Financial Compliance

Financial compliance refers to the adherence of financial institutions to relevant laws, regulations, and standards that govern their operations and practices. This crucial aspect of the financial sector encompasses a broad range of activities, including anti-money laundering (AML) measures, Know Your Customer (KYC) regulations, data protection protocols, and compliance with reporting and auditing requirements. As regulatory landscapes evolve, the importance of comprehensive compliance management cannot be overstated, especially given recent trends such as the increasing complexity of regulations driven by technological advancements and changing political climates. In a world where transparency, ethical operations, and stakeholder trust are paramount, financial compliance plays a vital role in safeguarding the integrity of financial markets. Institutions must navigate a complex web of regulations from entities like the Securities and Exchange Commission (SEC) and the Consumer Financial Protection Bureau (CFPB), which seek to protect consumers and ensure ethical conduct across the industry. With the financial sector recently facing over $2.7 billion in regulatory fines, the implications of non-compliance can be severe, leading to legal actions, reputational damage, and financial losses. Recent developments highlight the necessity for robust compliance strategies, as financial institutions adopt advanced technologies, such as artificial intelligence (AI), to enhance their compliance processes and analytics capabilities. These innovative tools not only assist in real-time risk detection and management but also streamline the monitoring of evolving regulatory requirements. As the landscape becomes increasingly intricate, it is imperative for organizations to maintain effective compliance frameworks, integrate environmental, social, and governance (ESG) considerations, and proactively engage in compliance management to mitigate risks and ensure sustainable growth.

What is President Trump's view on the Internal Revenue Service and its oversight capabilities?

President Trump expresses strong confidence in the IRS, describing them as doing "a hell of a job" and calling them a "force of super geniuses." He indicates that the IRS will be subject to scrutiny like other government entities, suggesting comprehensive oversight across all sectors. Trump portrays the IRS as highly effective in their operations, noting that when they engage with people about certain deals, those individuals become "tongue tied," implying the agency's intimidating competence and thoroughness in their investigative work.

Watch clip answer (00:20m)What went wrong with the Biden administration's $160 million funding to a Canadian electric vehicle bus manufacturer, and what were the consequences for school districts?

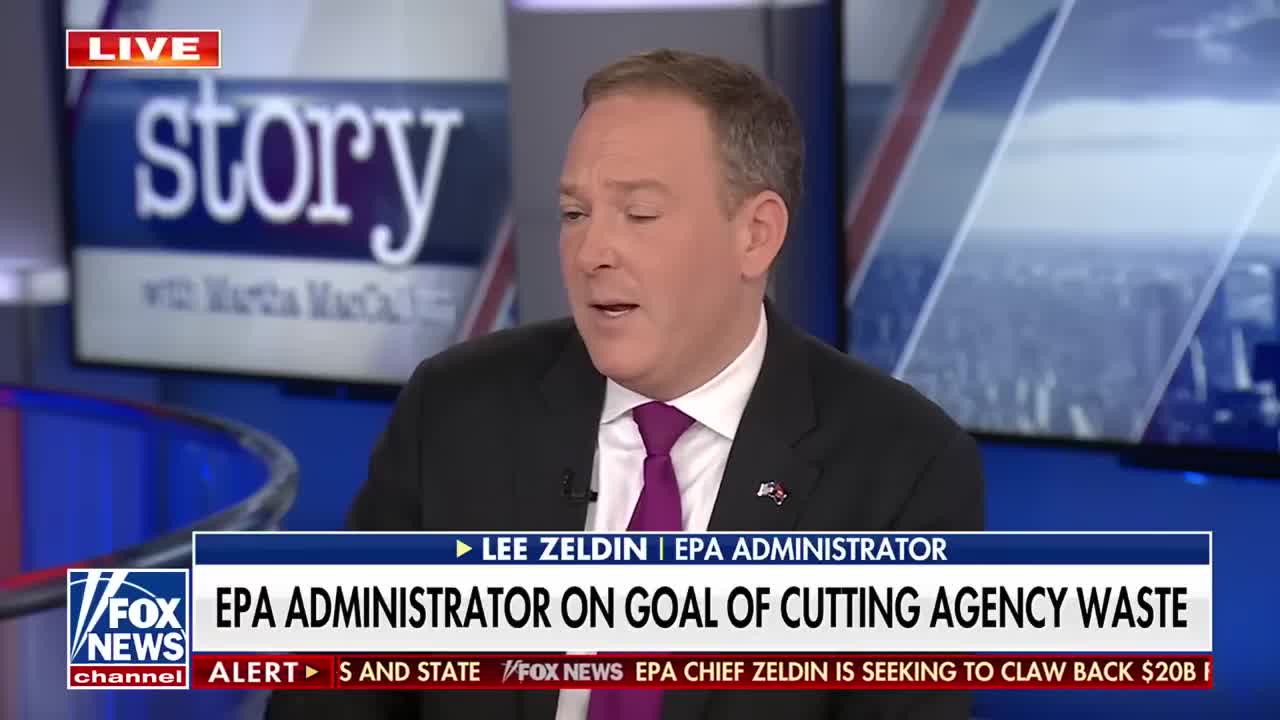

The Biden administration made a critical error by providing the entire $160 million upfront to a Canadian electric vehicle bus manufacturer without implementing proper oversight or milestone-based payments. This poor financial management led to catastrophic results when the manufacturer declared bankruptcy, leaving 55 school districts without $95 million worth of promised electric school buses. EPA Administrator Lee Zeldin highlights this as a prime example of failed federal funding practices that lack accountability and proper safeguards to protect taxpayer money.

Watch clip answer (00:24m)What are the major oversight and accountability concerns that EPA Administrator Lee Zeldin has identified regarding the distribution of taxpayer funds at the Environmental Protection Agency?

EPA Administrator Lee Zeldin has raised serious concerns about the hasty distribution of $20 billion in taxpayer funds to eight private entities with minimal oversight. The administrator revealed that some entities were specifically created just to receive this funding, raising questions about accountability and proper vetting processes. Additionally, Zeldin has taken corrective action by canceling controversial grants, including a $50 million allocation to a climate advocacy group, and highlighted risks from mismanaged funds, particularly citing issues with a Canadian electric bus manufacturer's bankruptcy that could impact taxpayer investments.

Watch clip answer (00:17m)What did EPA Administrator Lee Zeldin discover regarding mismanaged funds from the previous administration?

EPA Administrator Lee Zeldin revealed the discovery of $20 billion in mismanaged funds that were hastily allocated by the Biden administration before Inauguration Day. This came after concerns were raised about a video showing a Biden EPA political appointee discussing rushing billions of dollars "out the door" before the transition, metaphorically described as "tossing gold bars off the Titanic." During his confirmation process, Congress asked Zeldin to prioritize investigating these rushed allocations, which he successfully located after being confirmed, demonstrating his commitment to accountability and transparency in environmental funding.

Watch clip answer (00:29m)What are the contradictions between the Trump administration's claims of fighting fraud and corruption versus their actual policy actions?

The fundamental contradiction lies in the disconnect between rhetoric and action. While claiming to combat fraud and corruption, the Trump administration systematically dismantled the very institutions designed to prevent these issues. This includes firing inspectors general who save taxpayers $70 billion annually in waste prevention, gutting ethics offices, weakening the FBI and Department of Justice, and closing consumer protection agencies. The real agenda appears to be wealth transfer from working-class Americans to billionaires rather than genuine anti-corruption efforts. When someone with fraud convictions leads anti-fraud initiatives, it creates an inherent conflict of interest that undermines credibility and effectiveness.

Watch clip answer (00:52m)What challenges will investigators face when uncovering the full extent of government fraud and systemic corruption?

According to the discussion, uncovering government fraud will be an extensive, multi-year process that's only just beginning. The investigation is compared to "Iran Contra on steroids," suggesting the scale will be unprecedented. Currently, investigators haven't even examined major areas like Medicaid and other medical programs, where experts believe the largest concentrations of fraudulent activity exist. The challenge lies in managing justifiable public anger while maintaining appropriate boundaries during this massive overhaul. As more corruption is revealed, there's a risk that legitimate outrage could lead to overcorrection or hasty decisions. The sheer magnitude of undiscovered fraud across various government programs means this investigation will require sustained effort and careful navigation to properly address systemic issues without causing unintended consequences.

Watch clip answer (00:41m)