Financial Compliance

Financial compliance refers to the adherence of financial institutions to relevant laws, regulations, and standards that govern their operations and practices. This crucial aspect of the financial sector encompasses a broad range of activities, including anti-money laundering (AML) measures, Know Your Customer (KYC) regulations, data protection protocols, and compliance with reporting and auditing requirements. As regulatory landscapes evolve, the importance of comprehensive compliance management cannot be overstated, especially given recent trends such as the increasing complexity of regulations driven by technological advancements and changing political climates. In a world where transparency, ethical operations, and stakeholder trust are paramount, financial compliance plays a vital role in safeguarding the integrity of financial markets. Institutions must navigate a complex web of regulations from entities like the Securities and Exchange Commission (SEC) and the Consumer Financial Protection Bureau (CFPB), which seek to protect consumers and ensure ethical conduct across the industry. With the financial sector recently facing over $2.7 billion in regulatory fines, the implications of non-compliance can be severe, leading to legal actions, reputational damage, and financial losses. Recent developments highlight the necessity for robust compliance strategies, as financial institutions adopt advanced technologies, such as artificial intelligence (AI), to enhance their compliance processes and analytics capabilities. These innovative tools not only assist in real-time risk detection and management but also streamline the monitoring of evolving regulatory requirements. As the landscape becomes increasingly intricate, it is imperative for organizations to maintain effective compliance frameworks, integrate environmental, social, and governance (ESG) considerations, and proactively engage in compliance management to mitigate risks and ensure sustainable growth.

How effective are nonpartisan civil servants in protecting government funds and sensitive information?

According to Ben Shapiro, nonpartisan civil servants have failed in their responsibility to protect public funds and sensitive information. He points to billions of dollars from USAID being channeled to Hamas for building terror tunnels and cites incidents of data mishandling, including Trump's tax returns being leaked to the New York Times. Shapiro also references Hillary Clinton's private server storing classified information as evidence of systemic failures. He argues that despite claims of impartiality and rigorous ethics standards, the bureaucracy has demonstrated financial misconduct and information security vulnerabilities.

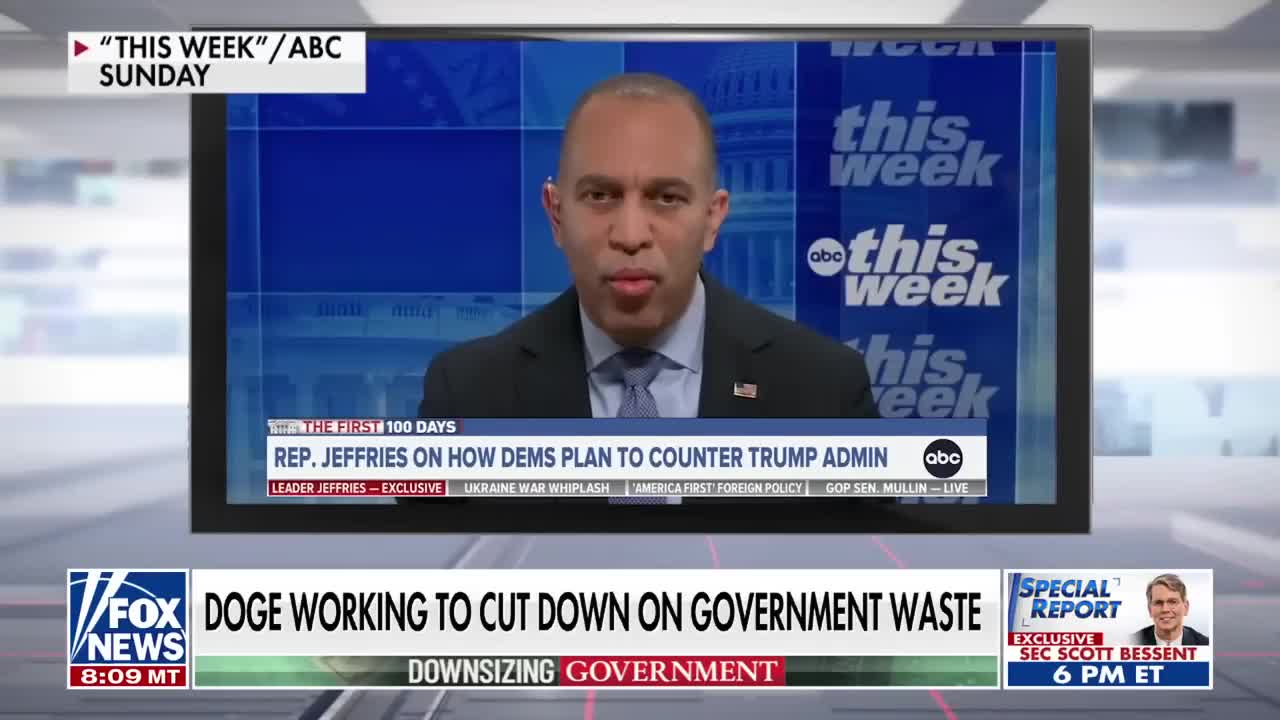

Watch clip answer (01:13m)Why are Elon Musk and Russ Vought trying to dismantle the Consumer Financial Protection Bureau?

According to Elizabeth Warren, Musk and Vought's efforts to eliminate the CFPB represent a payoff to wealthy donors who invested in Trump's campaign. Despite Trump campaigning on helping working people, Warren suggests this move would benefit rich supporters who want to operate without regulatory oversight. If successful, this dismantling would allow CEOs and Wall Street to 'trick, trap and cheat' consumers by removing the agency designed to protect them in financial matters. Warren characterizes this as a scam that prioritizes wealthy interests over consumer protections.

Watch clip answer (00:44m)What were some of Kamala Harris's notable actions as California's Attorney General?

As California's Attorney General, Kamala Harris fought against the death penalty and took on big banks following the 2008 housing crisis, securing $18 billion in relief for California homeowners. She also won a billion dollars for victims of predatory for-profit universities, specifically Corinthian Colleges that took advantage of Californians seeking to achieve the American dream. Perhaps her most nationally recognized moment came when she directed the clerk of Los Angeles to begin issuing marriage licenses to same-sex couples during the contentious debate around Proposition 8, which challenged the legality of gay marriage. These actions demonstrated her commitment to criminal justice reform, consumer protection, and civil rights.

Watch clip answer (00:45m)What new accountability measures has the Treasury Department implemented to improve financial transparency?

The Treasury Department has implemented new tracking systems that require identification on payments, addressing a previous lack of transparency. Before this change, trillions of dollars could be disbursed without names or identifiers. This accountability measure ensures that under the current administration, when money is earmarked by the Treasury, there will be clear tracking of where funds go. The initiative aims to combat potential fraud by bureaucrats who might be funneling money to NGOs or accumulating personal wealth disproportionate to their government salaries. This represents a critical step toward ensuring taxpayer money is properly tracked and spent responsibly.

Watch clip answer (00:51m)What was Elizabeth Annaskevich's experience with the federal workforce layoffs?

Elizabeth Annaskevich, an employee at the Consumer Financial Protection Bureau, experienced an abrupt termination that left her without sufficient information to file for unemployment. She described the situation as being 'tossed out on the streets,' calling it both angering and heartbreaking. The impact was immediate and severe—her pay stopped the same day she received her termination letter. As of Tuesday, she and her colleagues were left without paychecks, creating financial uncertainty. Her emotional testimony highlights the human cost of the sudden federal workforce reductions, leaving affected employees struggling with both practical challenges and emotional distress.

Watch clip answer (00:22m)How much money is the federal government potentially losing to fraud annually?

According to government accounting organizations, the federal government could be losing between $233 billion and $521 billion annually to fraud. This estimate was released by the GAO (Government Accountability Office) last year, before recent investigations by Elon Musk and others. The issue of government fraud is significant and well-documented, with thousands of IRS investigations conducted yearly. Despite some media narratives attempting to downplay the problem, the existence of massive fraud in federal programs is not genuinely debatable.

Watch clip answer (01:50m)