Financial Markets

Financial markets play a pivotal role in the global economy, serving as platforms where buyers and sellers can trade financial assets, including stocks, bonds, currencies, and derivatives. These markets facilitate essential transactions between capital providers such as investors and savers, and capital seekers like corporations and governments. The dynamics of financial markets influence investment strategies and stock market analysis, making understanding their mechanics vital for both individual and institutional investors. Recent trends indicate that as the global economy continues to evolve, the significance of online trading platforms has surged, with a keen focus on identifying the best trading platforms to optimize trading strategies. In recent assessments, financial markets have demonstrated resilience amidst challenges such as inflationary pressures and geopolitical uncertainties. A cautious yet optimistic environment has emerged, especially in mergers and acquisitions (M&A) and initial public offerings (IPOs), signaling potential opportunities for growth. With demand for investment-grade private credit and asset-backed finance on the rise, along with notable activity in equity markets, understanding the state of financial markets involves navigating a complex landscape of opportunities and risks. Key players in these markets are increasingly leveraging technology and integrating artificial intelligence into their operations, ensuring that they remain competitive in a rapidly changing financial landscape. Overall, the mechanisms of trading platforms and profound effects of market fluctuations continuously shape investment strategies and opportunities within financial markets.

What is the expected trading range for the Indian stock market according to analysts, and what factors will determine future market movements?

Analysts predict that the Indian markets may continue to trade sideways within a range of 22,800 to 23,100. A decisive breakout on either side will determine the next major move - a break below 22,800 could trigger further correction, while movement past 23,000 might signal renewed bullish momentum. Despite potential upside potential, the overall investor sentiment remains cautious, with market participants closely monitoring global market trends and upcoming economic events. This sideways trading pattern reflects the current uncertain environment where investors are waiting for clear directional signals before making significant moves.

Watch clip answer (00:31m)How is geopolitical uncertainty affecting European stock markets?

European stocks are opening lower as geopolitical uncertainty continues to influence market performance. While the broader market experiences a downturn, defense stocks are bucking the trend by leading gains due to increased allocations for military spending across the region. This divergent performance highlights how specific sectors can benefit from geopolitical tensions even as the overall market sentiment remains cautious. The increased military spending appears to be a direct response to ongoing global conflicts and security concerns, creating investment opportunities in defense-related companies despite broader market challenges.

Watch clip answer (00:09m)What was the performance of the Indian stock markets in the recent trading session?

The Indian stock markets experienced another volatile trading session recently. While the Nifty and Sensex indices managed to bounce back from the day's lows, they ultimately failed to close higher, reflecting the continued instability in the market. Sector-wise, technology stocks emerged as the leaders, posting gains during the session. In contrast, pharmaceutical stocks headed in the opposite direction, leading the declines. This sectoral divergence highlights the selective nature of the current market momentum.

Watch clip answer (00:14m)What is OPEC's current plan regarding oil supply despite market speculation?

OPEC is firmly maintaining its plan to increase oil supply starting in April 2023, despite growing speculation about possible delays to this scheduled increase. Russian Deputy Prime Minister Alexander Novak has explicitly dismissed reports suggesting any reconsideration of this plan. Industry insiders remain optimistic about market conditions, suggesting that global oil markets have the capacity to absorb this additional supply without significant disruption. This steadfast approach indicates OPEC's confidence in current market dynamics and its strategic direction for global oil supply management.

Watch clip answer (00:16m)What happened with President Javier Milei's promotion of the Libra virtual coin?

President Javier Milei promoted the virtual Libra coin on social media platform X last Friday, claiming it would encourage economic growth by funding small businesses and startups. Following his endorsement, the price of Libra skyrocketed almost immediately. However, the situation quickly deteriorated when the coin's value began to drop. In response, Milei deleted his original post, but this action couldn't prevent the cryptocurrency from ultimately crashing. The incident has led to significant financial losses for investors and sparked accusations of fraud, with the president now potentially facing impeachment proceedings.

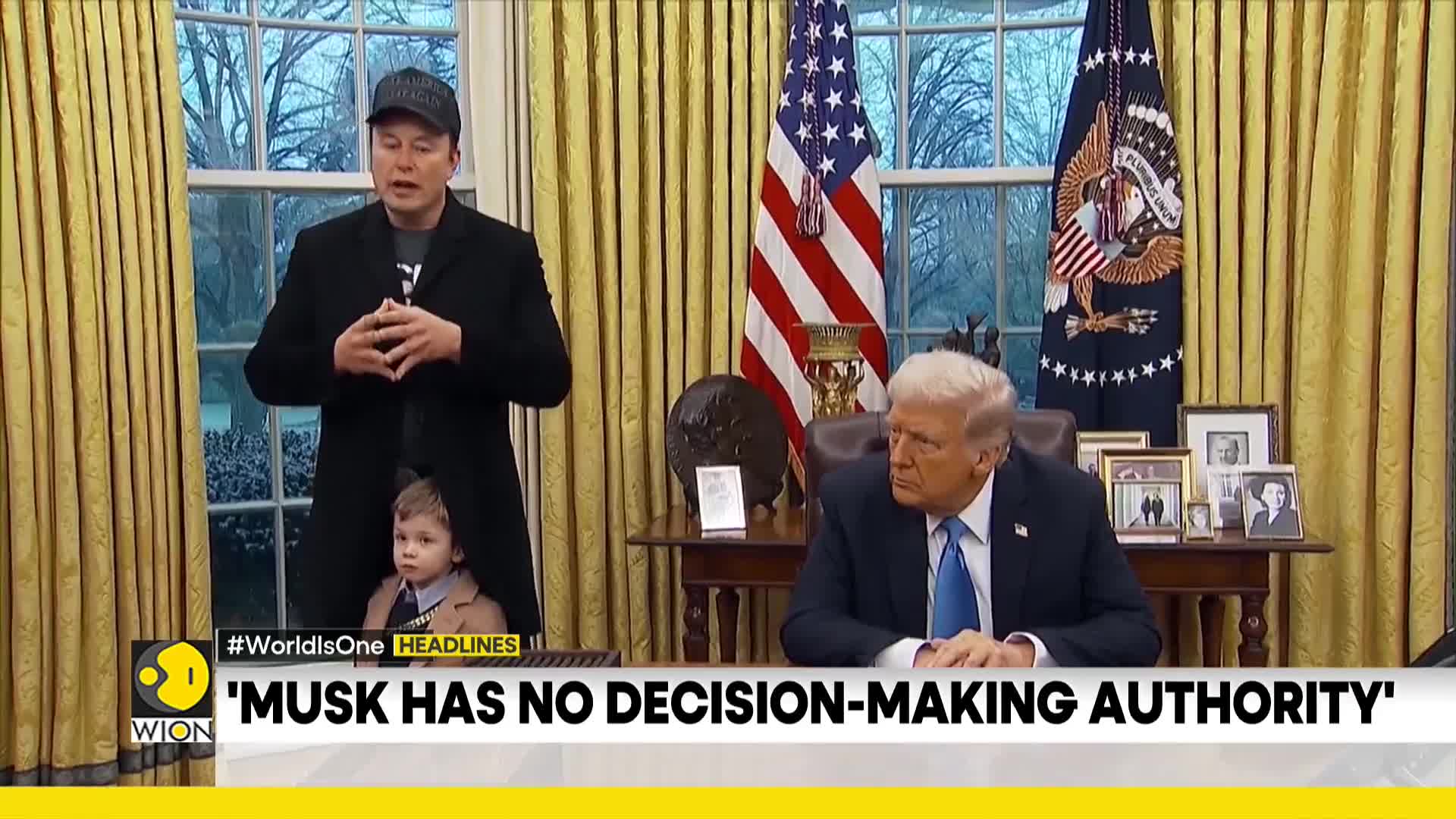

Watch clip answer (00:21m)How did the Indian stock market react following the meeting between Elon Musk and Prime Minister Narendra Modi?

Despite the potentially positive meeting between Elon Musk and Indian Prime Minister Narendra Modi during Modi's US visit, the Indian stock market started on a negative note. The Sensex dropped over 100 points and the Nifty fell nearly 0.2% on Tuesday. The overall sentiment in the market remains negative, influenced by corporate earnings reports and sustained foreign outflows. This indicates that while high-profile diplomatic and business engagements might create optimism, other fundamental factors continue to weigh heavily on India's financial markets.

Watch clip answer (00:34m)