Tax Compliance

What is the major source of government waste and fraud in the US taxpayer system?

According to the clip, foreign nationals using fake Social Security numbers and identities are stealing billions in taxpayer benefits. This organized fraud is occurring across multiple agencies including the FDA, Medicare, and Medicaid. The commentator suggests that by addressing this massive fraud in tax and entitlement systems, the government could potentially save over a trillion dollars over a 10-year budget window. Meanwhile, the Biden administration has focused on hiring 87,000 IRS agents rather than tackling these systemic issues.

Watch clip answer (00:48m)How much money could be saved by addressing fraud in the U.S. tax and entitlement systems?

According to the discussion between Jesse Watters and Greg Gutfeld, over a 10-year normal budget window, the government could potentially save over a trillion dollars by clamping down on massive fraud in tax and entitlement systems. The fraud involves criminals using fake identities to steal billions in taxpayer benefits. The exact amount is difficult to determine without full access to the data, but the scale of the problem is significant enough that addressing it could recover substantial taxpayer funds that are currently being stolen through organized fraud schemes targeting government benefit programs and tax systems.

Watch clip answer (00:20m)What is the Amazon VAT evasion investigation in Italy about?

Italian prosecutors are investigating Amazon for allegedly evading €1.2 billion in value-added tax (VAT) from third-party sellers between 2019 and 2021. This investigation stems from a significant legal change that occurred in 2019, which made e-commerce platforms directly responsible for collecting and remitting VAT on sales made by non-EU sellers on their platforms. The case represents a major tax compliance issue for online marketplaces operating in the European Union, as it indicates authorities are holding platforms accountable for ensuring proper tax collection even from international third-party merchants using their services.

Watch clip answer (00:18m)What are the main concerns about DOGE Service staff accessing IRS systems?

The main concerns involve potential access to sensitive taxpayer information through IRS confidential systems. Officials are alarmed about security risks, with attempts to prevent DOGE staff from accessing classified information sometimes leading to confrontations. Legal challenges are being considered to block this access, similar to issues at the Social Security Administration that led to its head resigning. Additionally, the IRS faces threats of mass firings affecting 9,000-10,000 employees, creating further tension between the agency and the White House as systems control becomes a critical point of contention.

Watch clip answer (01:06m)Why are UK business leaders skeptical about economic recovery?

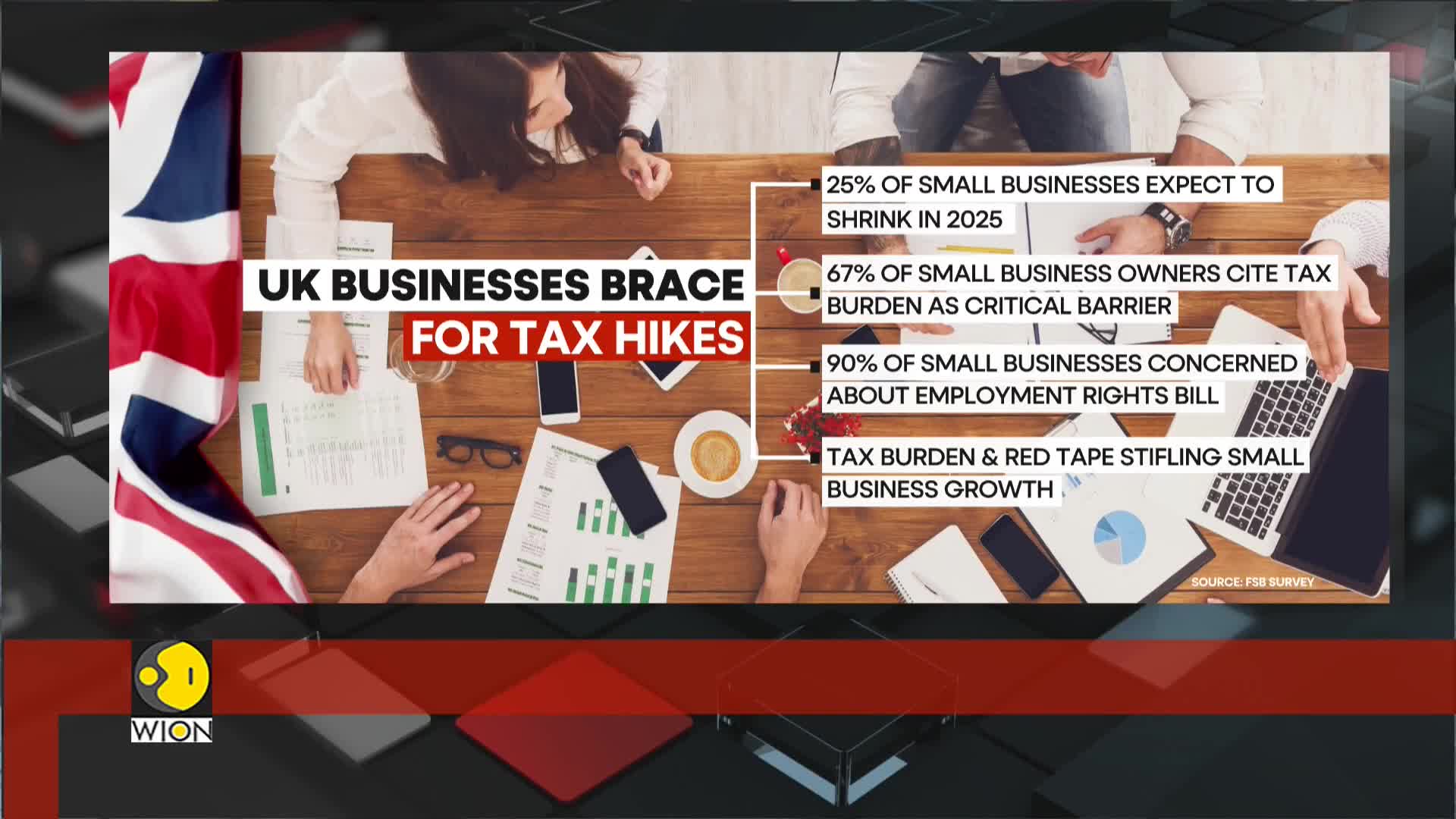

UK business leaders remain skeptical about economic recovery despite Treasury promises, primarily due to rising costs and increasing regulatory pressures. Companies are implementing hiring freezes and delaying investments as they struggle to manage mounting financial challenges. The economic outlook appears uncertain for many businesses as they attempt to navigate these obstacles. With one in four companies considering layoffs and employer confidence at its lowest in a decade, the private sector faces significant hurdles on the path to recovery amid stagnant GDP growth.

Watch clip answer (00:16m)How is the £25 billion tax burden affecting UK small businesses in a stagnating economy?

The £25 billion tax burden is severely impacting UK small businesses amid economic stagnation, with GDP growth nearly flat at just 0.1% in the final quarter of 2025. Small businesses already spend an estimated £25 billion annually on tax compliance alone, creating a double financial pressure on these enterprises. These tax burdens are exacerbating the economic situation as the private sector struggles while government spending and borrowing continue to drive minimal growth. Experts suggest that reducing this tax compliance burden could significantly improve productivity, allowing small businesses to allocate resources more effectively rather than being hindered by excessive regulatory costs.

Watch clip answer (00:25m)