Economic Trends

Economic trends play a crucial role in understanding the dynamic landscape of global finance, shaping everything from market behavior to policy decisions. These trends encompass a variety of economic indicators, including inflation rates forecasts, employment figures, and trade balances, which collectively inform stakeholders about the health of economies worldwide. Recently, there has been a notable trend of slowing growth across major markets, with projections indicating a decline in global GDP growth rates to approximately 2.4-3.2%. Policymakers face the challenge of navigating heightened uncertainties stemming from geopolitical tensions, particularly between the U.S. and China, which further complicate economic forecasting. As businesses and investors seek clarity, market trends analysis becomes essential. Understanding leading economic indicators, such as consumer confidence and inflation rates, allows for more strategic planning and investment. Recent reports highlight critical factors influencing these trends, including the impact of rising protectionism and tariff pressures on international trade dynamics. For instance, tariff increases have raised production costs and disrupted supply chains, leading to increased concerns about potential stagflation—a period characterized by stagnant economic growth combined with inflation. By monitoring these economic indicators and broader trends, analysts and stakeholders can better position themselves to respond to ongoing shifts in the global economy, ensuring they are equipped to adapt and thrive in an increasingly complex environment.

What is driving the surge in European stocks to record highs?

European stocks have surged to lifetime peaks primarily driven by the prospect of increased defense spending related to potential Ukraine peace agreements. The pan-European stocks index has reached record highs, with defense and aerospace sectors experiencing significant growth. These defense stocks have more than doubled in value since Russia's invasion of Ukraine three years ago, creating what analysts are calling a 'supercycle' in defense investments. This market movement demonstrates how geopolitical events can create substantial opportunities in specific market sectors.

Watch clip answer (00:21m)How did the recent drone attack in Kazakhstan affect Brent oil prices?

Brent oil prices initially gained due to restricted flows from Kazakhstan following a drone attack on a Russian oil pipeline pumping station, pushing benchmark crude above $75 per barrel. However, despite these initial gains, prices subsequently ticked downward. The attack on the Caspian pump station disrupted oil transportation, creating temporary market volatility. This price movement illustrates how geopolitical incidents involving energy infrastructure can have immediate but sometimes short-lived impacts on global oil markets.

Watch clip answer (00:13m)What is the predicted future price for gold according to analysts?

According to financial analysts featured on WION News, gold is predicted to reach an unprecedented milestone of $3,000 per ounce in the near future. This would mark the first time ever that the yellow metal has achieved such a high valuation. This bullish prediction comes amid a complex market landscape characterized by muted performance in Asian shares while European stock indices, particularly in the defense sector, have been surging. The anticipated gold price surge appears to be influenced by ongoing geopolitical tensions that are reshaping market dynamics and investor strategies.

Watch clip answer (00:05m)What are investors concerned about in commodity markets?

Investors are demonstrating caution regarding the potential intensification of trade wars and their impact on commodity markets. The financial community appears to be monitoring signs of escalating trade tensions that could disrupt global commodity flows and pricing. This wariness comes amid a mixed market landscape where Asian shares show muted performance while European markets, particularly defense and banking sectors, reach new highs. Meanwhile, key commodities like Brent oil and gold are experiencing notable price fluctuations, reflecting the underlying uncertainty in global trade relations.

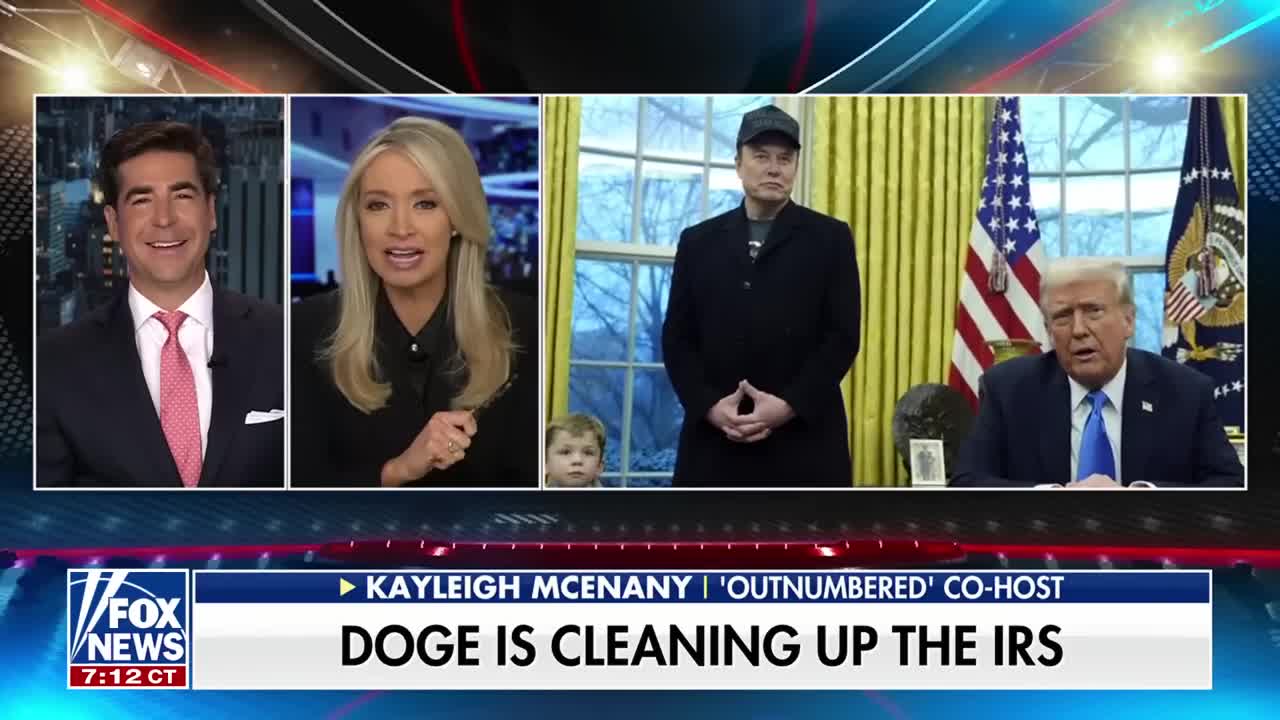

Watch clip answer (00:04m)What is President Trump's current approval rating according to Kayleigh McEnany?

According to Kayleigh McEnany in the Outnumbered segment, President Trump has a 53.3% approval rating. This statistic was mentioned while she was discussing the national debt crisis and contrasting Trump's budgeting approach with current government spending priorities. The high approval rating suggests significant public support for Trump's economic policies and perspectives on government spending during a time of financial challenges facing the nation.

Watch clip answer (00:03m)Why are UK citizens feeling poorer despite overall economic growth, and what challenges does this present for the government's economic mission?

The UK economy is experiencing a troubling disconnect where total GDP grows but GDP per capita actually shrinks. This occurs because population growth is outpacing economic expansion, meaning the economic pie isn't growing fast enough to maintain or improve individual living standards. As Chris Mason explains, real GDP per head showed contraction in recent quarters, making people feel genuinely poorer on average. This presents a significant challenge for the government, whose core mission is economic growth. The stagnation trend has persisted since the financial crisis, creating a long-term pattern that any government would struggle to reverse quickly. While the Chancellor faces pressure to deliver on growth promises, the underlying economic trajectory suggests this won't be easily achieved through short-term policy interventions alone.

Watch clip answer (01:00m)