Tax Planning

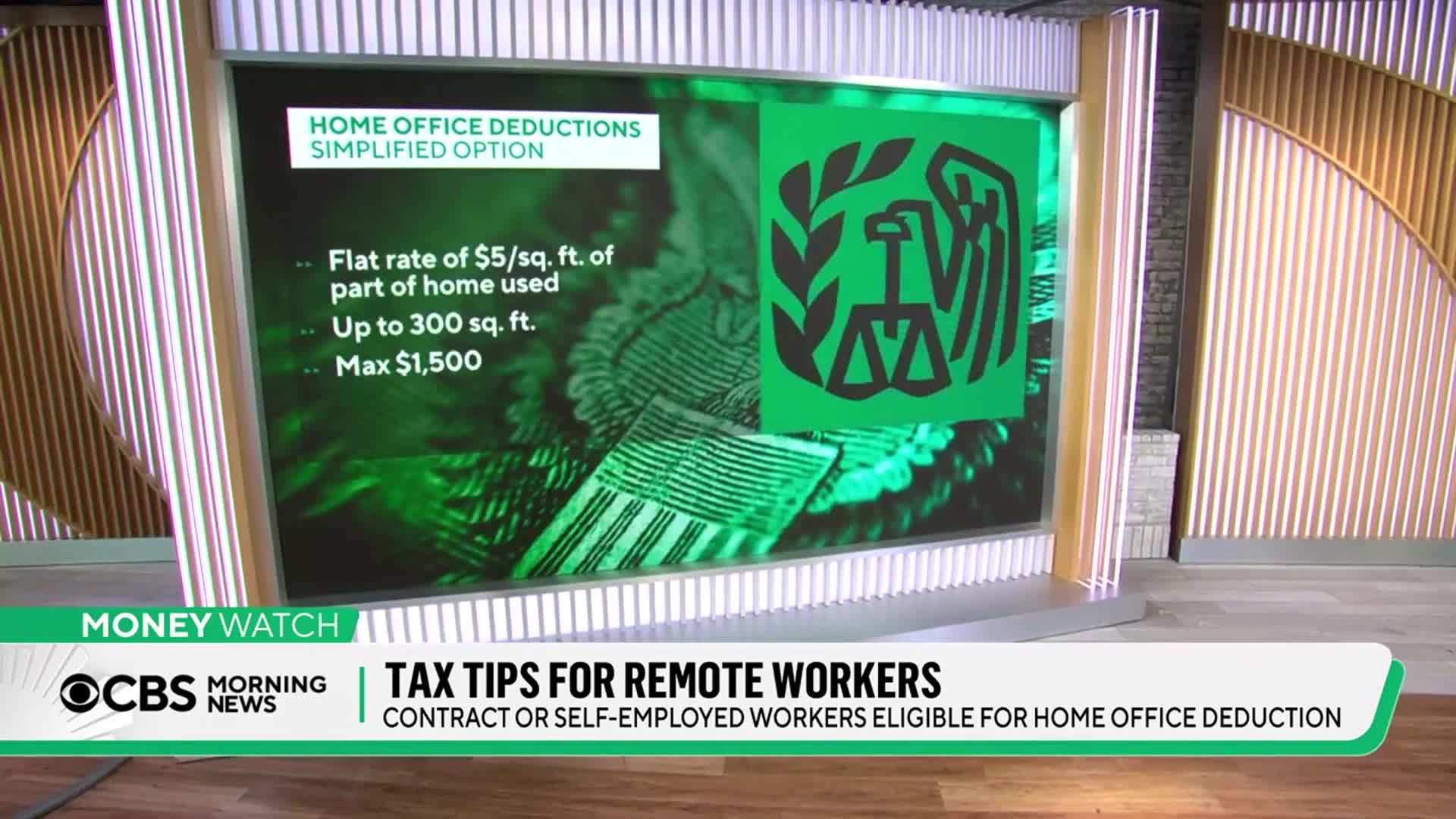

What expenses can self-employed remote workers deduct from their taxes for a home office?

Self-employed remote workers can deduct much more than just basic office equipment. Beyond cell phones, laptops, printers and supplies, they can deduct a portion of their rent or mortgage, real estate taxes, homeowners insurance, and utilities based on the percentage of home used exclusively for business. For example, if 20% of your home serves exclusively as an office, you can deduct 20% of these housing-related expenses from your taxes. Proper documentation is essential when claiming these deductions, as all expenses must be thoroughly recorded to support your tax claims.

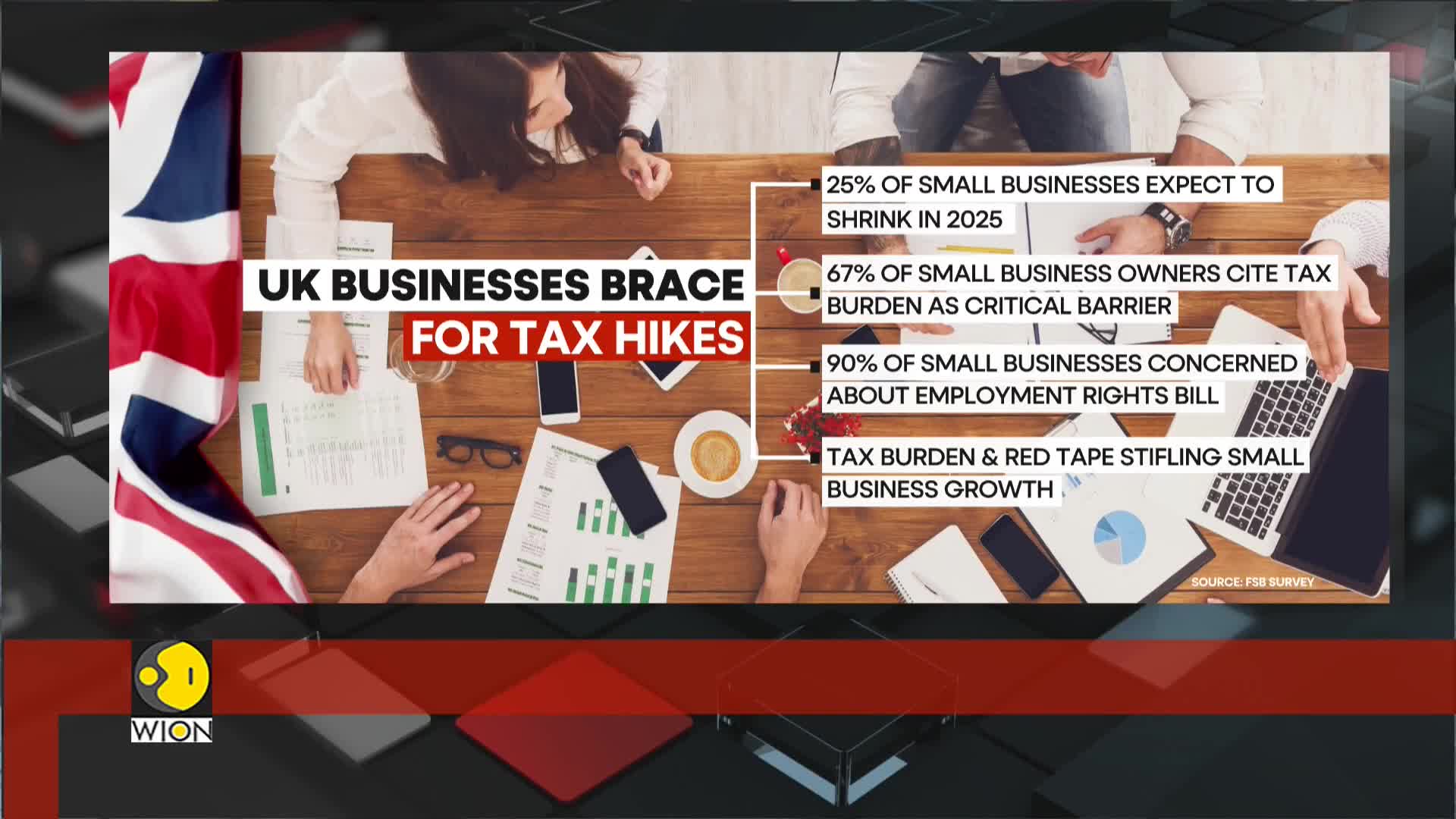

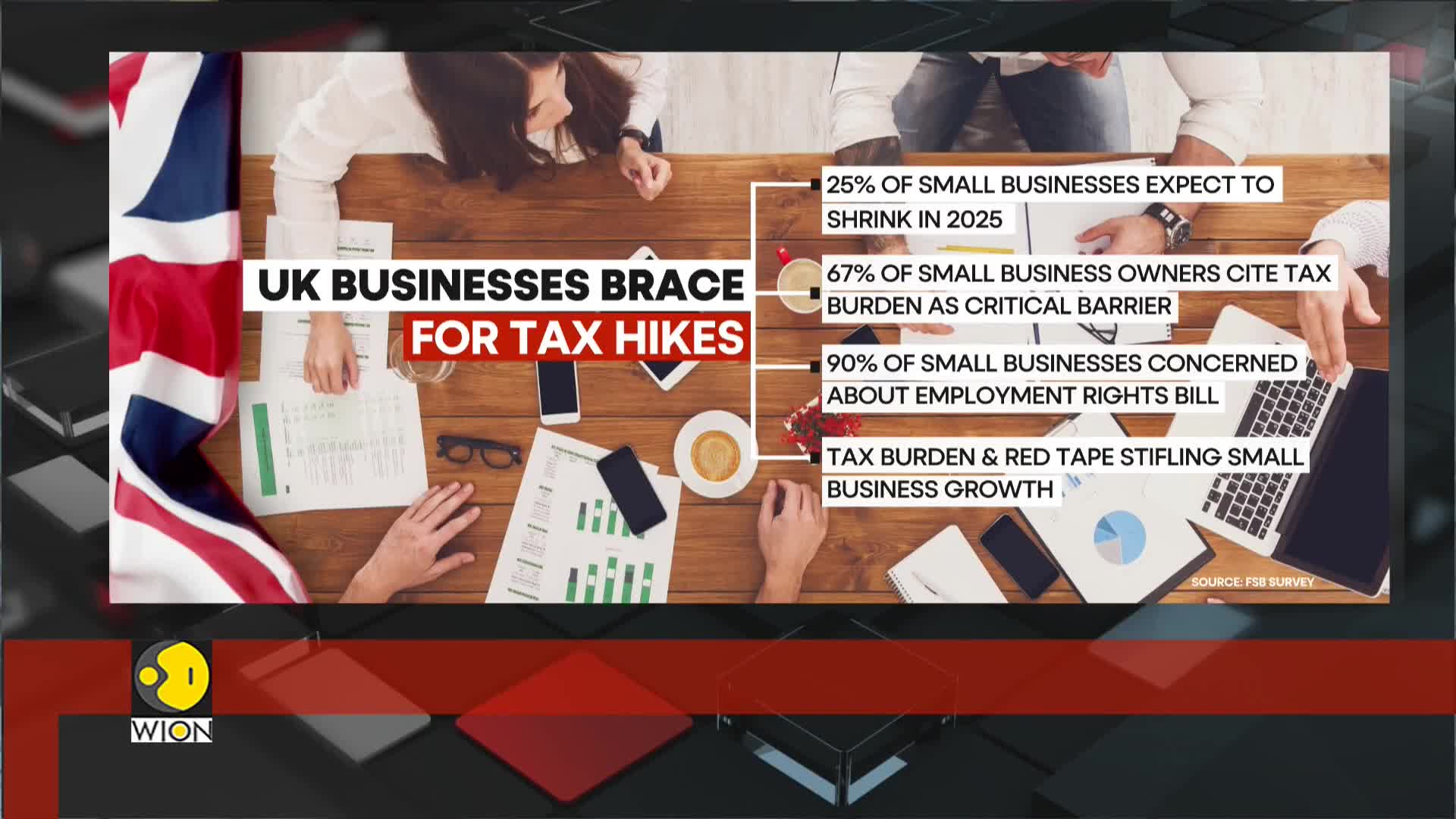

Watch clip answer (00:32m)What impact is the upcoming tax hike having on UK businesses?

The impending tax hike is causing significant disruption across UK businesses, with one in four companies planning to lay off staff. According to a survey by the Chartered Institute of Personnel and Development, this represents the highest proportion of employers considering redundancies in the past decade, excluding the pandemic period. The retail and hospitality sectors are particularly affected by rising national insurance rates and shrinking earnings thresholds. While the public sector remains somewhat insulated due to recent pay increases, small businesses are especially vulnerable, with many owners citing the tax burden as a major obstacle to growth and sustainability.

Watch clip answer (00:18m)How are tax burdens affecting UK businesses in the current economic climate?

UK businesses, particularly small ones, are struggling with significant tax compliance costs that amount to an estimated £25 billion annually. Despite treasury promises, business leaders remain skeptical due to rising costs and increasing regulatory pressures. As the private sector faces these financial burdens, many companies are implementing hiring freezes and delaying investments. This economic pressure is occurring while government spending continues to drive minimal growth, making the path to economic recovery uncertain for many businesses in the final quarter of 2025.

Watch clip answer (00:34m)What do American citizens fundamentally prioritize in politics, and how should government focus shift to better serve them?

According to this political discussion, Americans prioritize fundamental bread-and-butter issues over complex ideological debates. Citizens want practical improvements like better education funding for their children, lower taxes that put more money in their pockets, secure borders for national safety, and law and order in their communities. The conversation suggests that both major political parties have lost sight of these core priorities, with Democrats particularly divided between traditional economic concerns and identity politics. The speakers advocate for a return to citizen-first governance that addresses these basic needs rather than getting caught up in bureaucratic complications. The underlying message emphasizes that American people feel neglected by current political leadership and deserve a government that puts their fundamental concerns—economic security, safety, and their children's future—at the forefront of policy-making decisions.

Watch clip answer (00:26m)What is the Republican strategy behind the Senate Budget Committee's resolution on immigration and defense, and how does it impact American families?

According to Senator Jeff Merkley, Republicans are using defense and homeland security as a "Trojan horse" to disguise their real agenda of cutting $1.5-2 trillion from essential family programs including healthcare, housing, education, and childcare. These cuts are designed to fund approximately $4.5 trillion in tax cuts primarily benefiting billionaires. The strategy creates a concerning fiscal pattern: reduce spending on programs that help families achieve middle-class stability, provide massive tax breaks to the wealthiest Americans, and increase national debt by $2.5-3 trillion. Merkley argues this three-part plan deliberately uses the respectable cover of defense and homeland security—typically bipartisan issues—to mask what he calls an "assault on families" and a giveaway to billionaires.

Watch clip answer (01:56m)What distinguishes democratic governance from authoritarian rule in the context of current political and economic policies?

Senator Jeff Merkley emphasizes a fundamental distinction between democratic and dictatorial systems of governance. In his view, true democracy requires accountability and transparency, particularly when it comes to economic policies that affect ordinary families and essential social programs. The senator argues that current GOP economic strategies favor billionaire interests through tax breaks for the wealthy while simultaneously cutting spending on programs that support the middle class. This approach undermines democratic principles by prioritizing partisan interests over the needs of the broader population. Democratic governance, according to Merkley, demands that elected officials serve all constituents rather than just wealthy donors, ensuring that economic policies strengthen social services and support working families rather than concentrate wealth among the elite.

Watch clip answer (00:08m)