Financial Security

Financial security is a fundamental aspect of personal finance, encompassing the ability to meet essential living expenses, navigate unforeseen costs, and maintain a stable financial future without undue stress. It is characterized by a well-structured system that includes living within one's means, establishing a robust emergency fund, and minimizing high-interest debts. As a key component of financial well-being, achieving financial security allows individuals to confidently plan for long-term goals, such as effective retirement planning and investments. The importance of financial security has intensified recently, as economic uncertainties and rising costs have prompted many to reassess their financial strategies. To secure financial stability, it is crucial to adopt sound financial habits, including creating and adhering to a budget and consistently saving for future needs. Research emphasizes the necessity of building an emergency fund, ideally covering three to six months' worth of living expenses, which acts as a buffer against financial shocks. In addition, minimizing liabilities through prudent debt management and employing effective investment strategies can enhance your financial resilience. As recent surveys indicate heightened financial optimism among Americans, the focus on preparing for unexpected expenses and solidifying savings continues to be essential for long-term peace of mind. By prioritizing financial security, individuals can take steps towards achieving freedom from money worries and fostering a secure future.

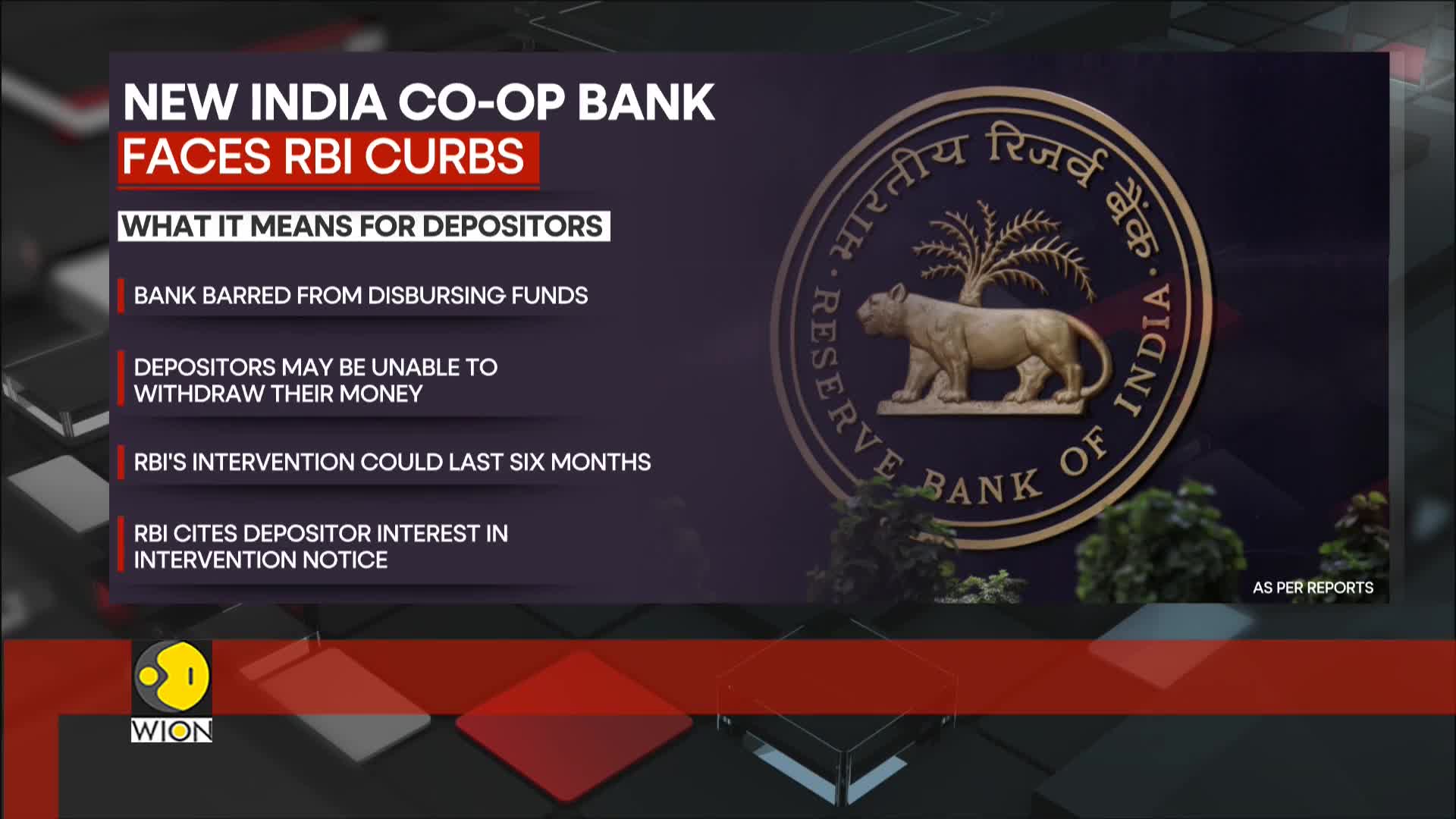

Why did the Reserve Bank of India intervene with New India Cooperative Bank?

The Reserve Bank of India intervened with New India Cooperative Bank citing 'material developments' as the reason for their action. The central bank's primary aims were to protect depositor interests and ensure financial stability amid liquidity concerns at the bank. This intervention was implemented as a protective measure to safeguard customers' savings, though it triggered immediate panic among account holders. Following the announcement, customers rushed to bank branches fearing their savings were at risk, with many expressing frustration over the lack of prior warning about the situation.

Watch clip answer (00:18m)What regulatory action has the Reserve Bank of India taken against New India Cooperative Bank, and how has it affected depositors?

The Reserve Bank of India (RBI) has imposed regulatory curbs on New India Cooperative Bank due to supervisory concerns, creating significant disruption for the institution's operations. This regulatory intervention has directly impacted the bank's branches in Mumbai and Pune, where depositors are now experiencing difficulties accessing their funds. The RBI's supervisory action has triggered a funding panic among customers, as depositors face substantial issues when attempting to withdraw their deposits. This situation reflects broader concerns about the bank's financial stability and regulatory compliance, highlighting the central bank's role in maintaining banking sector integrity through decisive supervisory measures when institutions fail to meet required standards.

Watch clip answer (00:26m)What reforms are needed to fix the broken U.S. unemployment system?

The U.S. unemployment system requires comprehensive reforms, starting with immediate funding for states to upgrade their outdated technology and remove bureaucratic obstacles that prevent eligible applicants from receiving assistance. The current system's failures during COVID-19 demonstrated that raising payments and expanding coverage were necessary admissions that the framework was fundamentally broken. Long-term solutions should focus on replacing the current 53 separate state systems with one unified federal system, which would prevent states from engaging in a "race to the bottom" by slashing programs to appear pro-business. If federalization isn't feasible, Congress must establish minimum standards for unemployment benefits that states cannot reduce. The core principle should shift from preventing undeserving recipients from getting payments to ensuring those who genuinely need help can access it efficiently and equitably.

Watch clip answer (01:34m)What are the systemic challenges and broader impacts of unemployment, particularly as highlighted during the pandemic?

John Oliver examines unemployment as both a personal trauma and systemic issue, using humor to address the serious challenges faced by millions during the pandemic. He highlights how job loss affects entire families, referencing personal stories and even puppet characters to illustrate the widespread nature of this crisis. The discussion reveals critical flaws in the unemployment insurance framework, showing how difficult it can be for people to actually secure benefits they're entitled to. Oliver emphasizes that unemployment isn't just an individual problem but a societal issue with broader economic implications. Through his characteristic blend of comedy and serious analysis, Oliver demonstrates how unemployment affects people from all walks of life, making the case for urgent reform of existing systems while maintaining empathy for those struggling with job loss.

Watch clip answer (01:35m)What led to Wendy Williams being placed under guardianship and what concerns were raised about her financial situation?

Wendy Williams was placed under guardianship after her bank, Wells Fargo, identified irregular financial transactions and filed court documents claiming she was an incapacitated person. The bank alleged that Williams was a victim of undue influence and financial exploitation, which prompted the legal guardianship process. Attorney Sabrina Morrissey was subsequently appointed as Williams' guardian to oversee both her healthcare decisions and financial affairs. This guardianship arrangement has become controversial, with Williams herself claiming to be a victim of financial exploitation while under this legal protection. The situation has raised significant public concern, leading to the #FreeWendy movement as supporters question the restrictive nature of her current circumstances.

Watch clip answer (00:25m)