Economic Policy

Economic policy encompasses the strategies and actions undertaken by governments to influence their nation's economy. It is critical in steering economic growth, controlling inflation, reducing unemployment, and addressing income inequality. Broadly categorized into two main types—**fiscal policy**, which includes government spending and taxation, and **monetary policy**, which focuses on managing the money supply and interest rates—these policies serve as essential tools for economic stabilization and growth. Understanding the mechanisms and implications of these policies is vital, especially in a landscape marked by frequent shifts in global and domestic economic conditions. Recent discussions around economic policy have highlighted concerns over inflation, trade tensions, and the potential for recession, particularly in light of aggressive tariff strategies seen in various countries. These elements underscore a need for careful fiscal management and strategic decision-making to safeguard economic stability. Furthermore, policymakers are increasingly interested in sustainable practices, aimed at bolstering confidence and encouraging investment during periods of uncertainty. With international cooperation becoming vital amidst geopolitical strains, the relevance of sound economic policy frameworks cannot be overstated. As we navigate this complex environment, it remains crucial for both citizens and businesses to understand how economic policies impact their day-to-day lives and long-term prospects.

How might Germany's borrowing policies change after the upcoming federal election?

The upcoming German federal election suggests potential relaxation of tight borrowing restrictions. Frederick Mertz, the Christian Democrat chancellor candidate leading in polls, has shown willingness to move away from debt restrictions, though he emphasizes reducing bureaucracy and spending first before taking on more debt. A likely outcome is a coalition between Mertz's party and either the Social Democrats or Greens, both of whom advocate for increased borrowing. This coalition is viewed as the most market-friendly scenario, giving investors hope that the new government will adopt more flexible fiscal policies to boost Germany's economy.

Watch clip answer (00:31m)What is driving the strong performance of the German stock market ahead of the election?

The German stock market's strong performance is largely driven by investor hopes that the upcoming German administration will secure a strong parliamentary majority capable of implementing economic reforms. The German stock index has outperformed both US and European peers since snap elections were announced, reflecting market optimism about potential economic revival under new leadership. Investors are particularly focused on the possibility of meaningful reforms that could revitalize Germany's economy following the election.

Watch clip answer (00:15m)What is the current situation regarding Germany's upcoming federal election and its potential impact on European stock markets?

Germany's high-stakes federal election is scheduled for Sunday, with European stock markets already pricing in what they consider to be a near-perfect result. This suggests investors have developed specific expectations about the election outcome, potentially one that might ease borrowing restrictions and support economic reforms, as indicated by the DAX index reaching new highs. However, this market confidence could be misplaced. Analysts warn about complacency, referencing previous elections that delivered unexpected results leading to significant market shifts. The outcome holds particular importance amid ongoing global tensions and could substantially influence Europe's economic direction.

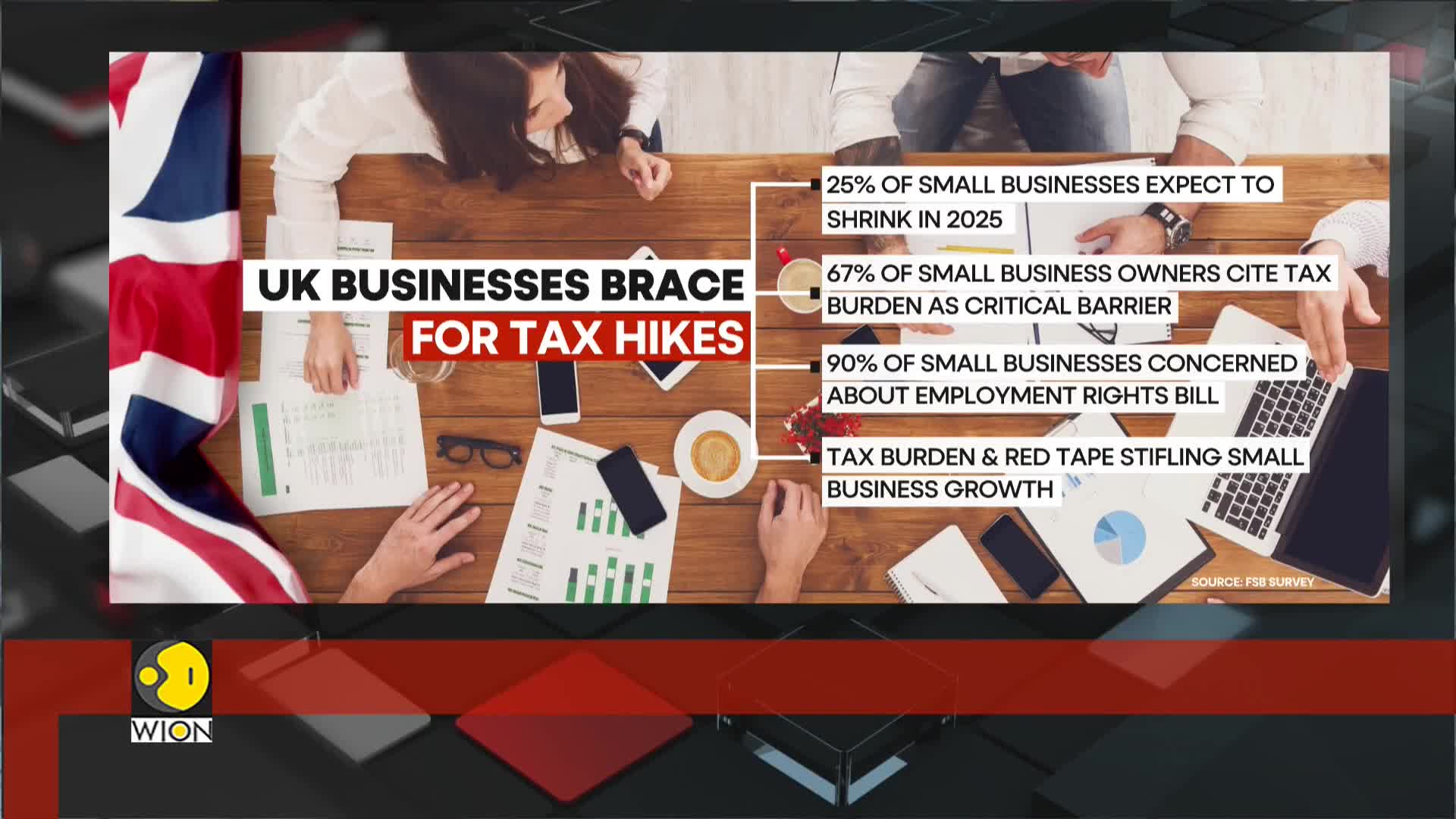

Watch clip answer (00:07m)How is the UK government's tax policy affecting small businesses?

The UK government's 25 billion pound tax is severely impacting small businesses, exacerbating economic stagnation across the country. With one in four companies planning layoffs—the highest rate in a decade—small business confidence has plummeted, with 67% citing tax burdens as a major barrier to growth. This financial pressure is particularly devastating retail and hospitality sectors, which are experiencing lower earnings while facing higher costs. New regulations, including the Employment Rights Bill, are adding further strain to businesses already struggling with rising national insurance rates, creating a perfect storm of economic challenges.

Watch clip answer (00:12m)How are UK businesses responding to the upcoming tax hike?

UK businesses are facing significant challenges due to an upcoming tax hike, with one in four companies planning to lay off staff. This marks the highest proportion of employers considering redundancies in a decade (excluding the pandemic period), according to a survey by the Chartered Institute of Personnel and Development. The rising national insurance rates and lower earnings threshold are particularly impacting retail and hospitality sectors, which are expected to be the hardest hit as they already struggle with higher costs. Employer confidence has fallen to its lowest point in 10 years outside the pandemic, with the tax increase set to take effect in April further undermining business outlook.

Watch clip answer (00:40m)How did the stock market react to Sri Lanka's budget announcement?

The stock market responded positively to Sri Lanka's budget announcement, with a notable 1.43% rise in the CSE All Share Index. This favorable reaction reflects investor confidence in the budget presented by President Anuradh Dasanaike, which is a key element in the nation's post-crisis recovery strategy. The budget projects 5% economic growth for 2025 and includes several important fiscal reforms such as targeted fiscal discipline, reduced budget deficit, and plans to increase tax revenue to 15% of GDP. Additional measures like the liberalization of vehicle imports and a substantial minimum wage increase for state employees are expected to enhance state revenue and reduce poverty, further strengthening economic stability in Sri Lanka.

Watch clip answer (00:12m)