Financial Security

Financial security is a fundamental aspect of personal finance, encompassing the ability to meet essential living expenses, navigate unforeseen costs, and maintain a stable financial future without undue stress. It is characterized by a well-structured system that includes living within one's means, establishing a robust emergency fund, and minimizing high-interest debts. As a key component of financial well-being, achieving financial security allows individuals to confidently plan for long-term goals, such as effective retirement planning and investments. The importance of financial security has intensified recently, as economic uncertainties and rising costs have prompted many to reassess their financial strategies. To secure financial stability, it is crucial to adopt sound financial habits, including creating and adhering to a budget and consistently saving for future needs. Research emphasizes the necessity of building an emergency fund, ideally covering three to six months' worth of living expenses, which acts as a buffer against financial shocks. In addition, minimizing liabilities through prudent debt management and employing effective investment strategies can enhance your financial resilience. As recent surveys indicate heightened financial optimism among Americans, the focus on preparing for unexpected expenses and solidifying savings continues to be essential for long-term peace of mind. By prioritizing financial security, individuals can take steps towards achieving freedom from money worries and fostering a secure future.

What reforms would Bailey like to see in the healthcare system?

Bailey believes we must recognize that in America, wealth directly determines health outcomes. She emphasizes that her ability to afford treatments could prevent frequent surgeries and invasive procedures, highlighting how financial barriers have prevented her from accessing post-surgical care and appointments due to costs like gas money. Bailey argues the current system creates injustice not only for patients but also for healthcare workers including doctors, nurses, and support staff. She sees this as a community-wide issue, emphasizing that reforms must address both patient access and the working conditions of those providing care in our healthcare system.

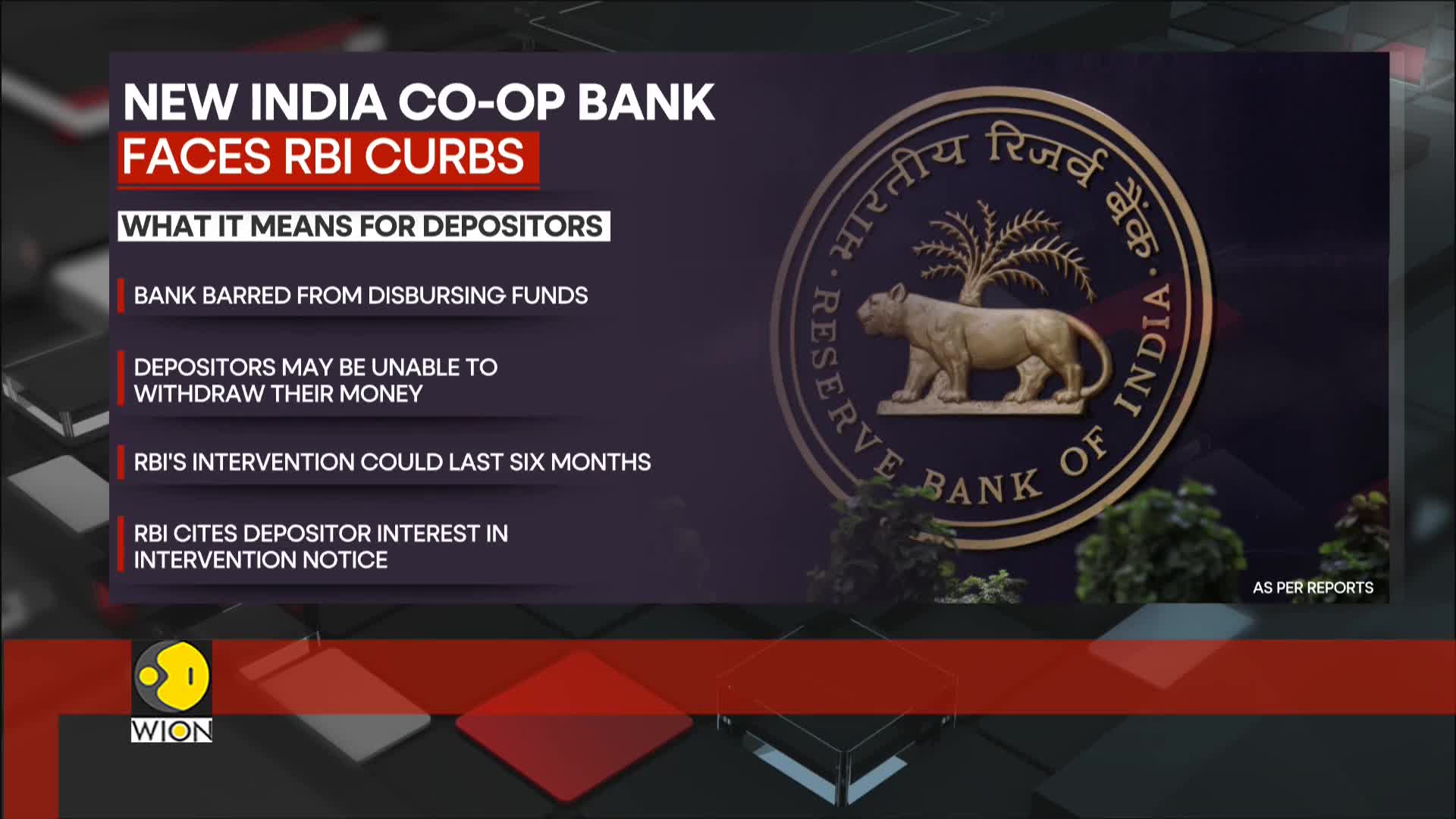

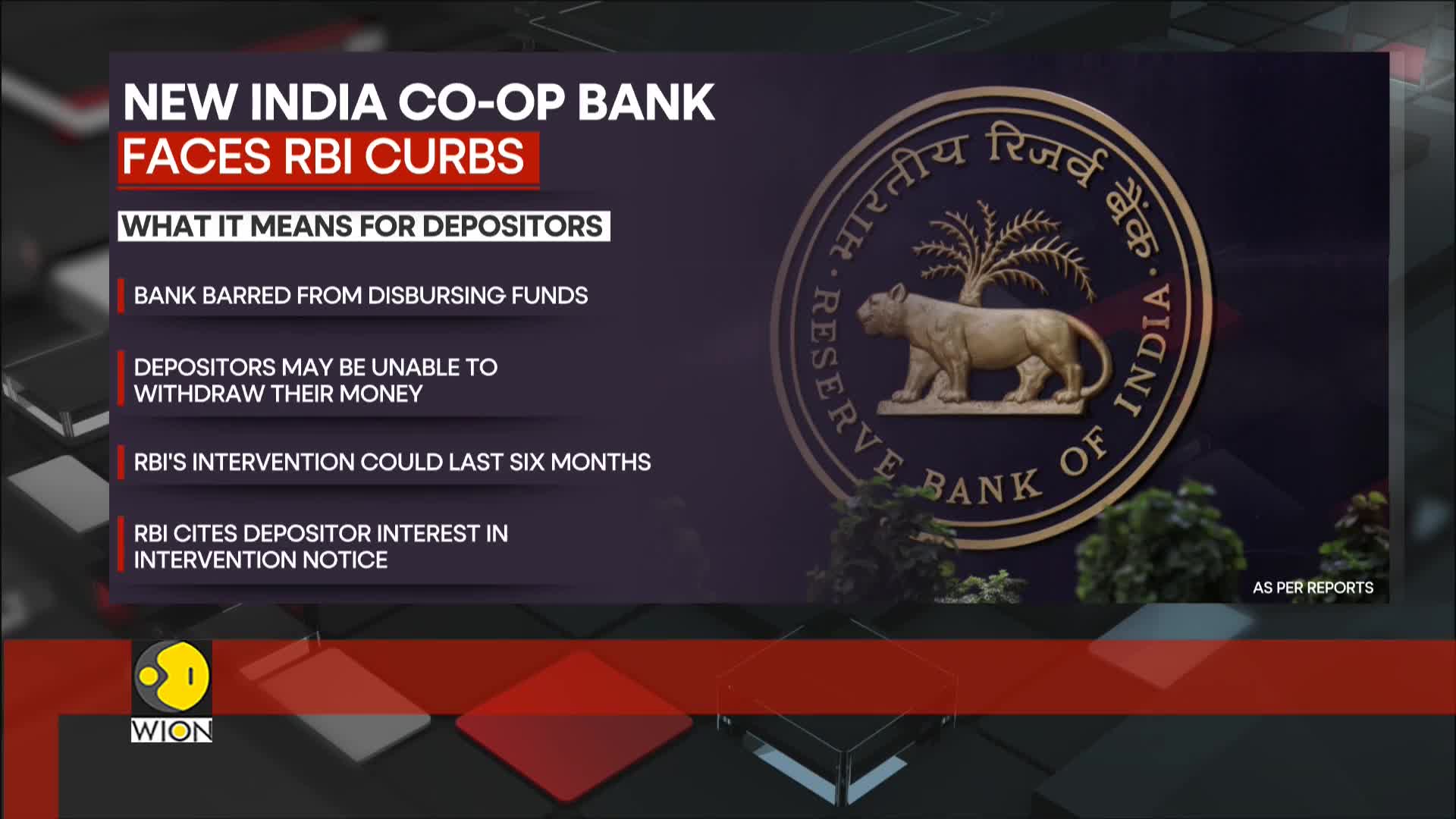

Watch clip answer (02:16m)How did customers react to the RBI's restrictions on New India Cooperative Bank?

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

Watch clip answer (00:17m)What challenges are depositors facing due to the RBI restrictions on New India Cooperative Bank?

Depositors are experiencing significant financial distress due to the sudden RBI restrictions on New India Cooperative Bank. Many have expressed frustration over the lack of prior warning from the bank, leaving them unprepared for the fund disbursement limitations imposed for six months. With monthly interest payments and daily expenses to manage, customers face immediate financial hardship as they can't access their savings. The situation is particularly concerning because the bank's financial health has been under substantial pressure, yet depositors weren't adequately informed before the restrictions took effect.

Watch clip answer (00:15m)What restrictions has the RBI imposed on the New India Cooperative Bank?

The RBI has imposed restrictions on the New India Cooperative Bank effective from February 13, which will remain in place for six months pending review. The central bank cited material developments as the reason for this intervention, with the primary aim of protecting depositor interests and ensuring financial stability. During this period, the bank is prevented from disbursing funds, which has caused concern among depositors who have been lining up outside bank branches worried about accessing their savings. This regulatory action highlights the RBI's role in maintaining stability in the cooperative banking sector.

Watch clip answer (00:13m)How are depositors affected by the RBI's restrictions on New India Cooperative Bank?

Depositors are experiencing immediate financial distress due to their inability to access funds following RBI's restrictions on New India Cooperative Bank. With monthly interest payments and daily expenses to manage, many account holders face severe financial hardship as they cannot withdraw their money beyond the imposed limits. The bank's deteriorating financial health, which has been under significant pressure, has directly impacted customers who rely on these funds for their everyday needs. This situation highlights the vulnerability of depositors when regulatory actions are taken against struggling cooperative banks, leaving many in precarious financial circumstances.

Watch clip answer (00:11m)How did customers react to the Reserve Bank of India's restrictions on New India Cooperative Bank?

Following the announcement of RBI restrictions on New India Cooperative Bank, customers immediately rushed to the bank's branches in a state of panic. They were primarily motivated by fears that their savings could be at risk due to the bank's liquidity issues. The restrictions, effective from February 13 for six months, have significantly impacted depositors who are now unable to access their savings. This situation highlights the vulnerability of smaller financial institutions in emerging markets and has created considerable anxiety among account holders who face financial uncertainty.

Watch clip answer (00:05m)