Compliance and Regulations

Compliance and regulations are critical components in the operational framework of organizations across varied industries. They encompass the adherence to laws, standards, and guidelines set forth by government agencies and regulatory bodies. These requirements can range from sector-specific mandates like HIPAA in healthcare to broad legal frameworks such as the GDPR in data protection. Maintaining effective compliance is not just about avoiding fines; it builds trust with stakeholders, enhances business reputation, and mitigates risks associated with legal infractions. As businesses face an increasingly complex regulatory landscape influenced by rapid technological advancements and shifting geopolitical dynamics, the importance of compliance management has surged. Recent studies indicate that organizations are dedicating more resources to compliance technology, with a significant number adopting automation and AI to enhance their compliance strategies. This modernization allows for real-time regulatory responses and continuous compliance efforts rather than traditional periodic checks. Key challenges include navigating divergent regulatory standards across jurisdictions, particularly in areas like environmental, social, and governance (ESG) criteria and diversity, equity, and inclusion (DEI) policies. Furthermore, compliance is crucial for safeguarding sensitive information and ensuring operational integrity. Organizations that integrate robust compliance programs are better equipped to manage risks, ensuring they not only meet regulatory requirements but also adapt to the evolving demands of their industries. As the regulatory environment continues to evolve, businesses must proactively adjust their compliance strategies to stay ahead, using technology to ensure alignment with ever-changing rules and standards.

When will Jannik Sinner return to tennis after his doping ban and what tournaments will he be able to play?

Jannik Sinner, who has won both the US Open and Australian Open since his failed doping tests, is set to return to professional tennis in early May. This timing strategically allows him to participate in the French Open and ensures he won't miss any Grand Slam tournaments during his suspension period. While Sinner is cleared to resume competition, questions remain about whether he'll immediately regain the exceptional form he displayed before his ban. His case has generated significant controversy within the tennis community, with many players and fans expressing dissatisfaction with how anti-doping authorities handled the situation.

Watch clip answer (00:23m)What factors are contributing to Baidu's recent stock challenges?

Baidu faces significant challenges as the Chinese government attempts to support its tech sector following years of regulatory pressure. However, the absence of founder Robin Lee at a high-profile meeting has raised investor concerns, contributing to a $2.4 billion market value loss. This notable absence may signal deeper issues about Baidu's future position in the Chinese tech landscape. The company's challenges are further complicated as it navigates integrating AI into its search engine while adapting to shifting market dynamics, raising questions about its competitive standing moving forward.

Watch clip answer (00:14m)How did customers react to the RBI's restrictions on New India Cooperative Bank?

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

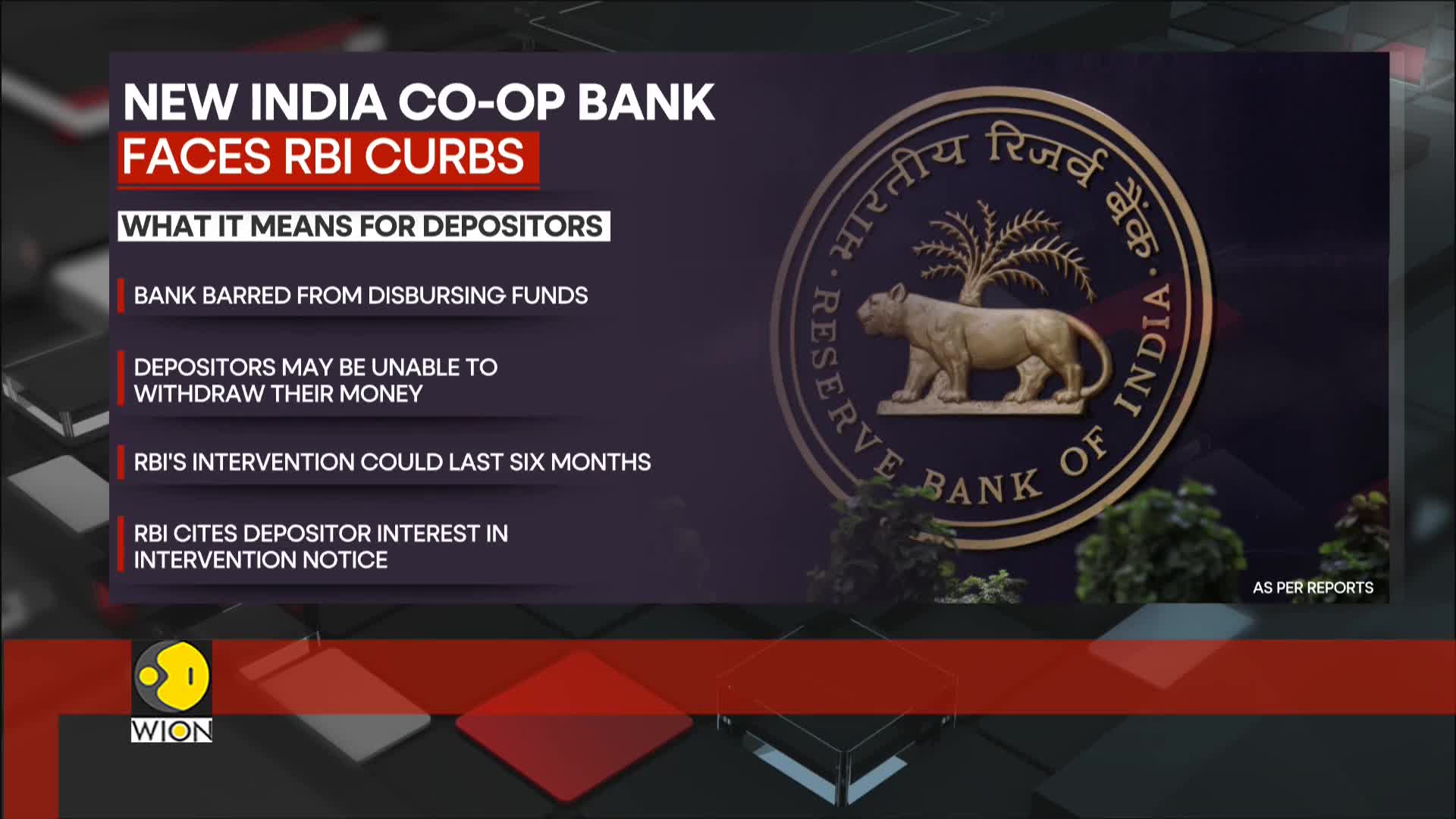

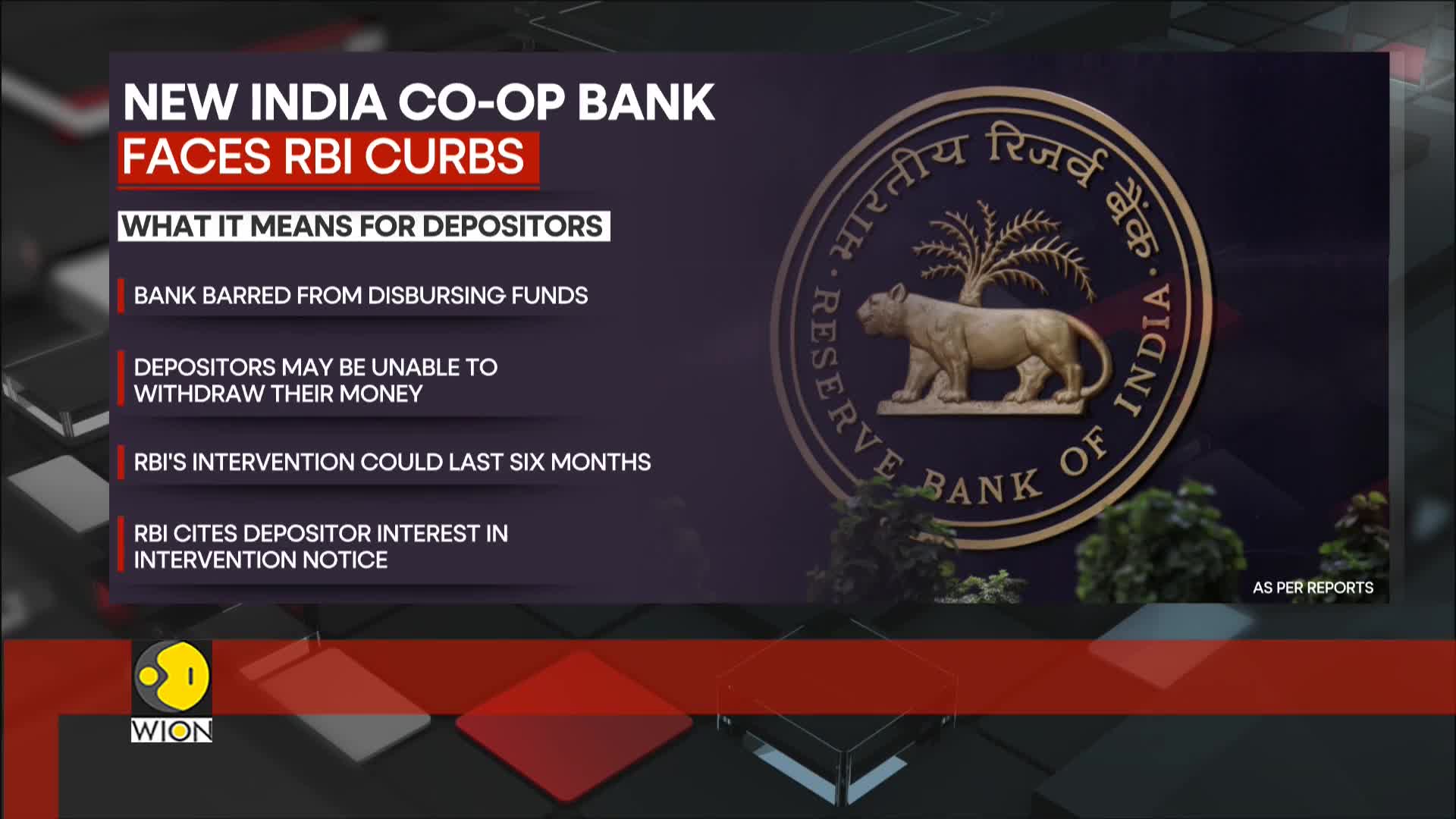

Watch clip answer (00:17m)What restrictions has the Reserve Bank of India imposed on the New India Cooperative Bank and how are depositors affected?

The Reserve Bank of India has imposed strict restrictions on the Mumbai-based New India Cooperative Bank due to liquidity concerns. The bank has been barred from disbursing funds, which has left depositors unable to withdraw their money, causing commotion outside bank branches as worried customers seek access to their savings. This regulatory action highlights the fragility of smaller financial institutions in emerging markets like India. The situation underscores the challenges faced by depositors when banking institutions face liquidity issues, leaving them in financial limbo until the restrictions are lifted or alternative arrangements are made.

Watch clip answer (00:36m)What restrictions has the RBI imposed on the New India Cooperative Bank?

The RBI has imposed restrictions on the New India Cooperative Bank effective from February 13, which will remain in place for six months pending review. The central bank cited material developments as the reason for this intervention, with the primary aim of protecting depositor interests and ensuring financial stability. During this period, the bank is prevented from disbursing funds, which has caused concern among depositors who have been lining up outside bank branches worried about accessing their savings. This regulatory action highlights the RBI's role in maintaining stability in the cooperative banking sector.

Watch clip answer (00:13m)How are depositors affected by the RBI's restrictions on New India Cooperative Bank?

Depositors are experiencing immediate financial distress due to their inability to access funds following RBI's restrictions on New India Cooperative Bank. With monthly interest payments and daily expenses to manage, many account holders face severe financial hardship as they cannot withdraw their money beyond the imposed limits. The bank's deteriorating financial health, which has been under significant pressure, has directly impacted customers who rely on these funds for their everyday needs. This situation highlights the vulnerability of depositors when regulatory actions are taken against struggling cooperative banks, leaving many in precarious financial circumstances.

Watch clip answer (00:11m)