Compliance and Regulations

Compliance and regulations are critical components in the operational framework of organizations across varied industries. They encompass the adherence to laws, standards, and guidelines set forth by government agencies and regulatory bodies. These requirements can range from sector-specific mandates like HIPAA in healthcare to broad legal frameworks such as the GDPR in data protection. Maintaining effective compliance is not just about avoiding fines; it builds trust with stakeholders, enhances business reputation, and mitigates risks associated with legal infractions. As businesses face an increasingly complex regulatory landscape influenced by rapid technological advancements and shifting geopolitical dynamics, the importance of compliance management has surged. Recent studies indicate that organizations are dedicating more resources to compliance technology, with a significant number adopting automation and AI to enhance their compliance strategies. This modernization allows for real-time regulatory responses and continuous compliance efforts rather than traditional periodic checks. Key challenges include navigating divergent regulatory standards across jurisdictions, particularly in areas like environmental, social, and governance (ESG) criteria and diversity, equity, and inclusion (DEI) policies. Furthermore, compliance is crucial for safeguarding sensitive information and ensuring operational integrity. Organizations that integrate robust compliance programs are better equipped to manage risks, ensuring they not only meet regulatory requirements but also adapt to the evolving demands of their industries. As the regulatory environment continues to evolve, businesses must proactively adjust their compliance strategies to stay ahead, using technology to ensure alignment with ever-changing rules and standards.

What is Security Compliance?

Security compliance refers to following regulations, standards and guidelines set to protect sensitive information and data. It ensures that organizations implement necessary measures to safeguard data from unauthorized access or breaches, and is crucial in various industries to maintain data integrity and confidentiality. The process involves regular audits and assessments to ensure adherence to legal requirements and industry best practices. Non-compliance can result in severe consequences, including financial penalties and damage to an organization's reputation. By implementing proper security compliance measures, organizations demonstrate their commitment to protecting data security and privacy.

Watch clip answer (00:42m)What are the ethical implications of AI surveillance by 2025?

By 2025, AI surveillance systems will be deployed globally by governments and corporations, raising significant ethical questions about privacy and civil liberties. These sophisticated systems enable predictive policing and real-time tracking of individuals across vast areas, with China already implementing large-scale AI surveillance networks while other countries explore similar technologies. While AI surveillance can enhance security, its potential for misuse has sparked global debates about regulation and privacy rights. As these systems continue to expand, public discourse will increasingly focus on balancing safety with individual freedoms, making AI surveillance one of the most critical and controversial technological issues facing society.

Watch clip answer (00:54m)Why is there growing discussion about lethal autonomous weapon systems (LAWS)?

The discussion around lethal autonomous weapon systems (LAWS) is expanding because technological advancements have made them increasingly practical. Recent decades have seen dramatic improvements in computing power and sensor systems that are now compact and affordable enough for military applications. As the speaker notes, GPU performance per dollar has doubled roughly every 2.5 years between 2006 and 2021. These technological developments enable systems that can perceive, analyze, and make decisions with minimal human intervention. While many current autonomous systems still require human operators for lethal decision-making, the capability exists to create fully autonomous systems where machines select and engage targets independently. This technological reality, combined with the economic and tactical advantages of systems that 'don't complain, don't eat, don't need training,' is driving increased military interest in and development of LAWS.

Watch clip answer (04:33m)How will American consumer behavior change in the coming decades compared to the past 30 years?

According to David Wessel, American consumers will likely shift from being spendthrift to more thrifty for the next couple of decades. This behavioral change will force the rest of the world to rely more on domestic demand and less on exporting to the United States. Additionally, Wessel predicts an era of greater skepticism toward markets, with increased faith and reliance on government regulation to maintain economic stability. This represents a significant departure from previous beliefs that sophisticated market participants with their own money at stake would keep the system honest.

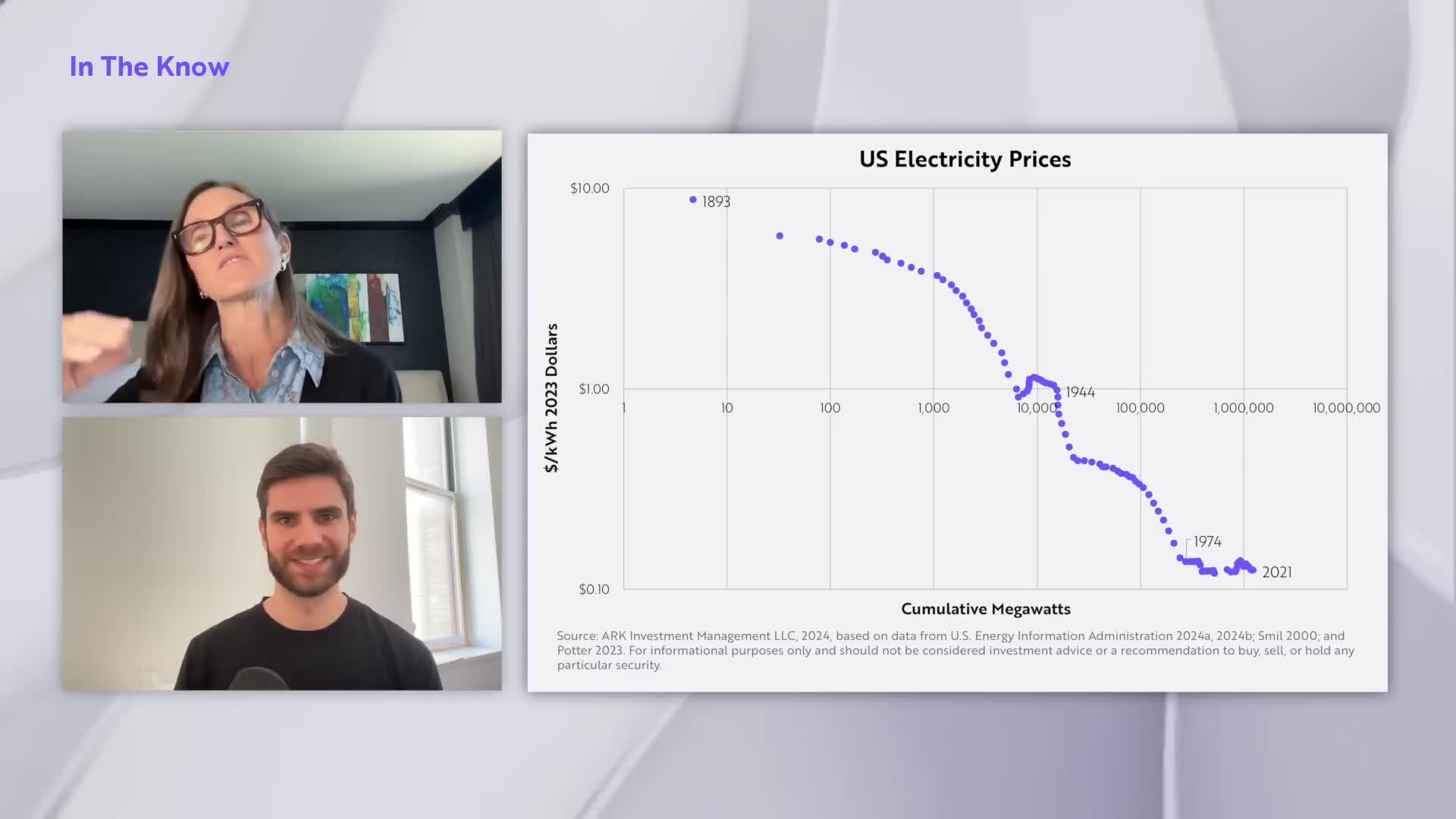

Watch clip answer (00:51m)How will regulatory changes impact businesses, especially in the digital asset space?

The current regulatory environment has created a morass that has had a stranglehold on businesses, particularly small and medium enterprises. According to Cathie Wood, we're approaching a significant shift as SEC Chairman Gary Gensler has announced his departure on January 20th, which will likely remove regulatory shackles that have hindered business growth and innovation. Wood predicts these changes will be especially transformative for the digital asset world, which she believes is now poised to 'take off and thrive.' While acknowledging the need for appropriate regulations for safety, she emphasizes that the current system has become overly burdensome as regulators continue building their 'empires' and creating more regulations.

Watch clip answer (01:06m)What is the Consumer Financial Protection Bureau (CFPB) and how are its operations changing under new leadership?

The CFPB was established in 2010 following the Great Recession to protect consumers from financial institutions and prevent another crisis. Under Rohit Chopra's leadership since 2021, the bureau implemented aggressive regulations against big banks, including limiting overdraft fees, capping credit card late fees, and banning medical debt from credit reports. Now, with Scott Besant appointed as acting director after Chopra's firing, the CFPB's operations have dramatically shifted. Besant has ordered a freeze on regulatory activities, halted enforcement actions, and directed lawyers to stop defending existing regulations in court. This leadership change has drawn celebration from Republicans and financial institutions while sparking backlash from consumer advocates and Democrats who warn it threatens basic consumer protections.

Watch clip answer (01:46m)