Financial Forecasting

What is the real power of pipeline management for business growth?

The real power of pipeline management comes from tracking deals in a CRM and understanding conversion metrics between sales stages. It enables founders to forecast accurately by analyzing win rates, establishing proper pipeline coverage (3-5x the target goal), and identifying optimization opportunities. Through regular pipeline reviews, teams can assess whether they have sufficient deals to meet targets and make data-driven decisions about marketing and sales strategies. This visibility helps businesses predict outcomes, adjust tactics when needed, and transform their sales methodology into a revenue-generating machine.

Watch clip answer (06:00m)What are the different types of revenue streams and why are they important for businesses?

Revenue streams represent the various ways businesses generate income, categorized as operating revenues (from core business activities like Coca-Cola selling drinks) and non-operating revenues (from side activities like interest, rent, and dividends). These streams follow different models: transaction-based (one-time payments), service (time-based billing), project (large one-time tasks), and recurring revenue (subscription or licensing fees). Understanding these revenue streams is crucial for financial analysts as they significantly impact business evaluation and forecasting. Each type has unique implications for cash flow predictability—recurring revenues provide consistent income, while transaction-based and project revenues fluctuate with demand. This knowledge helps analysts accurately evaluate business sustainability and develop appropriate forecasting models for different revenue types.

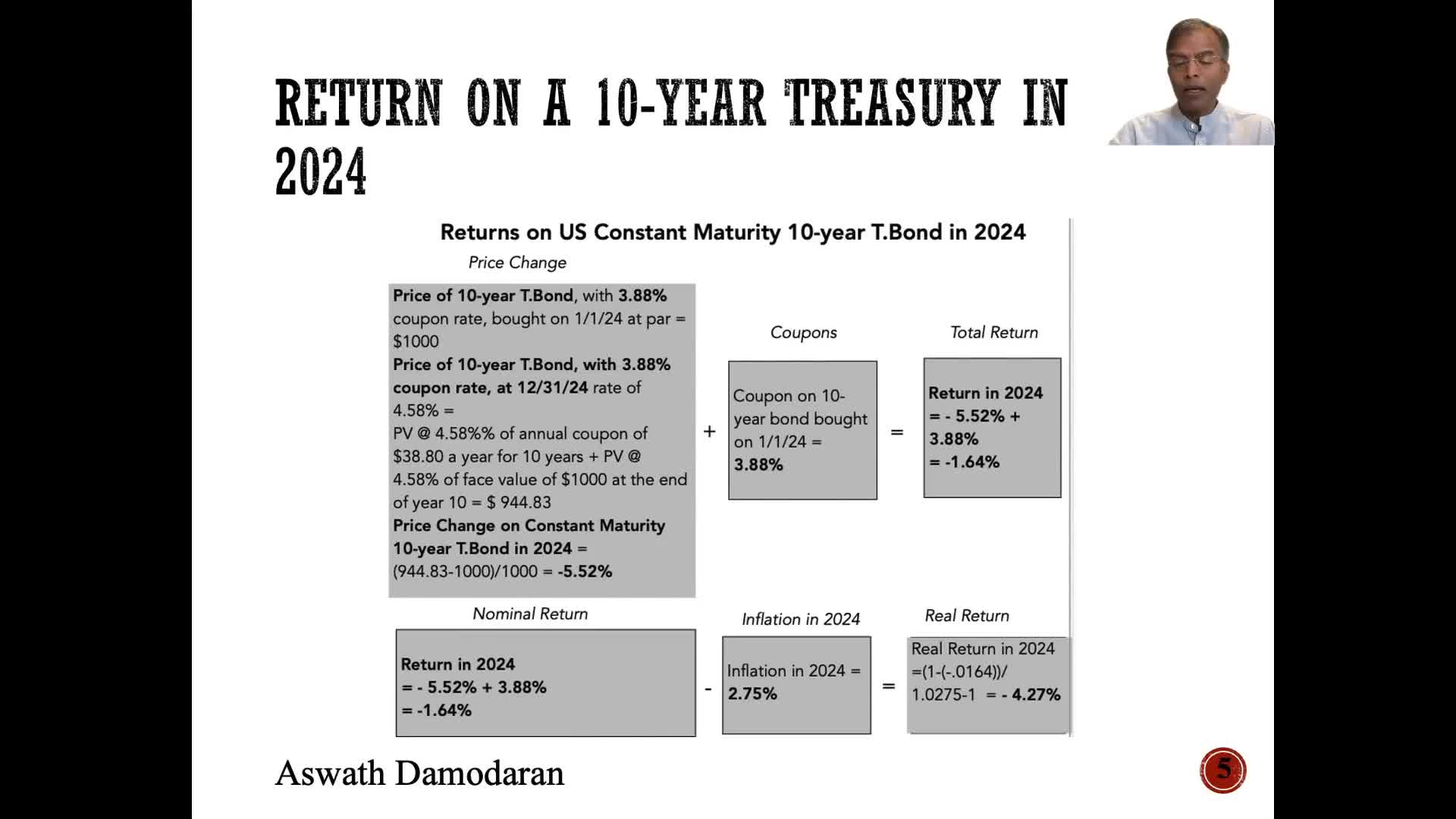

Watch clip answer (04:18m)What is the intrinsic risk-free rate and how does it explain interest rate movements?

The intrinsic risk-free rate provides a valuable framework for understanding why interest rates move over time. It represents the fundamental economic factors driving rates, distinct from the actual T-bond rate that fluctuated significantly in recent years. The difference between the intrinsic risk-free rate and actual T-bond rates was particularly notable when inflation spiked to 7-8% in 2022. Coming into 2025, this difference has narrowed to its lowest point in four years, reflecting changing economic fundamentals. These underlying economic factors, including inflation and real growth, are the primary drivers that determine interest rate movements across treasury and corporate bond markets.

Watch clip answer (00:24m)What are the essential components of a winning investor pitch deck?

A winning investor pitch deck includes several critical components: a financial model with projections, clear valuation details, and the specific amount to be raised. The deck should be 15-25 slides and can be created using established templates that successful founders have used to raise millions worldwide. Beyond the deck itself, effective fundraising requires thorough preparation, typically taking 1-2 months, and a targeted list of investors whose investment thesis aligns with your business. This means focusing on investors who match your geographic location, industry segment, and current financing cycle (seed or Series A).

Watch clip answer (01:14m)What is the USDA's prediction about egg prices for the end of this year?

According to CBS News MoneyWatch correspondent Kelly O'Grady, the USDA predicts a 20% increase in egg prices by the end of this year. This concerning forecast continues the trend of significant inflation affecting grocery costs, particularly for this essential food item. Egg prices have already experienced historic inflation, reaching an average of $4.95 per dozen in 2023. The anticipated price hike is expected to impact consumer buying habits and potentially affect prices of other proteins as shoppers adjust their purchasing decisions in response to rising costs.

Watch clip answer (00:05m)What is the projected outlook for China's property market in the coming years?

China's property market faces significant challenges ahead, with Barclays projecting property sales to decline another 10% in 2025, following a steep 13% drop in 2024. The Chinese stock market has already underperformed for an extended period, providing little relief to investors in this sector. In a worst-case scenario, analysts suggest the property crisis could potentially extend until 2030, indicating a prolonged period of market adjustment. This persistent downturn reflects deeper structural issues in China's real estate sector, with implications for both domestic and international investors.

Watch clip answer (00:20m)