Financial Compliance

Financial compliance refers to the adherence of financial institutions to relevant laws, regulations, and standards that govern their operations and practices. This crucial aspect of the financial sector encompasses a broad range of activities, including anti-money laundering (AML) measures, Know Your Customer (KYC) regulations, data protection protocols, and compliance with reporting and auditing requirements. As regulatory landscapes evolve, the importance of comprehensive compliance management cannot be overstated, especially given recent trends such as the increasing complexity of regulations driven by technological advancements and changing political climates. In a world where transparency, ethical operations, and stakeholder trust are paramount, financial compliance plays a vital role in safeguarding the integrity of financial markets. Institutions must navigate a complex web of regulations from entities like the Securities and Exchange Commission (SEC) and the Consumer Financial Protection Bureau (CFPB), which seek to protect consumers and ensure ethical conduct across the industry. With the financial sector recently facing over $2.7 billion in regulatory fines, the implications of non-compliance can be severe, leading to legal actions, reputational damage, and financial losses. Recent developments highlight the necessity for robust compliance strategies, as financial institutions adopt advanced technologies, such as artificial intelligence (AI), to enhance their compliance processes and analytics capabilities. These innovative tools not only assist in real-time risk detection and management but also streamline the monitoring of evolving regulatory requirements. As the landscape becomes increasingly intricate, it is imperative for organizations to maintain effective compliance frameworks, integrate environmental, social, and governance (ESG) considerations, and proactively engage in compliance management to mitigate risks and ensure sustainable growth.

How much money is the federal government losing to fraud annually?

According to government accounting estimates cited in the clip, the U.S. federal government could be losing between $233 billion and $521 billion annually to fraud. These alarming figures come from an official government accounting organization that tracks financial mismanagement within federal programs. This massive scale of fraudulent spending significantly impacts U.S. taxpayers and contributes to the growing $2 trillion deficit, highlighting critical concerns about transparency and accountability in government spending.

Watch clip answer (00:17m)What is the Amazon VAT evasion investigation in Italy about?

Italian prosecutors are investigating Amazon for allegedly evading €1.2 billion in value-added tax (VAT) from third-party sellers between 2019 and 2021. This investigation stems from a significant legal change that occurred in 2019, which made e-commerce platforms directly responsible for collecting and remitting VAT on sales made by non-EU sellers on their platforms. The case represents a major tax compliance issue for online marketplaces operating in the European Union, as it indicates authorities are holding platforms accountable for ensuring proper tax collection even from international third-party merchants using their services.

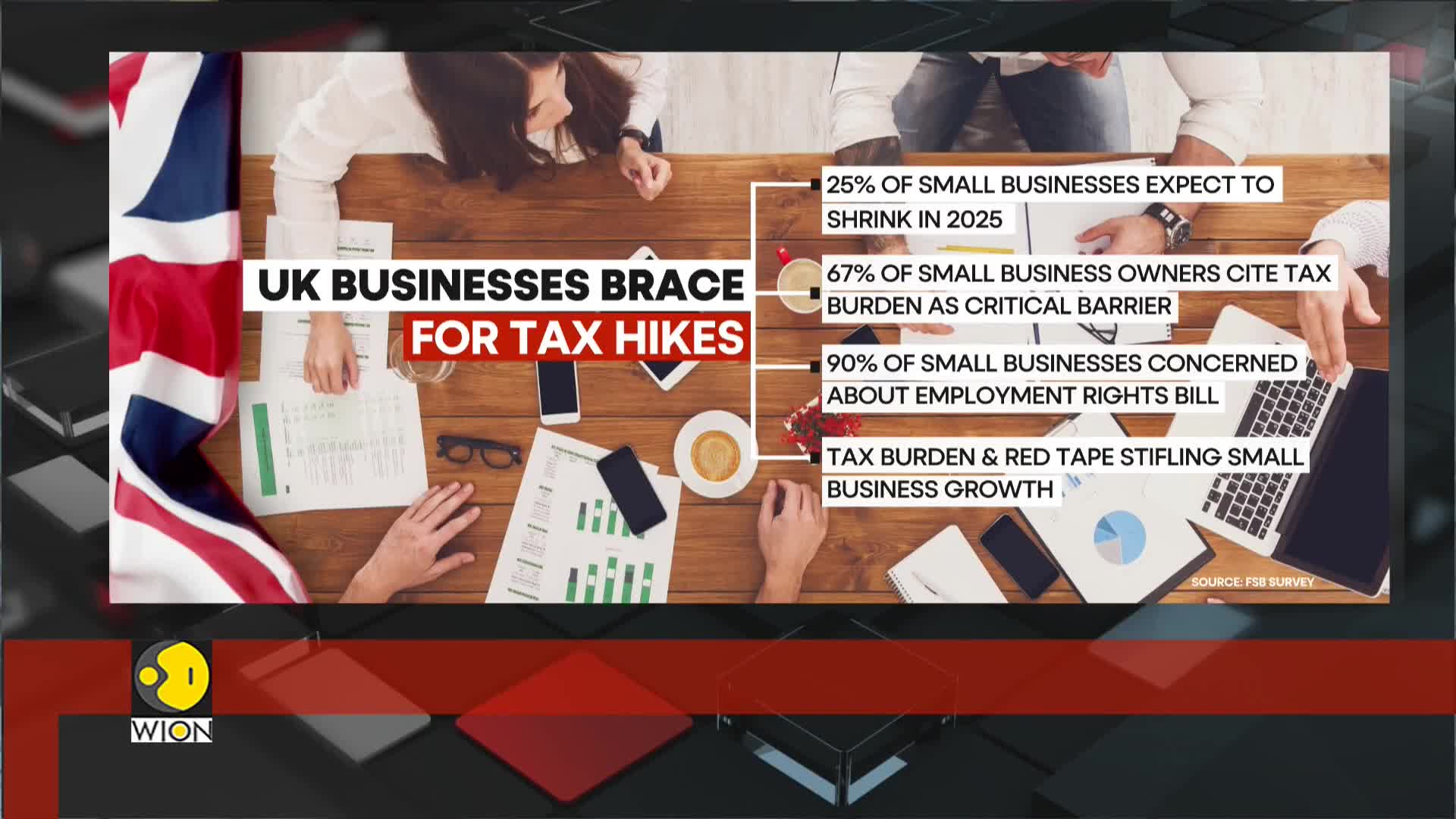

Watch clip answer (00:18m)How are tax burdens affecting UK businesses in the current economic climate?

UK businesses, particularly small ones, are struggling with significant tax compliance costs that amount to an estimated £25 billion annually. Despite treasury promises, business leaders remain skeptical due to rising costs and increasing regulatory pressures. As the private sector faces these financial burdens, many companies are implementing hiring freezes and delaying investments. This economic pressure is occurring while government spending continues to drive minimal growth, making the path to economic recovery uncertain for many businesses in the final quarter of 2025.

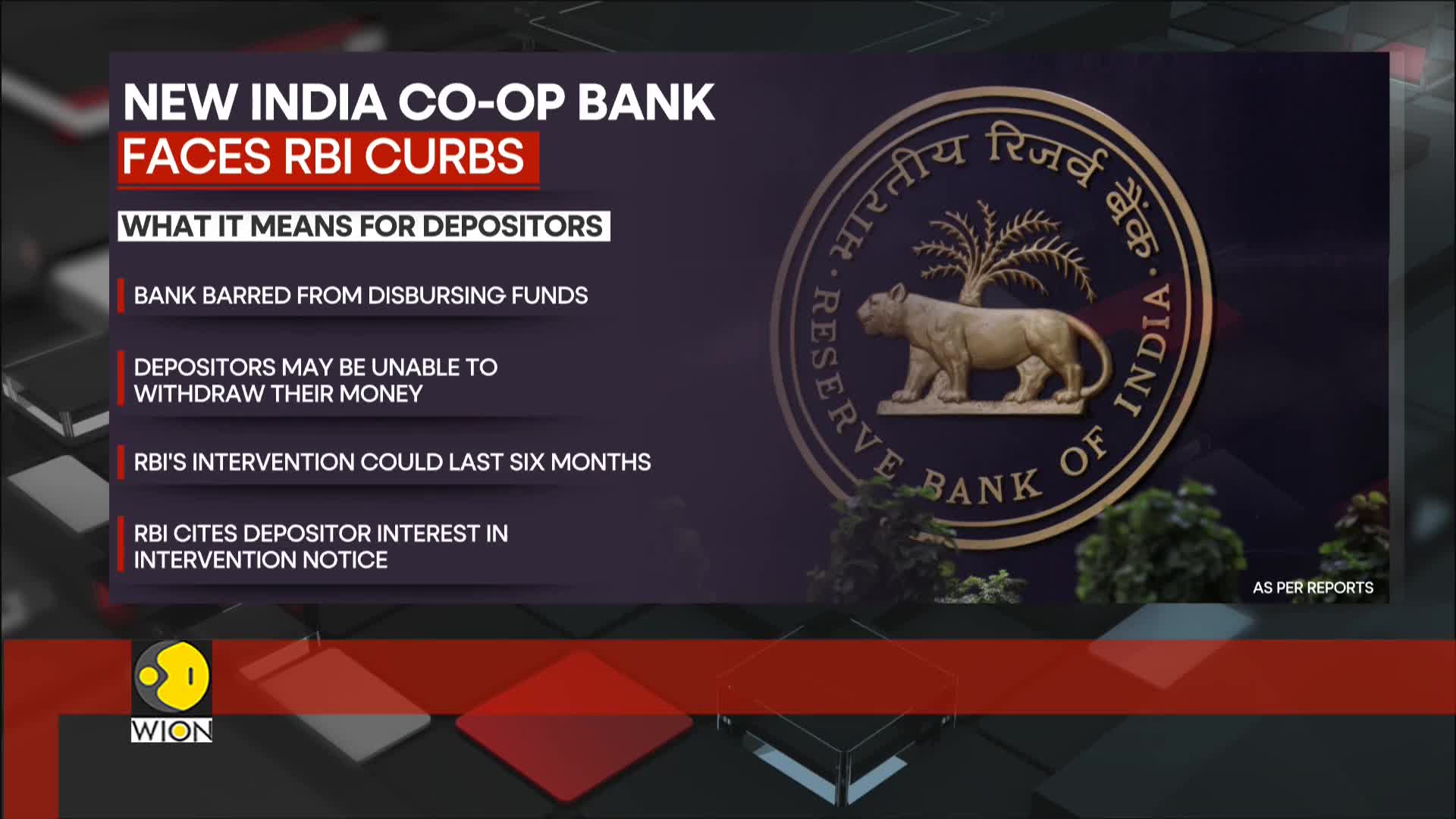

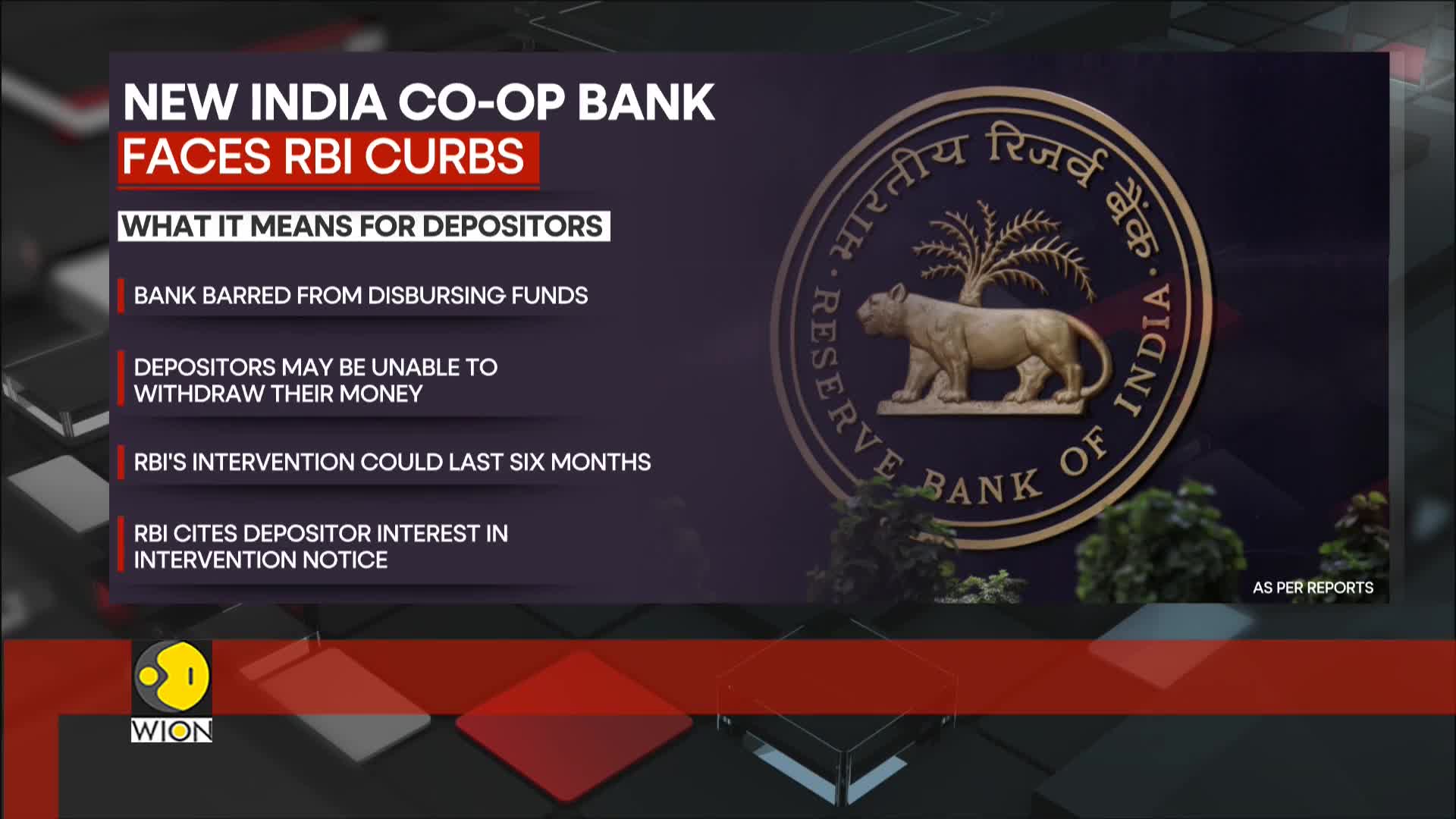

Watch clip answer (00:34m)What restrictions has the Reserve Bank of India imposed on the New India Cooperative Bank and how are depositors affected?

The Reserve Bank of India has imposed strict restrictions on the Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside bank branches as worried customers seek access to their savings. This regulatory action highlights the fragility of smaller financial institutions in emerging markets like India. The situation underscores the challenges faced by depositors when banking institutions face liquidity issues, leaving them in financial limbo until the restrictions are lifted or alternative arrangements are made.

Watch clip answer (00:36m)What restrictions has the Reserve Bank of India imposed on New India Cooperative Bank and why?

The Reserve Bank of India has imposed strict restrictions on Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside the bank branches. This intervention by India's central bank highlights the fragility of smaller financial institutions in emerging markets like India. The situation has created significant turbulence in India's banking sector as customers find themselves cut off from accessing their savings, demonstrating the vulnerabilities that exist within the country's cooperative banking system.

Watch clip answer (00:36m)How did Marco Rubio respond to criticism about his controversial campaign spending, particularly the $134 haircut charged to his GOP credit card?

Marco Rubio addressed the controversy surrounding his $100,000+ in party fund spending with humor and deflection. When confronted about the infamous $134 haircut charged to his GOP credit card, Rubio used self-deprecating wit to dismiss the criticism, joking that "spending money on a haircut is not a crime" and that "the only crime is looking this good." This response demonstrates how politicians often use humor as a strategic tool to navigate potentially damaging financial controversies and redirect public attention away from serious questions about campaign finance ethics.

Watch clip answer (00:14m)