Deposit Withdrawals

Deposit withdrawals are fundamental banking operations that involve the movement of funds to and from accounts. A **deposit** increases an account's balance by adding money, while a **withdrawal** decreases it by removing funds. These transactions are essential for individuals and businesses, impacting their cash flow management, payment capabilities, and overall financial health. Understanding how deposits and withdrawals work is crucial, as they can involve various methods, including bank transfers, cash deposits at ATMs, and digital transactions through mobile banking applications. In the latest banking landscape, the evolution of technology has introduced new dimensions to deposit and withdrawal processes. Digital innovations such as Distributed Ledger Technology (DLT) and tokenization have significantly enhanced transaction efficiency and security. Recently, regulations have adapted to accommodate these advancements, with shifts in oversight and policies impacting how withdrawal limits and fees are structured. For example, the changes coming into effect in July 2025 regarding funds availability and minimum withdrawal amounts reflect an ongoing effort to modernize and protect consumer access to their funds. The significance of understanding deposit limits, withdrawal fees, and processing times cannot be overstated. Not only do they influence daily banking experiences, but they also reflect broader economic conditions. Consumer knowledge about these aspects can lead to better financial decisions, avoiding potential pitfalls such as fees related to ATM withdrawals and ensuring access to available funds during critical financial needs. By staying informed about the latest trends and regulations in deposit withdrawals, individuals can effectively manage their finances in a rapidly evolving banking environment.

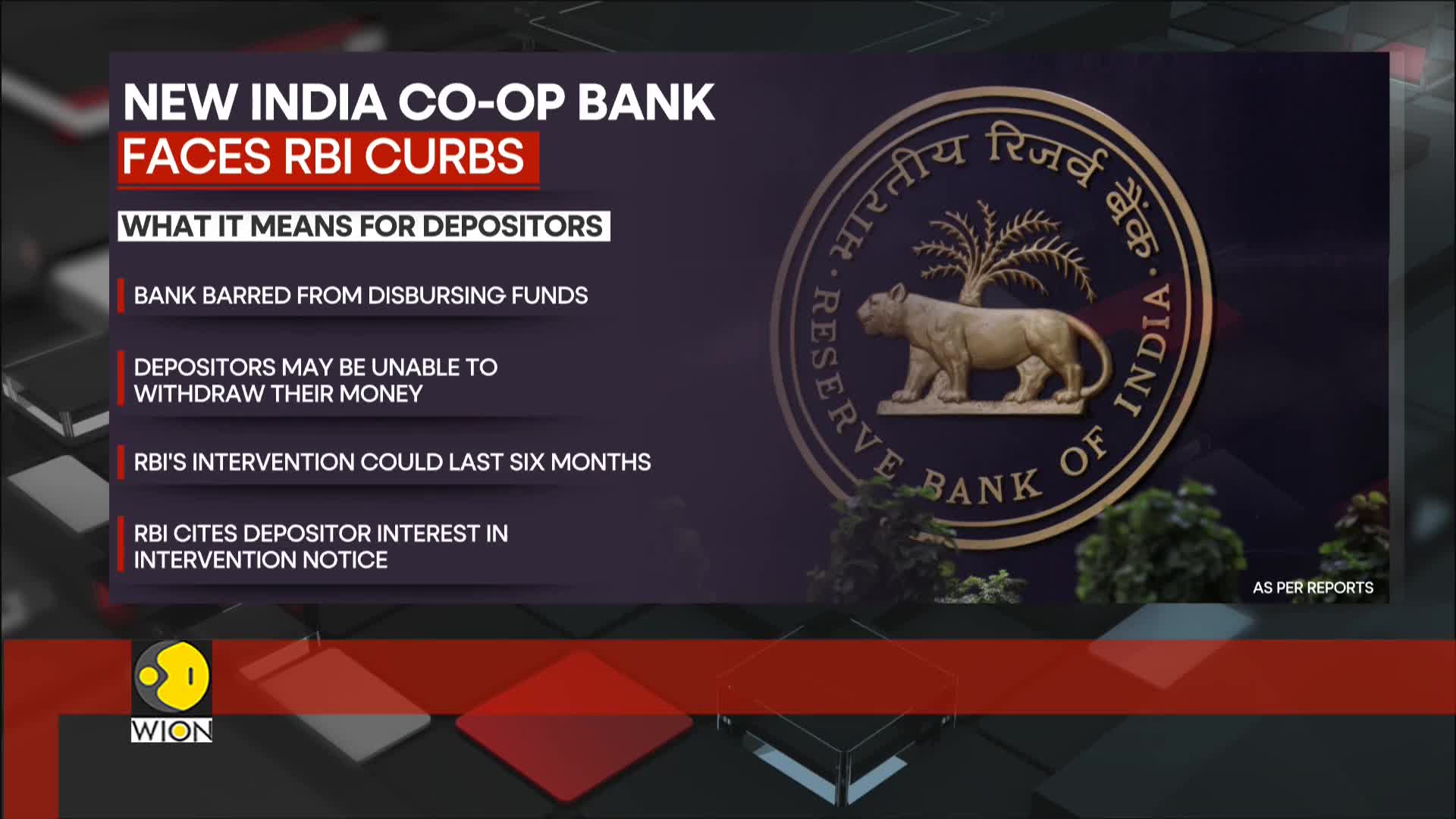

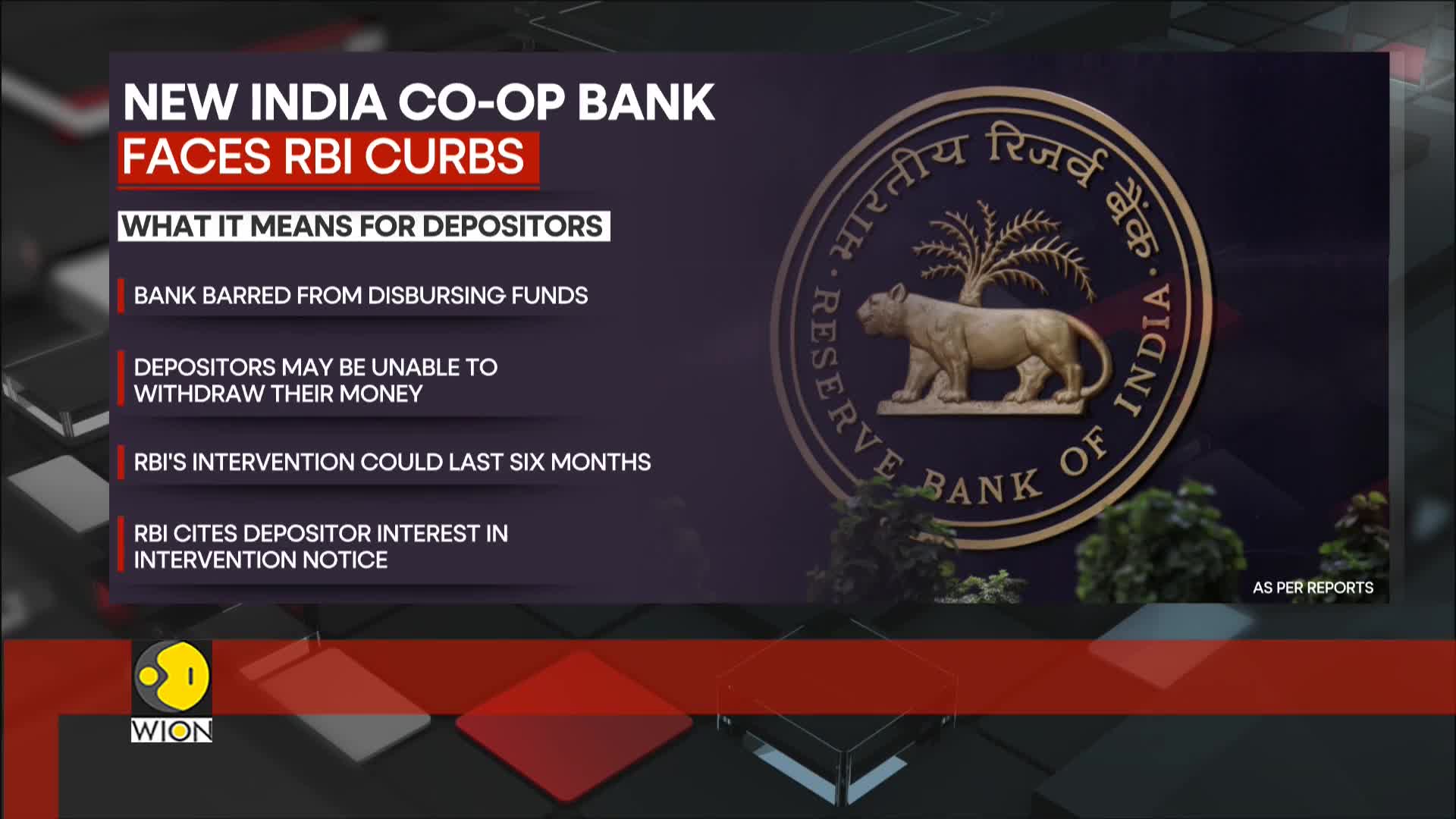

How did customers react to the RBI's restrictions on New India Cooperative Bank?

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

Watch clip answer (00:17m)What challenges are depositors facing due to the RBI restrictions on New India Cooperative Bank?

Depositors are experiencing significant financial distress due to the sudden RBI restrictions on New India Cooperative Bank. Many have expressed frustration over the lack of prior warning from the bank, leaving them unprepared for the fund disbursement limitations imposed for six months. With monthly interest payments and daily expenses to manage, customers face immediate financial hardship as they can't access their savings. The situation is particularly concerning because the bank's financial health has been under substantial pressure, yet depositors weren't adequately informed before the restrictions took effect.

Watch clip answer (00:15m)What restrictions has the RBI imposed on the New India Cooperative Bank?

The RBI has imposed restrictions on the New India Cooperative Bank effective from February 13, which will remain in place for six months pending review. The central bank cited material developments as the reason for this intervention, with the primary aim of protecting depositor interests and ensuring financial stability. During this period, the bank is prevented from disbursing funds, which has caused concern among depositors who have been lining up outside bank branches worried about accessing their savings. This regulatory action highlights the RBI's role in maintaining stability in the cooperative banking sector.

Watch clip answer (00:13m)How are depositors affected by the RBI's restrictions on New India Cooperative Bank?

Depositors are experiencing immediate financial distress due to their inability to access funds following RBI's restrictions on New India Cooperative Bank. With monthly interest payments and daily expenses to manage, many account holders face severe financial hardship as they cannot withdraw their money beyond the imposed limits. The bank's deteriorating financial health, which has been under significant pressure, has directly impacted customers who rely on these funds for their everyday needs. This situation highlights the vulnerability of depositors when regulatory actions are taken against struggling cooperative banks, leaving many in precarious financial circumstances.

Watch clip answer (00:11m)What restrictions has the Reserve Bank of India imposed on New India Cooperative Bank and why?

The Reserve Bank of India has imposed strict restrictions on Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside the bank branches. This intervention by India's central bank highlights the fragility of smaller financial institutions in emerging markets like India. The situation has created significant turbulence in India's banking sector as customers find themselves cut off from accessing their savings, demonstrating the vulnerabilities that exist within the country's cooperative banking system.

Watch clip answer (00:36m)How did customers react to the Reserve Bank of India's restrictions on New India Cooperative Bank?

Following the announcement of RBI restrictions on New India Cooperative Bank, customers immediately rushed to the bank's branches in a state of panic. They were primarily motivated by fears that their savings could be at risk due to the bank's liquidity issues. The restrictions, effective from February 13 for six months, have significantly impacted depositors who are now unable to access their savings. This situation highlights the vulnerability of smaller financial institutions in emerging markets and has created considerable anxiety among account holders who face financial uncertainty.

Watch clip answer (00:05m)