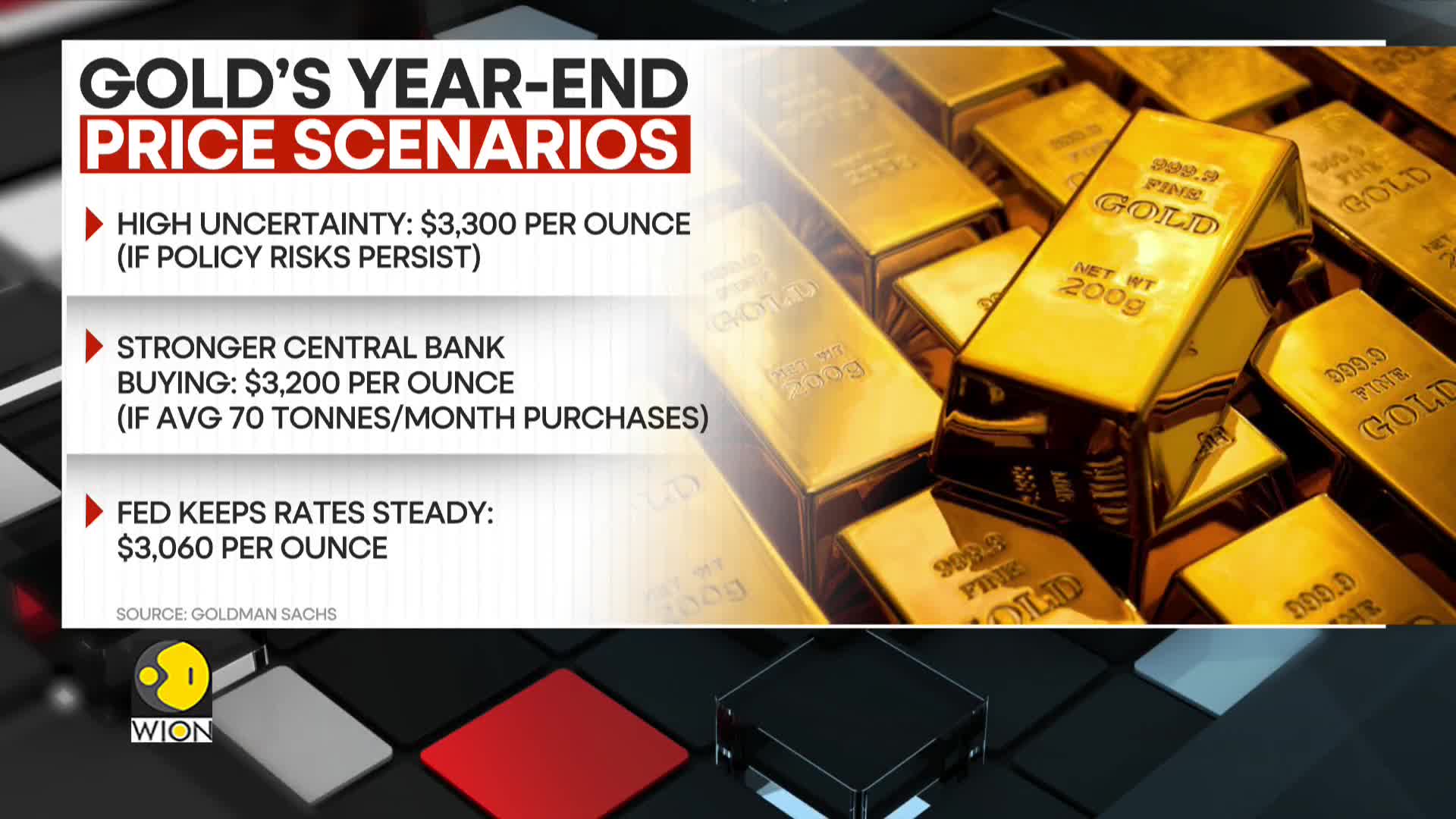

According to Goldman Sachs, if the Federal Reserve maintains steady interest rates, gold prices are expected to reach $3,060 by 2025. This bullish outlook is supported by several factors including ongoing central bank demand and anticipated ETF inflows. Goldman Sachs views gold as an important hedge against fiscal instability, inflation concerns, and trade tensions in the current economic climate. The bank has outlined various price scenarios based on monetary policy uncertainty and central bank purchasing trends, ultimately reinforcing a positive perspective on gold as an investment during economic fluctuations.

Watch clip answer (00:07m)Why is there concern about Fort Knox gold reserves?

Concerns about Fort Knox gold reserves have emerged because they are not subjected to annual external reviews, raising transparency issues among critics and lawmakers. With gold reserves valued at approximately $425 billion and claimed to total over 8,100 tonnes, the absence of regular independent verification has created skepticism about the actual state of America's treasure trove. This lack of oversight has prompted initiatives to audit Fort Knox, including recent efforts led by Elon Musk. The situation highlights growing demands for accountability regarding one of the nation's most valuable assets, with critics arguing that regular external audits are essential to maintain public trust in the government's financial reporting.

Watch clip answer (00:28m)What would be the implications of Elon Musk's proposed audit of the U.S. gold reserves at Fort Knox?

An audit led by Musk could significantly impact public trust in government financial representations by verifying the existence and condition of gold reserves or challenging broader credibility if discrepancies are found. The thorough inspection would involve weighing and assessing each gold bar against official records, though experts note this would be costly and time-consuming. Public reaction has been mixed but largely supportive of Musk's transparency initiative. Many view this audit as necessary to restore confidence in U.S. financial practices amid growing skepticism toward government accountability, suggesting it represents an important step toward greater financial transparency and verification of public assets.

Watch clip answer (00:46m)What is the predicted future price for gold according to analysts?

According to financial analysts featured on WION News, gold is predicted to reach an unprecedented milestone of $3,000 per ounce in the near future. This would mark the first time ever that the yellow metal has achieved such a high valuation. This bullish prediction comes amid a complex market landscape characterized by muted performance in Asian shares while European stock indices, particularly in the defense sector, have been surging. The anticipated gold price surge appears to be influenced by ongoing geopolitical tensions that are reshaping market dynamics and investor strategies.

Watch clip answer (00:05m)What are investors concerned about in commodity markets?

Investors are demonstrating caution regarding the potential intensification of trade wars and their impact on commodity markets. The financial community appears to be monitoring signs of escalating trade tensions that could disrupt global commodity flows and pricing. This wariness comes amid a mixed market landscape where Asian shares show muted performance while European markets, particularly defense and banking sectors, reach new highs. Meanwhile, key commodities like Brent oil and gold are experiencing notable price fluctuations, reflecting the underlying uncertainty in global trade relations.

Watch clip answer (00:04m)What is driving the recent record high in gold prices and their seven-week consecutive gains?

Gold prices have reached record highs and are experiencing their seventh consecutive week of gains, primarily driven by investor fears of an impending global trade war. This surge stems from concerns about Trump's aggressive tariff policies, which target any countries that impose fees on US imports, reflecting his zero-sum approach to international trade. The precious metal's rally demonstrates how geopolitical tensions and trade policy uncertainties can significantly impact financial markets. Gold traditionally serves as a safe-haven asset during times of economic uncertainty, making it particularly attractive when investors anticipate potential disruptions to global commerce and economic stability.

Watch clip answer (00:15m)