Compliance and Regulations

Compliance and regulations are critical components in the operational framework of organizations across varied industries. They encompass the adherence to laws, standards, and guidelines set forth by government agencies and regulatory bodies. These requirements can range from sector-specific mandates like HIPAA in healthcare to broad legal frameworks such as the GDPR in data protection. Maintaining effective compliance is not just about avoiding fines; it builds trust with stakeholders, enhances business reputation, and mitigates risks associated with legal infractions. As businesses face an increasingly complex regulatory landscape influenced by rapid technological advancements and shifting geopolitical dynamics, the importance of compliance management has surged. Recent studies indicate that organizations are dedicating more resources to compliance technology, with a significant number adopting automation and AI to enhance their compliance strategies. This modernization allows for real-time regulatory responses and continuous compliance efforts rather than traditional periodic checks. Key challenges include navigating divergent regulatory standards across jurisdictions, particularly in areas like environmental, social, and governance (ESG) criteria and diversity, equity, and inclusion (DEI) policies. Furthermore, compliance is crucial for safeguarding sensitive information and ensuring operational integrity. Organizations that integrate robust compliance programs are better equipped to manage risks, ensuring they not only meet regulatory requirements but also adapt to the evolving demands of their industries. As the regulatory environment continues to evolve, businesses must proactively adjust their compliance strategies to stay ahead, using technology to ensure alignment with ever-changing rules and standards.

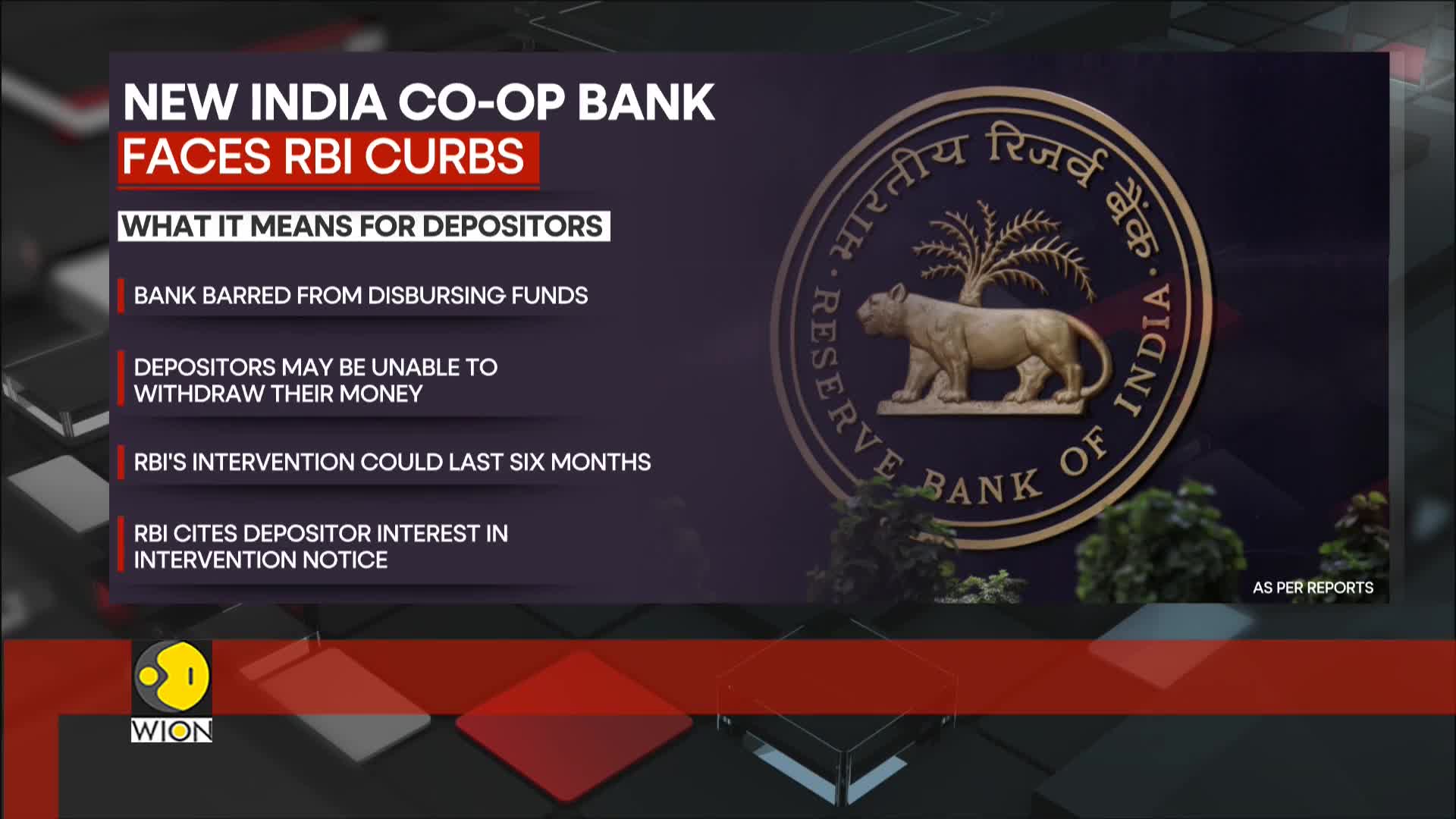

How did customers react to the Reserve Bank of India's restrictions on New India Cooperative Bank?

Following the announcement of RBI restrictions on New India Cooperative Bank, customers immediately rushed to the bank's branches in a state of panic. They were primarily motivated by fears that their savings could be at risk due to the bank's liquidity issues. The restrictions, effective from February 13 for six months, have significantly impacted depositors who are now unable to access their savings. This situation highlights the vulnerability of smaller financial institutions in emerging markets and has created considerable anxiety among account holders who face financial uncertainty.

Watch clip answer (00:05m)What are the key deadlines for ByteDance to divest its TikTok US operations?

US law requires China-based ByteDance to divest its TikTok US operations or face a complete ban in the country. Initially, then-President Joe Biden set a deadline of January 19, but this timeline was later extended by President Donald Trump, who pushed the deadline forward to April 5, giving ByteDance an additional 75 days to make a decision. This extension provides ByteDance with more time to determine how to comply with US regulations regarding TikTok's operations while addressing national security concerns raised by American officials about data privacy and potential misinformation risks.

Watch clip answer (00:20m)What regulatory action has the Reserve Bank of India taken against New India Cooperative Bank, and how has it affected depositors?

The Reserve Bank of India (RBI) has imposed regulatory curbs on New India Cooperative Bank due to supervisory concerns, creating significant disruption for the institution's operations. This regulatory intervention has directly impacted the bank's branches in Mumbai and Pune, where depositors are now experiencing difficulties accessing their funds. The RBI's supervisory action has triggered a funding panic among customers, as depositors face substantial issues when attempting to withdraw their deposits. This situation reflects broader concerns about the bank's financial stability and regulatory compliance, highlighting the central bank's role in maintaining banking sector integrity through decisive supervisory measures when institutions fail to meet required standards.

Watch clip answer (00:26m)What challenges did President Biden face with his student loan forgiveness program?

President Biden's student loan forgiveness program encountered significant legal challenges that highlighted the complex intersection of executive authority and judicial oversight. As Senator Jeff Merkley noted, conflicting legal cases emerged - some arguing the program was legally permissible while others contended it wasn't, ultimately requiring court intervention to resolve the dispute. This situation exemplifies the delicate balance between implementing policies intended to help American families and adhering to constitutional and legal frameworks. The program's legal battles underscore broader tensions in American governance, where well-intentioned initiatives can face scrutiny from various legal entities, forcing policy decisions through the judicial system rather than allowing direct executive implementation.

Watch clip answer (00:11m)How did the pandemic influence abortion pill access through telehealth services?

During the pandemic, the FDA made a significant policy change that expanded access to abortion pills by allowing them to be prescribed and sent through the mail. This shift was part of a broader expansion of telehealth services that occurred during COVID-19, aimed at maintaining healthcare access while reducing in-person contact. This telehealth expansion represented an important step toward making abortion care more accessible to patients, particularly those in areas with limited access to reproductive healthcare providers. However, these developments have since faced various legal challenges, creating ongoing uncertainty about the future of remote abortion care services.

Watch clip answer (00:16m)What accounting standards does the federal government follow compared to private businesses and organizations?

The federal government operates without the basic accounting standards that are mandatory for virtually every other type of organization in America. While public corporations, nonprofits, and even small convenience stores are required to maintain proper accounting records and financial transparency, the federal government lacks these fundamental oversight mechanisms. This absence of standard accounting practices represents a shocking departure from basic fiscal responsibility principles. The situation is particularly concerning because government officials appear to view this lack of accountability as acceptable and sustainable, despite the fact that such standards would be considered essential for any private entity handling far less money and responsibility than the federal government manages daily.

Watch clip answer (00:20m)