Consumer Prices

Consumer prices represent the amounts that households pay for a broad range of goods and services, serving as a vital indicator of inflation and the overall cost of living. A key metric for tracking these consumer price changes is the Consumer Price Index (CPI), which compiles data on a fixed basket of goods purchased by urban consumers. With changes in the CPI providing insights into inflationary trends, monitoring consumer prices becomes essential for policymakers, economists, and consumers alike. Recent data shows that inflation has recently reached approximately 2.9%, largely driven by increases in key areas such as food, shelter, and energy costs. Understanding consumer prices is increasingly important in today’s economic climate, where rising inflation has impacted household budgets across the nation. In the latest reports, it was noted that food prices, particularly for essentials like meats and produce, have risen significantly—by 3.2% in the last year. This uptick in prices has raised concerns over affordability and living standards, especially as many households face stagnant wages that do not keep pace with these rising costs. Additionally, external factors such as supply chain disruptions, tariff implications, and shifts in consumer behavior are influencing pricing dynamics, highlighting the necessity for consumers to stay informed about their economic environment. As we navigate these trends, tools like the CPI will continue to play a crucial role in understanding inflation's impact on consumer spending and overall economic stability.

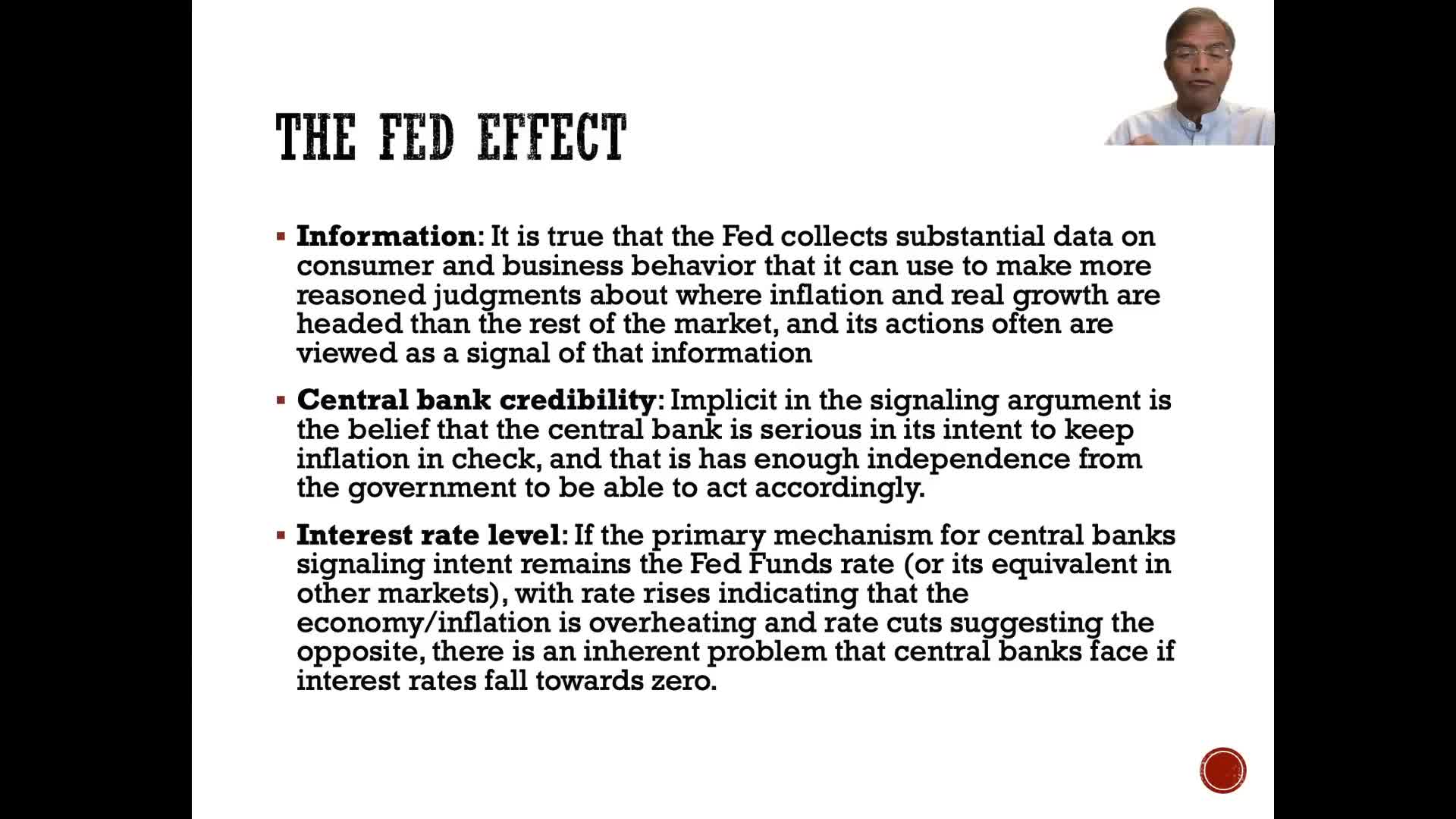

How do changes in interest rates affect company valuations?

Changes in interest rates affect company valuations differently based on underlying economic factors. Higher interest rates driven by inflation generally have neutral effects on companies with pricing power as they can pass inflation through, but negatively impact those without this ability. When interest rates rise due to higher real growth, the effects may be neutral as higher required returns are offset by higher earnings growth. The analyst emphasizes connecting interest rate forecasts to stories about inflation or real growth, rather than focusing solely on Federal Reserve actions, which has become a less useful approach in recent decades.

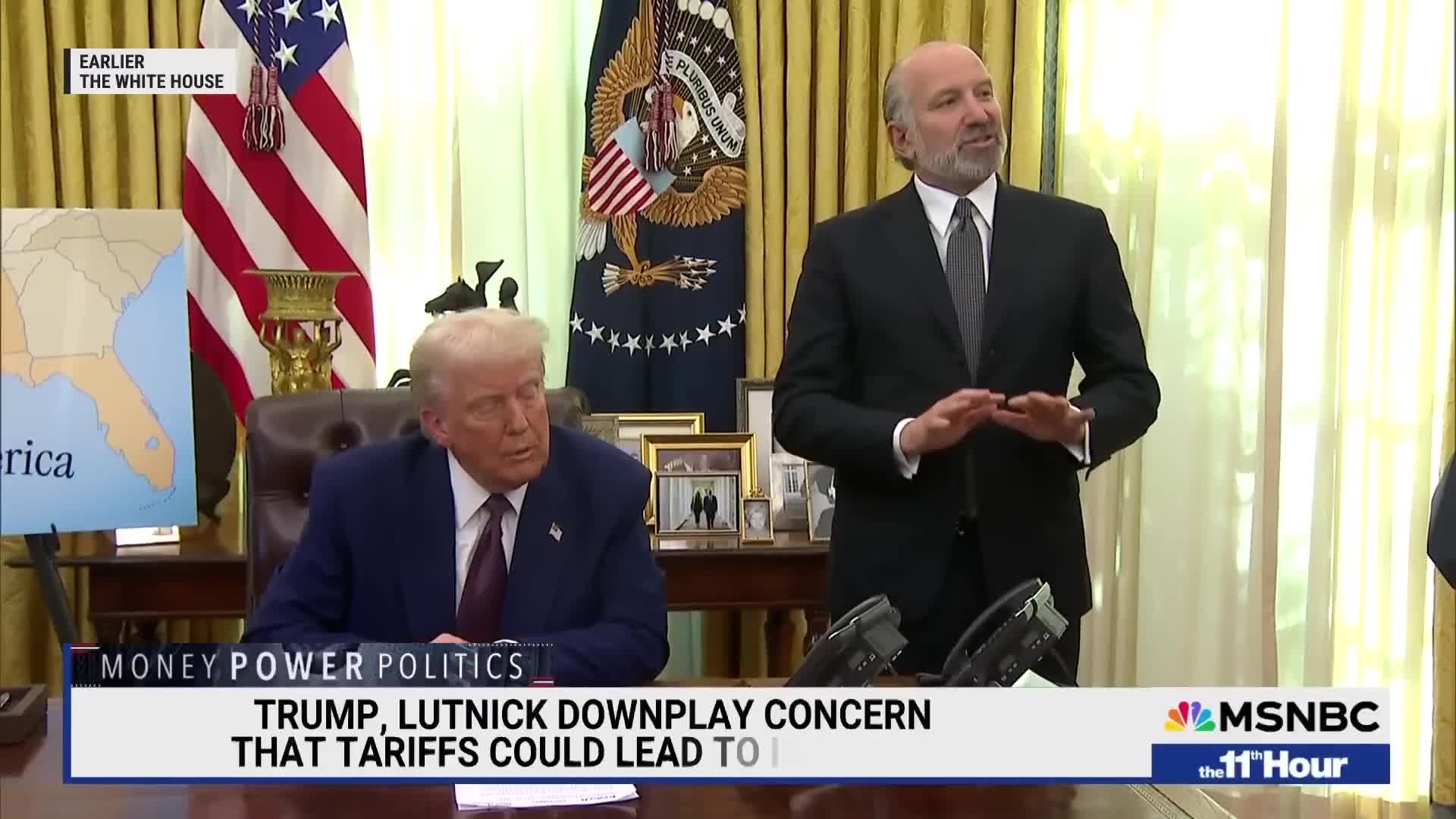

Watch clip answer (01:00m)Will prices rise because of Trump's tariffs?

The transcript reveals uncertainty about whether Trump's tariffs will increase consumer prices. When directly questioned, an economic advisor from Trump's team avoids giving a definitive answer, stating that 'prices fluctuate' and claiming to be 'confident' there won't be strong evidence of price effects from tariffs. However, experts in the discussion express concerns about these tariffs creating business uncertainty that could hurt US investment. The news analysts note that prices for gas and groceries have already risen and may increase further if the tariffs are implemented. The discussion also highlights how these policies might impact international trade relationships and alliances.

Watch clip answer (03:25m)What is the expected impact of Trump's proposed tariffs on prices and jobs?

According to President Trump, while prices might go up somewhat in the short term, the long-term effect would be positive with prices eventually going down. He emphasized that jobs will increase 'tremendously,' creating employment opportunities 'for everybody.' Frank Holland of CNBC explained that tariffs are essentially taxes on imported goods paid by businesses and typically passed on to consumers. However, there's uncertainty about implementation, as the administration is conducting a study due by April 1, suggesting a strategic approach targeting specific trading partners rather than universal tariffs. This tailored approach could potentially boost the US economy and increase foreign investment, leading to the job growth Trump referenced.

Watch clip answer (02:07m)How did the markets react to Trump's delay in tariff implementation?

The markets reacted very positively to the announcement that the tariff study wouldn't be completed until April 1, with tariffs potentially not being implemented until sometime after that date. This delay in the implementation of potential new tariffs was received as a relief by market participants. As Bill Cohan explains, this postponement gives businesses and investors more time to prepare and adjust strategies, reducing immediate economic uncertainty. The market's positive response indicates that concerns about tariffs' inflationary impact and potential disruption to global trade had been weighing on investor sentiment.

Watch clip answer (00:15m)What happened to food safety officers during the bird flu outbreak in the US?

Food safety and inspection officers from the Department of Agriculture, who were vital to the nation's bird flu response, were fired over the weekend precisely as the outbreak was intensifying across the US. These layoffs came at a critical time when their expertise was most needed to manage the escalating health crisis. The timing of these terminations had immediate economic consequences, driving up egg prices nationwide. The situation highlights the conflict between administrative decisions and public health necessities during an urgent national outbreak situation.

Watch clip answer (00:11m)How does Donald Trump characterize the spending on the Green New Deal and its impact on inflation?

Donald Trump criticizes the current administration for spending '$9 trillion' that they were 'given to throw out the window,' particularly on what he terms the 'green news scam.' He describes this as 'the greatest scam in the history of the country' and connects this excessive spending directly to the return of inflation. According to Trump, the current economic challenges were 'inherited' by him upon returning to office, emphasizing that inflation has returned despite only being back 'for two and a half weeks.' He argues that the administration has 'spent money like nobody has ever spent' and firmly places responsibility for inflation on these spending policies rather than his own actions.

Watch clip answer (00:26m)