Economic Policy

Economic policy encompasses the strategies and actions undertaken by governments to influence their nation's economy. It is critical in steering economic growth, controlling inflation, reducing unemployment, and addressing income inequality. Broadly categorized into two main types—**fiscal policy**, which includes government spending and taxation, and **monetary policy**, which focuses on managing the money supply and interest rates—these policies serve as essential tools for economic stabilization and growth. Understanding the mechanisms and implications of these policies is vital, especially in a landscape marked by frequent shifts in global and domestic economic conditions. Recent discussions around economic policy have highlighted concerns over inflation, trade tensions, and the potential for recession, particularly in light of aggressive tariff strategies seen in various countries. These elements underscore a need for careful fiscal management and strategic decision-making to safeguard economic stability. Furthermore, policymakers are increasingly interested in sustainable practices, aimed at bolstering confidence and encouraging investment during periods of uncertainty. With international cooperation becoming vital amidst geopolitical strains, the relevance of sound economic policy frameworks cannot be overstated. As we navigate this complex environment, it remains crucial for both citizens and businesses to understand how economic policies impact their day-to-day lives and long-term prospects.

How much money is the federal government losing to fraud annually?

According to James Freeman of the Wall Street Journal, Democrats on the House Oversight Committee have acknowledged that government fraud amounts to more than $200 billion annually. The Government Accountability Office (GAO) estimates put the figure possibly over $500 billion per year. As confirmed in the clip, the federal government could be losing between $233 billion and $521 billion annually to various fraudulent activities. This significant acknowledgment from both political parties indicates a concerning level of financial malfeasance within federal programs that requires greater accountability and oversight.

Watch clip answer (00:45m)How much is the government spending on luxury hotel accommodations for migrants?

According to James Freeman of the Wall Street Journal, the government has uncovered a $59 million expenditure on luxury hotel rooms to house migrants in New York. This represents what Freeman describes as a 'racket,' with these accommodations costing approximately $377 per night per room. This revelation highlights significant concerns about inefficient government spending and raises questions about financial accountability in the management of migration-related expenses.

Watch clip answer (00:14m)Why is Tesla now entering the Indian market after previously holding back?

Tesla previously hesitated to enter India's EV market due to high import duties, which made it difficult to operate profitably. However, recent policy changes have created a more favorable environment for global EV manufacturers. The Indian government has significantly reduced the basic customs duty on high-end EVs priced above $40,000 from 110% to 70%. This substantial reduction in import tariffs makes it economically viable for Tesla to bring its vehicles to the Indian market, despite India's relatively small EV sales volume of just 100,000 electric cars in 2023 compared to China's 11 million.

Watch clip answer (00:33m)How efficient is the Social Security Administration compared to private enterprise?

The Social Security Administration is described as exceptionally efficient, with Lawrence O'Donnell stating that there is no entity in the history of private enterprise that is as efficient as the Social Security Administration with its 58,000 employees. While Donald Trump promised during his presidential campaign not to cut Social Security, Elon Musk made no such promise. According to O'Donnell, Musk's only mission in government is cutting payments, which potentially threatens the efficient operation of this vital program that millions of Americans depend on.

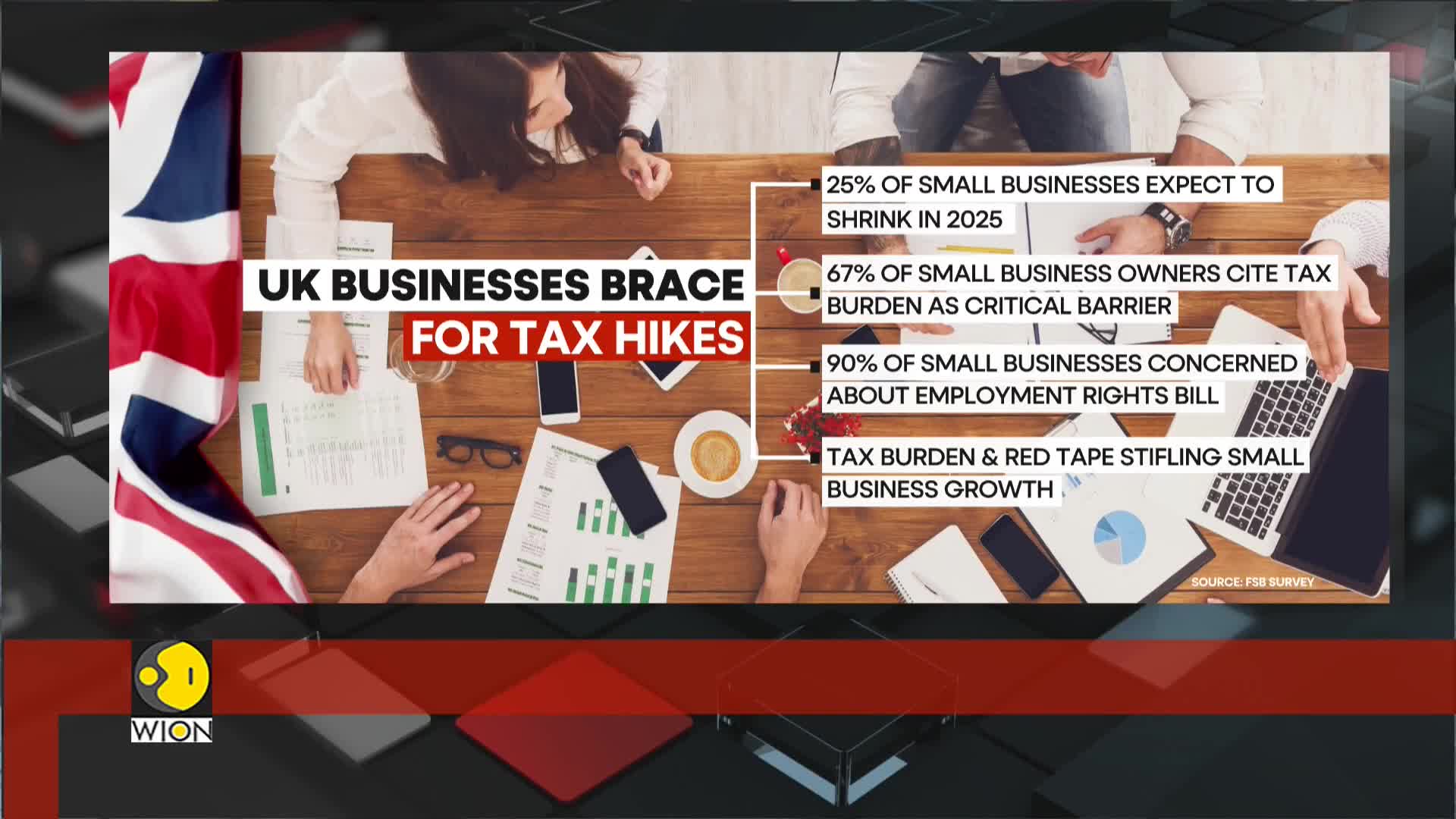

Watch clip answer (00:21m)How are the public and private sectors responding differently to rising tax burdens in the UK?

While the private sector is struggling with the increasing tax burden, the public sector is experiencing a more optimistic outlook. This contrast stems from recent public sector pay rises that have been funded by tax increases, creating a divergent economic reality between the two sectors. Small businesses are particularly vulnerable in this environment, with a Federation of Small Businesses survey revealing a steep decline in confidence among business owners. This highlights the disproportionate impact of the current tax policy, where increased taxation is simultaneously funding public sector improvements while potentially hampering private sector growth and confidence.

Watch clip answer (00:19m)What risks do analysts warn about regarding Germany's federal election impact on markets?

Analysts warn about the dangers of assuming a definite election outcome or underestimating potential market volatility following Germany's federal election. They point to historical precedent, specifically citing last year's European Parliament elections which resulted in unexpected political changes in France and triggered a significant market sell-off. This example highlights the inherent uncertainty in electoral processes and their market implications. With Germany's DAX at record highs, some investors may be overly confident about a market-friendly outcome, but experts caution that coalition dynamics could shift unpredictably, creating risks for those betting on specific electoral results.

Watch clip answer (00:18m)