Tax Planning

What are the two parts of the CFP certification education requirement?

The CFP certification education requirement consists of two key components. First, candidates must complete coursework through a CFP Board registered program, covering essential topics like income planning, risk management, investments, retirement planning, and estate planning. This culminates in a capstone course where students create a comprehensive financial plan. Second, candidates must submit their bachelor's degree transcript for verification. The degree can be in any discipline and submitted at any time, even after taking the CFP exam. Notably, those with certain credentials may qualify for an accelerated path, allowing them to skip most coursework and proceed directly to the capstone course.

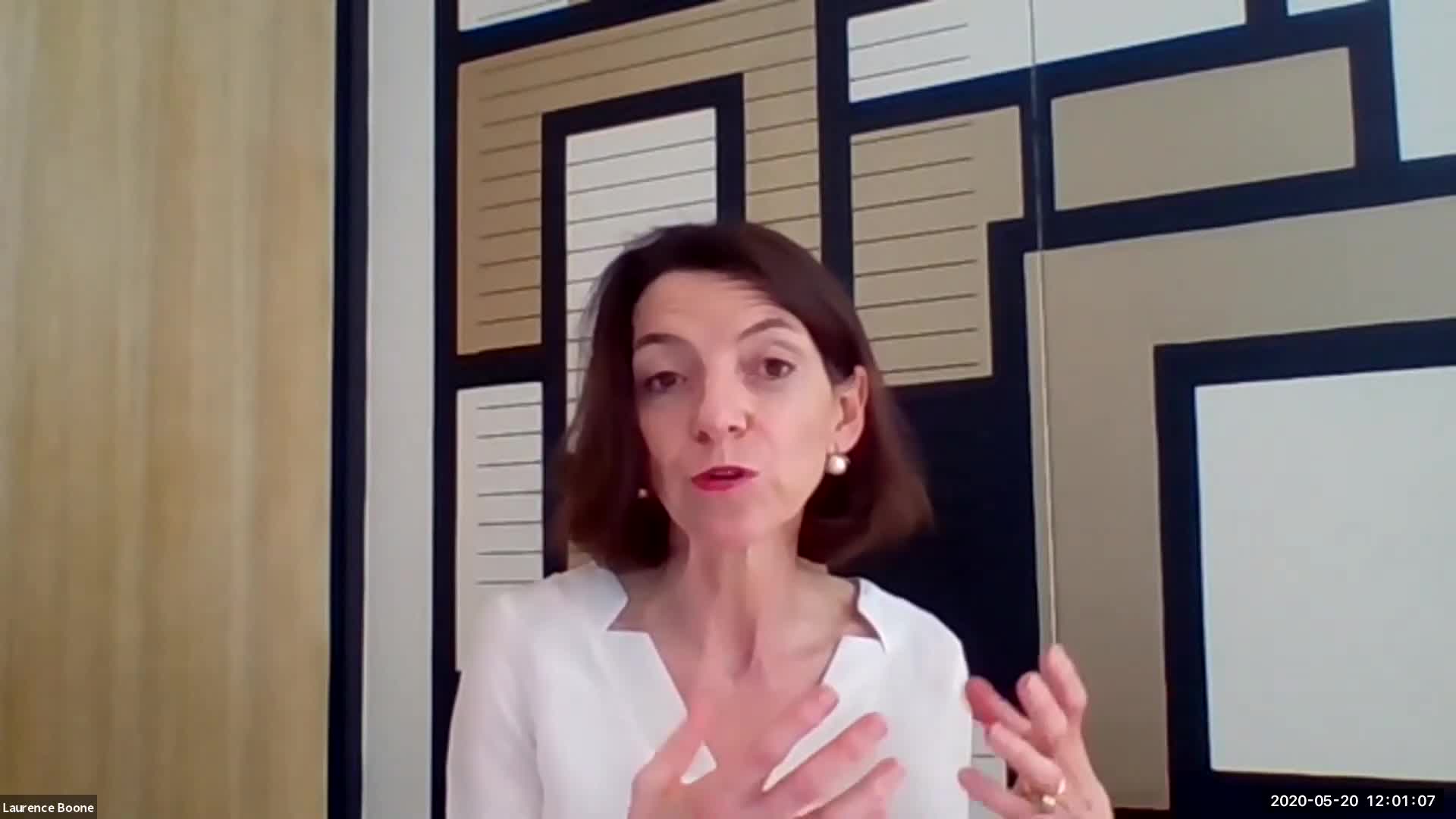

Watch clip answer (01:33m)What is the significance of the Franco-German collaboration in addressing Europe's economic challenges?

The Franco-German collaboration represents a traditional but vital approach to European consensus-building. As Laurence Boone explains, this partnership is working to bridge divisions between northern, southern, and eastern European interests, creating a stronger declaration than previous efforts like Meissenberg when fragmentation was occurring between regions. This collaboration sets the stage for addressing critical fiscal issues, including potential European-level taxation mechanisms. Adam Tooze highlights how this opens discussions on tax loopholes, wealth auditing systems, and carbon pricing. Meanwhile, Moritz Schularick points to the long-term implications where joint debt issuance creates incentives for developing European-level taxes to service this common debt rather than burdening national budgets.

Watch clip answer (03:12m)What tax reforms is Donald Trump proposing to provide economic relief to Americans?

Donald Trump is proposing comprehensive tax cuts across the board to provide urgent relief to Americans affected by inflation. His specific proposals include eliminating taxes on tips, overtime pay, and Social Security benefits for seniors. Additionally, he wants to make interest payments on car loans tax-deductible, but only for vehicles manufactured in America. These measures are part of his broader economic plan to stimulate growth and deliver financial relief to Americans struggling with rising costs.

Watch clip answer (01:38m)What was Google's tax settlement with Italy and why was it required?

Google agreed to pay 326 million euros to Italy following an investigation into unpaid taxes. Italian authorities accused the tech giant of failing to declare and pay taxes in the country between 2015 and 2019, which prompted the settlement. This case highlights the ongoing scrutiny that major technology companies face regarding their tax obligations in various countries where they operate. The significant settlement demonstrates Italy's commitment to enforcing tax compliance from multinational corporations operating within its borders.

Watch clip answer (00:17m)What does Hakeem Jeffries claim is the true goal of the Republican budget proposal?

According to House Democratic Leader Hakeem Jeffries, the Republicans' true goal is to enact massive tax cuts for their billionaire donors and wealthy corporations, which he identifies as the heart of their budget proposal. He argues that Republicans initially promised Americans they would drive down the high cost of living, but Jeffries claims they have lied about this commitment. His critique suggests that the Republican budget prioritizes the interests of the wealthy over addressing the economic challenges facing everyday Americans.

Watch clip answer (00:16m)What are the key concerns with the Republican budget proposal and who would it impact the most?

The Republican budget proposal threatens vulnerable populations through significant cuts to essential programs while prioritizing tax cuts for the wealthy. Congressman Brendan Boyle highlighted that these cuts would particularly harm seniors, low-income families, children, and people with disabilities by potentially stripping away healthcare services through Medicare and Medicaid. Democrats attempted to protect these vital programs including Social Security, ACA tax credits, and healthcare coverage that millions of Americans rely on. Meanwhile, the proposal includes giving trillions of dollars in handouts to billionaires and corporations while increasing the national debt by $4 trillion.

Watch clip answer (02:16m)