Deposit Withdrawals

Deposit withdrawals are fundamental banking operations that involve the movement of funds to and from accounts. A **deposit** increases an account's balance by adding money, while a **withdrawal** decreases it by removing funds. These transactions are essential for individuals and businesses, impacting their cash flow management, payment capabilities, and overall financial health. Understanding how deposits and withdrawals work is crucial, as they can involve various methods, including bank transfers, cash deposits at ATMs, and digital transactions through mobile banking applications. In the latest banking landscape, the evolution of technology has introduced new dimensions to deposit and withdrawal processes. Digital innovations such as Distributed Ledger Technology (DLT) and tokenization have significantly enhanced transaction efficiency and security. Recently, regulations have adapted to accommodate these advancements, with shifts in oversight and policies impacting how withdrawal limits and fees are structured. For example, the changes coming into effect in July 2025 regarding funds availability and minimum withdrawal amounts reflect an ongoing effort to modernize and protect consumer access to their funds. The significance of understanding deposit limits, withdrawal fees, and processing times cannot be overstated. Not only do they influence daily banking experiences, but they also reflect broader economic conditions. Consumer knowledge about these aspects can lead to better financial decisions, avoiding potential pitfalls such as fees related to ATM withdrawals and ensuring access to available funds during critical financial needs. By staying informed about the latest trends and regulations in deposit withdrawals, individuals can effectively manage their finances in a rapidly evolving banking environment.

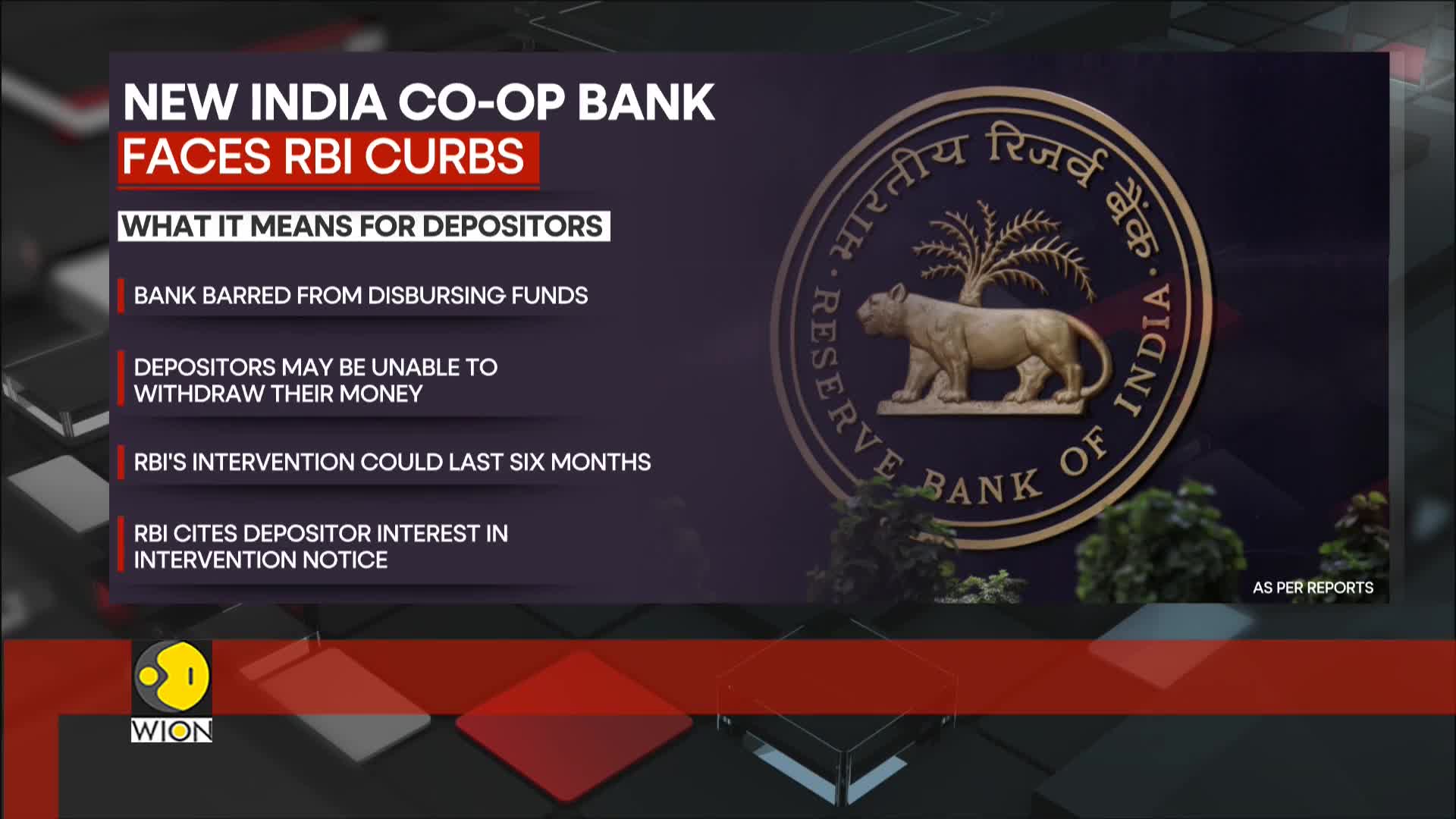

Why did the Reserve Bank of India intervene with New India Cooperative Bank?

The Reserve Bank of India intervened with New India Cooperative Bank citing 'material developments' as the reason for their action. The central bank's primary aims were to protect depositor interests and ensure financial stability amid liquidity concerns at the bank. This intervention was implemented as a protective measure to safeguard customers' savings, though it triggered immediate panic among account holders. Following the announcement, customers rushed to bank branches fearing their savings were at risk, with many expressing frustration over the lack of prior warning about the situation.

Watch clip answer (00:18m)What regulatory action has the Reserve Bank of India taken against New India Cooperative Bank, and how has it affected depositors?

The Reserve Bank of India (RBI) has imposed regulatory curbs on New India Cooperative Bank due to supervisory concerns, creating significant disruption for the institution's operations. This regulatory intervention has directly impacted the bank's branches in Mumbai and Pune, where depositors are now experiencing difficulties accessing their funds. The RBI's supervisory action has triggered a funding panic among customers, as depositors face substantial issues when attempting to withdraw their deposits. This situation reflects broader concerns about the bank's financial stability and regulatory compliance, highlighting the central bank's role in maintaining banking sector integrity through decisive supervisory measures when institutions fail to meet required standards.

Watch clip answer (00:26m)